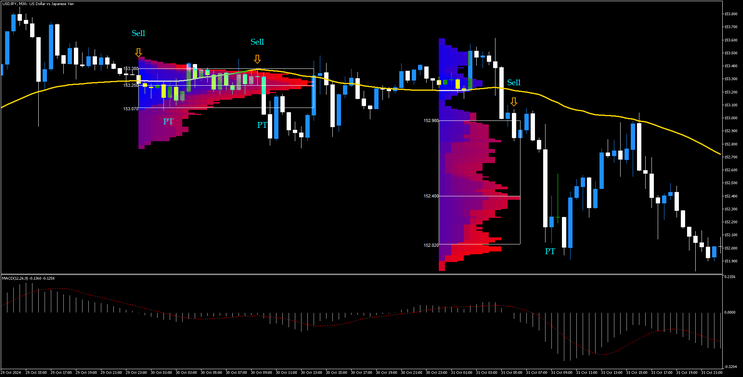

69# Market Profile Trading System MT5

Submit by Mximo Trader 2024

Here's a trading strategy for MetaTrader 5 (MT5) using the Market Profile indicator, enhanced with additional indicators to improve entry and exit signals. This strategy focuses on exploiting support and resistance levels, trend strength, and market reversals, making it suitable for various timeframes but best used on H1 or higher.

Here's a trading strategy for MetaTrader 5 (MT5) using the Market Profile indicator, enhanced with additional indicators to improve entry and exit signals. This strategy focuses on exploiting support and resistance levels, trend strength, and market reversals, making it suitable for various timeframes but best used on H1 or higher.

Strategy Overview

This strategy leverages the Market Profile indicator to identify high-probability areas for price action, complemented by the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) for confirmation. This combination aims to pinpoint key market zones, confirm trends, and validate potential reversals.

Indicators Used

-

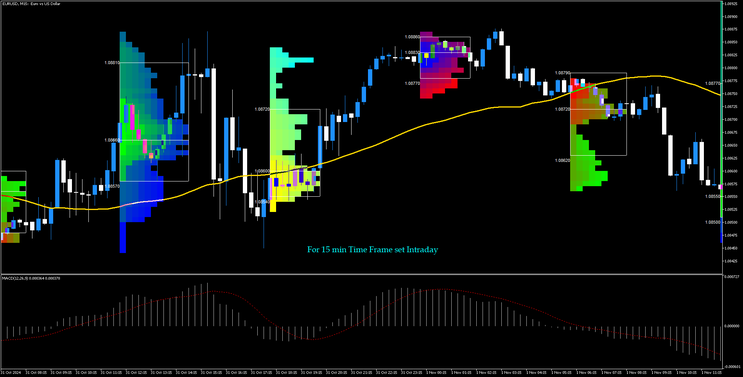

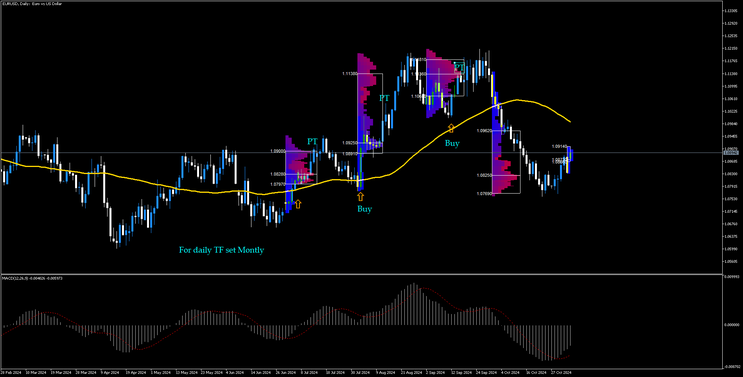

Market Profile: Helps identify key support and resistance levels based on the volume and time spent at certain price levels. Maeket profile setting: intraday: time frame 5, 15; Daily time frame 30,; weekly TF: 60, 240; Montly tf: daily, weekly.

-

MACD (12, 26, 9): Measures trend strength and provides potential reversal signals.

-

50-period Moving Average (MA): Acts as a trend filter.

Strategy Steps

1. Define Key Market Profile Levels

-

Point of Control (POC): This is the price level with the highest traded volume within a session. It represents a strong support/resistance level.

-

Value Area (VA): The range covering approximately 70% of the trading volume, marking areas where price is likely to consolidate.

-

High-Volume Nodes (HVN) and Low-Volume Nodes (LVN): These help identify areas where price may either consolidate (HVN) or break through (LVN).

2. Set Up Trend Filter Using Moving Average

-

If the price is above the 50-period Moving Average, look for long positions.

-

If the price is below the 50-period Moving Average, focus on short positions.

3. Entry Signals

-

Long Entry:

-

Market Profile Setup: The price should be at or near a support level identified by the POC or near the lower boundary of the Value Area.

-

MACD Confirmation: The MACD histogram should be turning upwards or show a bullish crossover (MACD line crossing above the signal line).

-

-

Short Entry:

-

Market Profile Setup: The price should be at or near a resistance level identified by the POC or the upper boundary of the Value Area.

-

MACD Confirmation: The MACD histogram should be turning downwards, or there should be a bearish crossover (MACD line crossing below the signal line).

-

4. Exit Signals

-

Long Exit:

-

Exit at the upper boundary of the Value Area or at a key resistance level identified by a high-volume node.

-

Alternatively, use a trailing stop loss to capture profits as the price moves in favor.

-

-

Short Exit:

-

Exit at the lower boundary of the Value Area or a key support level indicated by a high-volume node.

-

Use a trailing stop loss if the trend moves favorably.

-

5. Stop Loss and Risk Management

-

Place the stop loss just outside the Value Area range. For long positions, place it below the lower boundary of the Value Area or recent low; for short positions, above the upper boundary of the Value Area or recent high.

-

Risk-Reward Ratio: Aim for a minimum of 1:2 (risking 1 unit for a potential gain of 2 units). Adjust depending on market conditions and volatility.

Example: Long Trade Scenario

-

Trend Confirmation: The price is above the 50-period MA, indicating a potential long opportunity.

-

Market Profile Setup: The price approaches the POC, indicating strong support.

-

MACD Confirmation: MACD shows a bullish crossover.

-

Entry: Enter a long position.

-

Exit: Set a take profit at the upper boundary of the Value Area or trail the stop loss if the trend continues.

Tips for Optimization

-

Backtesting: Test the strategy on different assets and timeframes to refine the parameters.

-

Adjusting Value Area Period: Depending on the asset’s volatility, adjusting the Market Profile’s calculation period can improve precision.

-

News and Volatility: Avoid trading during high-impact news events as they can increase volatility and invalidate technical levels.

Summary

This strategy combines the precision of Market Profile levels with the MACD’s trend validation and RSI’s overbought/oversold signals, aiming for solid entries and disciplined exits. By identifying high-probability zones with the Market Profile and confirming trends with MACD and RSI, it aims to capture price movements efficiently with controlled risk.