93# Profit Trade Catcher Trading Strategy

Submit by Dimitri 2024

Overview

Profit Trade Catcher Trading Strategy follows market trends using three key indicators: the Center of Gravity (COG), MACD, and a 7-period Exponential Moving Average (EMA). It identifies trades based on price testing support/resistance and uses clear entry and exit rules.

Key Parameters

-

Time Frames: 15-minute (M15) and 1-hour (H1).

-

Indicators:

-

COG (Center of Gravity): Identifies support and resistance levels.

-

MACD: A momentum indicator with two lines: Blue (faster) and Orange (slower).

-

7 EMA (Red Line): Added for trend confirmation.

-

Currency pairs:Volatile.

Trading Rules

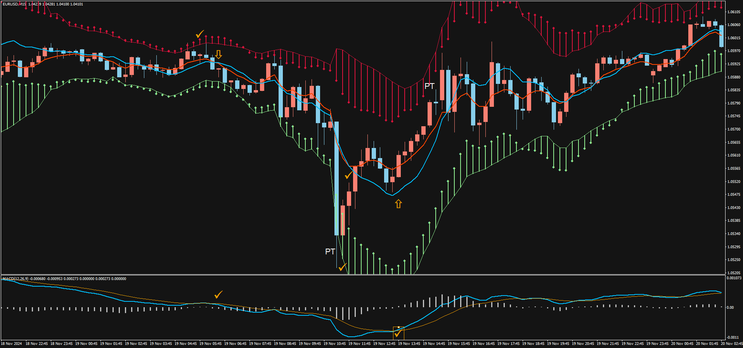

Buy Rules (Long Trades)

-

Step 1: Market Setup

-

The market is in a downward trend.

-

Price tests the lower COG channel line.

-

-

Step 2: Confirmation

-

The 7 EMA crosses above or is already above the middle COG line.

-

The MACD Blue line crosses above the Orange line.

-

-

Step 3: Entry

-

Enter a Buy trade when the MACD crossover occurs.

-

For a more conservative entry, wait for the candle to close.

-

-

Stop Loss and Take Profit

-

Stop Loss: A few pips below the recent low.

-

Take Profit: 1.5 times the distance from entry to stop loss.

-

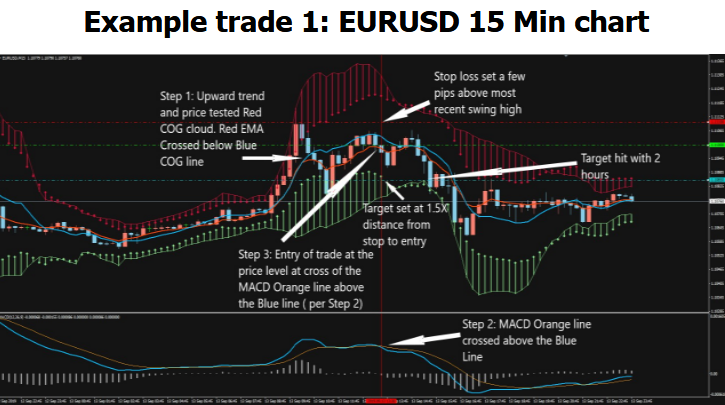

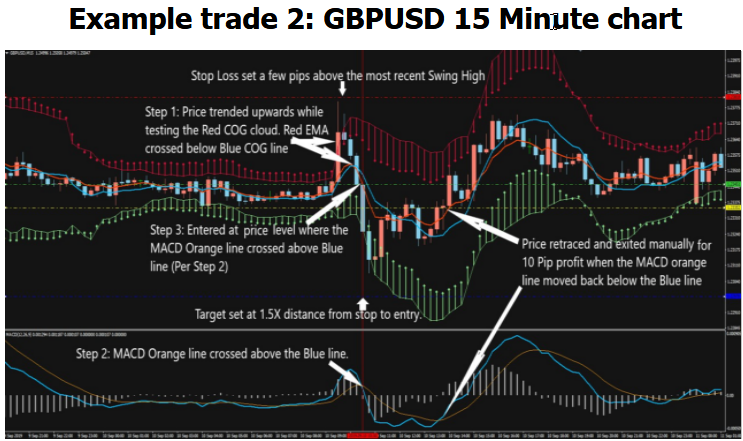

Sell Rules (Short Trades)

-

Step 1: Market Setup

-

The market is in an upward trend.

-

Price tests the upper COG channel line.

-

-

Step 2: Confirmation

-

The 7 EMA crosses below or is already below the middle COG line.

-

The MACD Orange line crosses above the Blue line.

-

-

Step 3: Entry

-

Enter a Sell trade when the MACD crossover occurs.

-

For a more conservative entry, wait for the candle to close.

-

-

Stop Loss and Take Profit

-

Stop Loss: A few pips above the recent high.

-

Take Profit: 1.5 times the distance from entry to stop loss.

-

Best Practices

-

Focus on currency pairs or instruments with strong momentum in the past 24 hours.

-

Use the 15-minute chart for quick trades and the 1-hour chart for swing trading.

-

Monitor charts for price tests at the COG lines, as these are key trade signals.

Summary

This strategy combines trend-following and momentum indicators to maximize profits while managing risk. It works best in markets with strong momentum and clear price movements. Always test the strategy on a demo account before trading live.

25# EMA's Band Scalp - Forex Strategies - Forex Resources -

4# Cross EMA - Forex Strategies - Forex Resources - Forex

84# 5 EMA and 13 EMA Fibonacci Numbers - Forex Strategies ...

40# MACD, RSI, 50 Ema and Pivot Points - Forex Strategies -

35# 100 EMA MultitimeFrame - Forex Strategies - Forex Resources

Ema Metatrader Indicator - Forex Strategies - Forex Resources ...

69# ADX, Parabolic Sar and three EMA - Forex Strategies - Forex

12# Ema, stochasticand RSI - Forex Strategies - Forex Resources

50# Williams % R , Stochastic and EMA - Forex Strategies - Forex

155# EMA CROSS RSI with Digital MACD - Forex Strategies -

72# EMA's, RSI and Stochastic - Forex Strategies - Forex

65# 100 'EMA and MACD “4H Strategy” - Forex Strategies - Forex

76# EMA's Retracement - Forex Strategies - Forex Resources ...

15# Ema Bands - Forex Strategies - Forex Resources - Forex ...

108# EMA's and RSI - Forex Strategies - Forex Resources - Forex

32# 4 EMA and Channel - Forex Strategies - Forex Resources ...

85# Ema's with Trading Range - Forex Strategies - Forex

126# 200 EMA Forex Strategy – - Forex Strategies - Forex ...

9# 6-12 EMA's - Forex Strategies - Forex Resources - Forex

96# EMA Cross - Forex Strategies - Forex Resources - Forex ...

6# Two Ema and MACD - Forex Strategies - Forex Resources ...

70# 3EMA'S - Forex Strategies - Forex Resources - Forex Trading

322# Channel 50 EMA two methods - Forex Strategies - Forex ...

83# 3 EMA's Forex Trading System - Forex Strategies - Forex ...