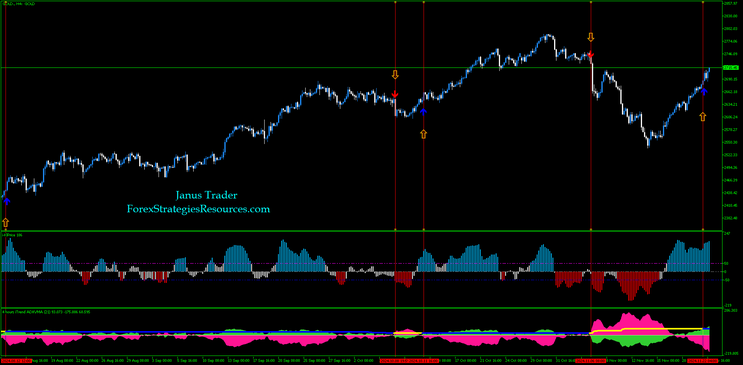

96# Keltner Channel Histogram with I-Trend ADX MT5

Submit by Janus Trader 2024

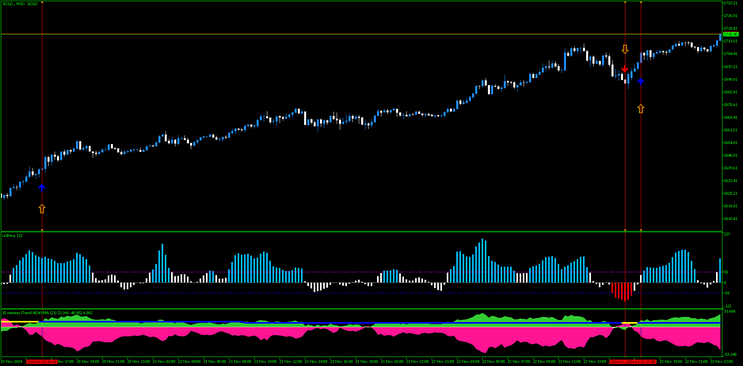

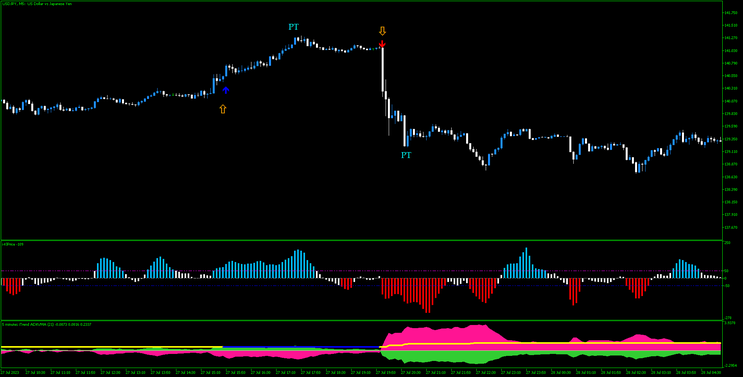

This trading strategy leverages the Keltner Channel Histogram as a trend identification tool and the ITrend ADX indicator for trend confirmation. The objective is to identify high-probability trade setups based on synchronized signals from these two indicators.

Indicators and Parameters

-

Keltner Channel Histogram

-

Purpose: Identifies the strength and direction of the trend.

-

Key Parameter Adjustments:

-

Smoothing Period: Reduced from 20 to 5.

-

-

Buy Signal: Histogram > 50, colored in dodger blue.

-

Sell Signal: Histogram < -50, colored in dodger blue.

-

-

ITrend ADX

-

Purpose: Confirms the trend with visual Buy and Sell Arrows.

-

Default settings are used.

-

-

Levels for Keltner Channel Histogram

-

Buy Level: +50

-

Sell Level: -50

-

Trading Rules

Buy Signal

-

Keltner Channel Histogram:

-

Value > 50.

-

Histogram bar is colored in dodger blue.

-

-

ITrend ADX:

-

Buy arrow appears.

Conditions:

-

The Keltner Histogram and ITrend ADX signals do not need to occur simultaneously but should align within a reasonable period to confirm a valid signal.

-

Sell Signal

-

Keltner Channel Histogram:

-

Value < -50.

-

Histogram bar is colored in dodger blue.

-

-

ITrend ADX:

-

Sell arrow appears.

Conditions:

-

As with the Buy Signal, synchronization is not required, but signals must align for confirmation.

-

Stop Loss and Profit Target

-

Stop Loss:

-

Place at the previous swing high (for short trades) or previous swing low (for long trades).

-

-

Profit Target:

-

Target a risk-to-reward ratio between 1:1.1 and 1:1.5.

-

Adjust based on market volatility and pair characteristics.

-

Time Frame and Assets

-

Time Frame: 5 minutes or higher. For 5 min time frame only Berlin session.

-

Currency Pairs: Suitable for all currency pairs, with the potential for application to other instruments (e.g., commodities or indices) after testing.

Implementation Notes

-

Signal Filtering:

-

Ensure no counter-signals are present in the indicators.

-

Avoid trades during low liquidity periods, such as the final hours of a trading session.

-

-

Risk Management:

-

Use a position size calculator to maintain consistent risk across trades, aiming for 1%-2% of account equity per trade.

-

-

Backtesting:

-

Perform extensive backtesting over at least six months of historical data for each asset and time frame to verify strategy performance.

-

-

Live Testing:

-

Use the strategy in a demo account to ensure robust real-time application before scaling to a live account.

-

By combining the Keltner Channel Histogram with the ITrend ADX indicator, this strategy seeks to identify trending markets with high accuracy while maintaining a disciplined approach to risk management.