76# FX Money Bounce Forex Strategy

Submit by Dimitri 2025 author Russ Horn

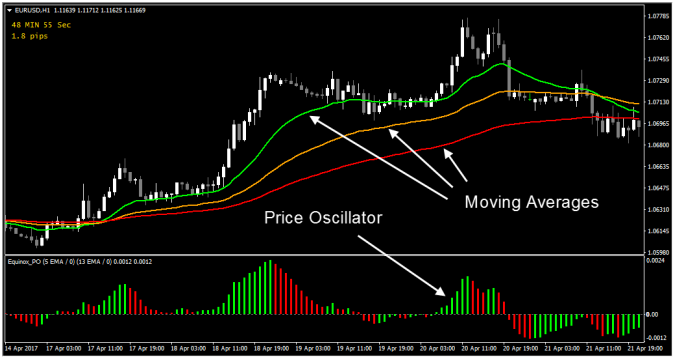

The FX Money Bounce system is a trend-following strategy that capitalizes on momentum by taking trades in the direction of the prevailing trend. This approach uses moving averages and a Price Oscillator to set up and confirm trades. Here are the main components, rules, and conditions for the strategy.

Key Components

-

Moving Averages:

-

20 EMA (Lime Green)

-

50 EMA (Orange)

-

100 EMA (Red)

-

The order of these moving averages is critical. For a trend to be confirmed:

-

Ascending order for long trades: 20 EMA above 50 EMA, which is above 100 EMA.

-

Descending order for short trades: 100 EMA above 50 EMA, which is above 20 EMA.

-

-

-

Price Oscillator:

-

A histogram showing the relationship between two moving averages (5 EMA and 13 EMA).

-

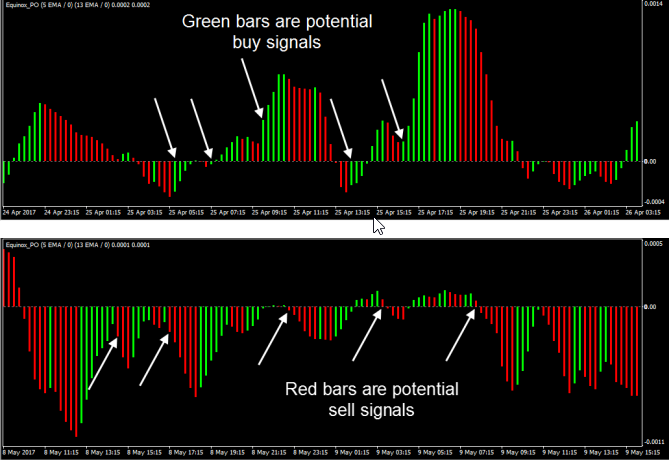

Green bar indicates a potential buy signal.

-

Red bar indicates a potential sell signal.

-

Note: The oscillator’s color only gives potential signals and needs to align with the moving average setup before taking a trade.

-

Rules for Long Trades

-

Trend Confirmation:

-

The 20, 50, and 100 EMAs must be in ascending order.

-

Price must be trading above the 20 EMA.

-

-

Setup:

-

Price must pull back and touch the 20 EMA (it’s acceptable if candles close slightly below it).

-

-

Signal:

-

A candle must close back above the 20 EMA.

-

The Price Oscillator must show a green bar.

-

-

Stop Loss:

-

Set the stop loss just below the most recent swing low.

-

-

Take Profit:

-

Target can be set at the same distance as the stop loss for a 1:1 risk-to-reward ratio, or at double the stop loss distance for a 2:1 reward.

-

Rules for Short Trades

-

Trend Confirmation:

-

The 100, 50, and 20 EMAs must be in descending order.

-

Price must be trading below the 20 EMA.

-

-

Setup:

-

Price must rise up to touch the 20 EMA (candles can close slightly above it).

-

-

Signal:

-

A candle must close back below the 20 EMA.

-

The Price Oscillator must show a red bar.

-

-

Stop Loss:

-

Place the stop loss just above the most recent swing high.

-

-

Take Profit:

-

Set target at the same distance as the stop loss for a 1:1 risk-to-reward ratio, or at double the stop loss distance for a 2:1 reward.

-

When Not to Trade

-

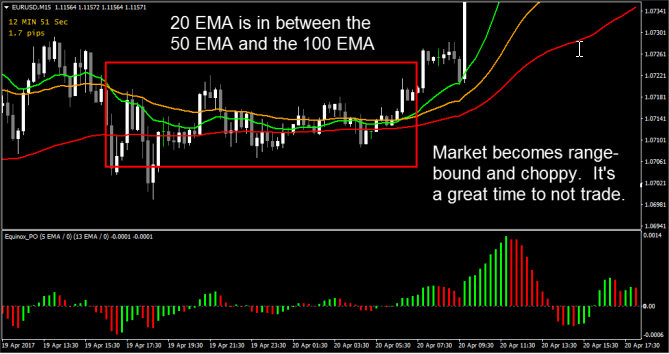

Out-of-Order Moving Averages:

-

If the EMAs are not in proper order (e.g., 100 EMA between 20 and 50 EMA or 20 EMA between 50 and 100 EMA), avoid trading as these conditions suggest a transition or range-bound market.

-

-

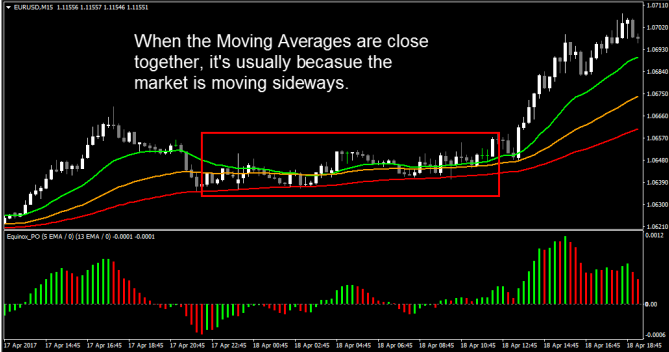

Squashed Moving Averages:

-

When the EMAs are very close together (even if in the correct order), this indicates a sideways or consolidating market. Avoid trades until the EMAs spread apart, signaling a clear trend direction.

-

Additional Notes

-

Confirmation: The Price Oscillator’s color doesn’t need to change on the exact candle that closes outside the 20 EMA; as long as it matches the trade direction, the trade is valid.

-

Time Frames and Pairs: The FX Money Bounce works on all time frames and currency pairs.

-

Profit Potential: Small stop losses and a 2:1 risk-to-reward ratio can yield numerous profitable opportunities by sticking with the trend and waiting for clear signals.

This strategy emphasizes simplicity and trend alignment, making it a solid option for identifying profitable trading opportunities in trending markets.

4H Forex Trading System

224# 4H Trader - Forex Strategies - Forex Resources - Forex ...

74# 4H Scalping - Forex Strategies - Forex Resources - Forex ...

65# 100 'EMA and MACD “4H Strategy” - Forex Strategies - Forex

44# 4H System - Forex Strategies - Forex Resources - Forex

90# 4H Kiss - Forex Strategies - Forex Resources - Forex Trading ...

39# 4H Trend - Forex Strategies - Forex Resources - Forex Trading

26# GPY 4H Strategy - Forex Strategies - Forex Resources - Forex

28# 4H Strategy: RSX and Murrey Math - Forex Strategies - Forex ...

31# 4H Breakout - Forex Strategies - Forex Resources - Forex ...

292# LawGirl's 4H strategy - Forex Strategies - Forex Resources ...

351# EJ 4H Method - Forex Strategies - Forex Resources - Forex ...