32# Reversal Trend Method MT5 -Polynomial Regression with TMA-

Submit by Joy22

Reversal Method with Polynomial Regression and TMA. Polynomial Regression with TMA is a trend reversal method that can be applied with the main

trading platforms MT4, MT5, TradingView and Tradestation, in this case I use MT5.

This strategy combines Polynomial Regression as a trend filter with TMA (Triangular Moving Average) Arrows for entry timing. Below is a detailed description of how to implement and trade using this strategy.

Components

Polynomial Regression: used to determine the trend direction and provide dynamic support and resistance levels.

TMA Arrows: used to signal potential trade entries when they align with the trend direction indicated by the polynomial regression.

Setup:

Chart Timeframe: 30 min or higher.

Indicators:

Polynomial Regression Bands: two yellow outer bands, one red central band, and one green central band ( 3 or 4 degree 2.0 standard deviation, periods channel 180).

TMA : blue for potential buy signals, yellow for potential sell signals.

Tma hal period 12, ATR period 100, Average True Range period 1.8.

Strategy Rules:

1. Identify the Trend:

Uptrend: The central polynomial regression band is green.

Downtrend: The central polynomial regression band is red.

2. Entry Signals:

Buy Signal:

The central polynomial regression band is green.

A blue TMA arrow appears.

Sell Signal:

The central polynomial regression band is red.

A yellow TMA arrow appears.

Note important!: You should take the arrows when the price is close to the edges of the bands and avoid entering into positions when the price exceeds the central band.:

3. Exit Signals:

Stop Loss:

Place a stop loss below the lower yellow band for long positions and above the upper yellow band for short positions.

Take Profit:

Ratio stop loss from 1:1 to 1:1.3.

Alternatively, use a fixed percentage or ATR-based stop loss.

4. Additional Rules:

Avoid trading during major news events to prevent high volatility scenarios.

Ensure proper risk management by not risking more than 1-2% of your trading capital on a single trade.

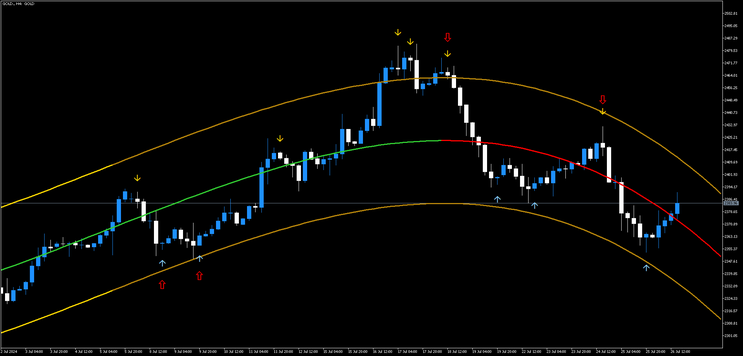

Example Sell US100 H1

Let's apply the rules to the chart provided (US100Cash H1):

Identifying the Trend:

The central polynomial regression band is red, indicating a downtrend.

Finding Entry Points:

Look for yellow TMA arrows for potential sell signals.

In this case we have two sell signals.

Executing the Trade:

Enter a short position when a yellow TMA arrow appears and the price is confirmed to be in a downtrend.

Place a stop loss above the recent swing high or above the upper yellow polynomial regression band.

Set a take profit target at the at midlle band or with ratio stop loss 1:1.2.

In this case i have placed Profit target at the middle band.

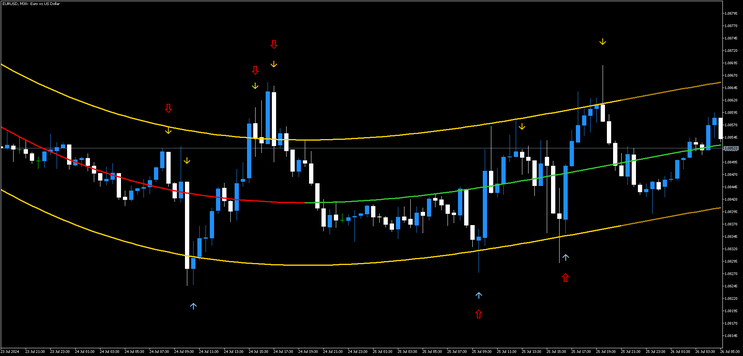

Example Buy USDJPY 30 minutes

Identifying the Trend:

The central polynomial regression band is green, indicating a uptrend.

Finding Entry Points:

Look for yellow TMA arrows for potential sell signals.

In this case we have one buy signal.

Executing the Trade:

Enter a short position when a yellow TMA arrow appears and the price is confirmed to be in a uptrend.

Place a stop loss above the recent swing low or below the upper yellow polynomial regression band.

Set a take profit target at the at midlle band or with ratio stop loss 1:1.2.

In this case i have placed profit target at the middle band.

By following these steps and using the combination of Polynomial Regression and TMA Arrows, you can create a robust trading strategy that leverages both trend direction and precise entry signals.

md irshad (Friday, 27 December 2024 02:50)

good indicator

Andrew (Friday, 06 September 2024 15:54)

Superb strategy great Joy22 I've been following you for years you never cease to amaze me, Your systems are better than the paid ones. I managed to be profitable thanks to you.!!!