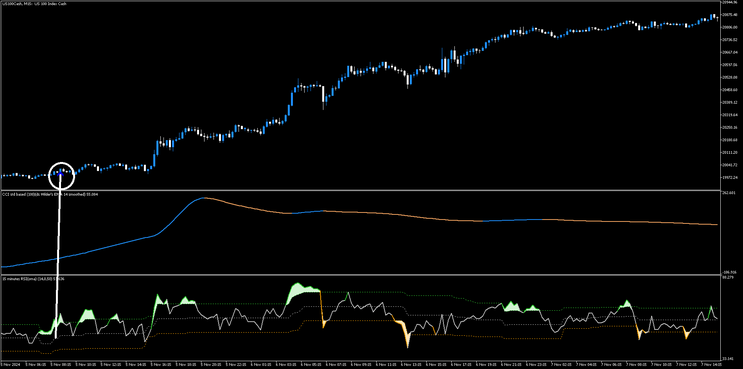

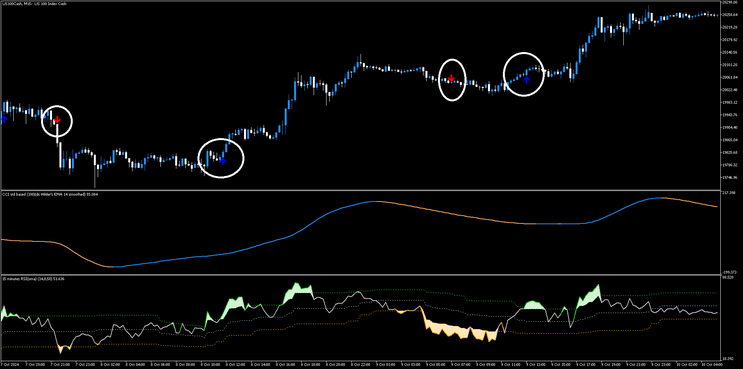

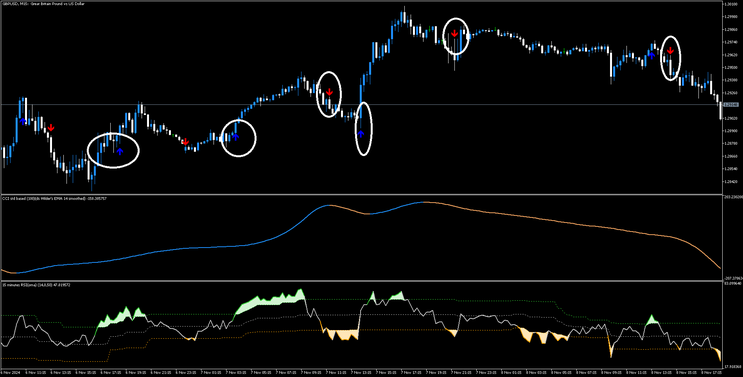

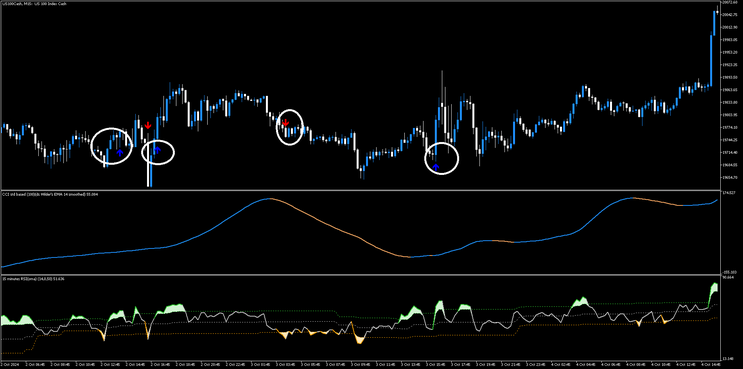

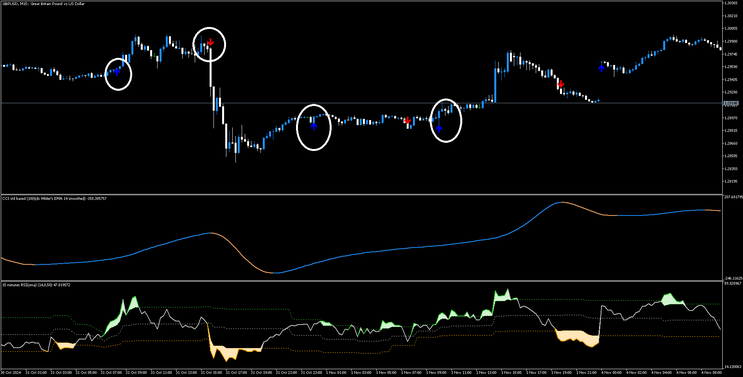

73# Double CCI and Rsioma FX MT5 Strategy

Submit by Maximo Trader 2024

Double CCI and RSIOMA FX Strategy MT5 trend momentum where these two indicators filter a trend arrow indicator.

Setup Strategy

Time Frame 5 minutes or higher but this setup is more suitable for day trading so for the time frame of 5 minutes and 15.

-

Indicators MT5:

-

Trend Signal: Primary timing indicator for entry signals (12, 2).

-

RSIOMA (Relative Strength Index of Moving Average): Confirms momentum strength and trend direction (default setting).

-

CCI Double Smoothed Wilder’s EMA: Trend confirmation indicator with a blue or orange line to signal the trend direction(default setting.

-

-

Asset: Suitable for forex pairs, indices, or major commodities with volatility.

Entry Rules

-

Trend Signal:

-

Look for a clear buy or sell signal generated by the Trend Signal indicator.

-

Buy Signal: When Trend Signal shows an upward signal.

-

Sell Signal: When Trend Signal shows a downward signal.

-

-

RSIOMA Confirmation:

-

For a Buy:

-

The RSIOMA main line should above green dot line, indicating bullish momentum.

-

-

-

For a Sell:

-

The RSIOMA main line should be oversold, indicating bearish momentum.

-

-

-

-

CCI Double Smoothed Wilder’s EMA Confirmation:

-

For a Buy:

-

The CCI line must be blue, indicating an uptrend.

-

-

For a Sell:

-

The CCI line must be orange, indicating a downtrend.

-

-

-

Entry:

-

Buy: Enter a buy trade only when Trend Signal gives a buy signal, RSIOMA confirms above green dot line, and the CCI line is blue.

-

Sell: Enter a sell trade only when Trend Signal gives a sell signal, RSIOMA confirms with a below orange dot line, and the CCI line is orange.

-

Exit Rules

-

Primary Exit (Profit-Taking):

-

Exit when the Trend Signal reverses its signal (e.g., from buy to sell).

-

Consider taking profit if the RSIOMA or CCI line indicates potential exhaustion:

-

RSIOMA reaches 80 or above (for a buy) or falls to 20 or below (for a sell).

-

CCI color change (e.g., from blue to orange for buys or orange to blue for sells) signals a possible trend change.

-

-

-

Secondary Exit (Stop Loss):

-

Place a stop loss at the nearest support level for buys or nearest resistance level for sells.

-

Alternatively, use an ATR-based stop loss:

-

Set the stop loss at 1.5 to 2 times the ATR value from the entry to account for price swings while protecting capital.

-

-

-

Trailing Stop (Optional):

-

Use a trailing stop based on ATR to secure profits as the trade moves in your favor, adjusting the stop as price continues in the trend direction.

-

Example Workflow Buy

-

Trend Signal issues a buy signal.

-

Check RSIOMA:

-

Main line is overbought and trending upward, confirming bullish momentum.

-

-

Check CCI Double Smoothed Wilder’s EMA:

-

CCI line is blue, confirming an uptrend.

-

-

Enter Buy Trade.

-

Monitor Exit Conditions:

-

Exit if Trend Signal reverses to a sell.

-

Exit if RSIOMA or CCI signals potential exhaustion (e.g., RSIOMA reaching 80 or CCI.

-

Example Workflow Sell

-

Trend Signal issues a sell signal.

-

Check RSIOMA:

-

Main line is oversoldt and trending downward, confirming bearish momentum.

-

-

Check CCI Double Smoothed Wilder’s EMA:

-

CCI line is orange, confirming an downtrend.

-

-

Enter Sell Trade.

-

Monitor Exit Conditions:

-

Exit if Trend Signal reverses to a buy.

-

Exit if RSIOMA or CCI signals potential exhaustion (e.g., RSIOMA reaching 20 or CCI.

-