64# Trend Direction Force Index Forex Strategy for MT5

Submit by Maximo Trader 2024

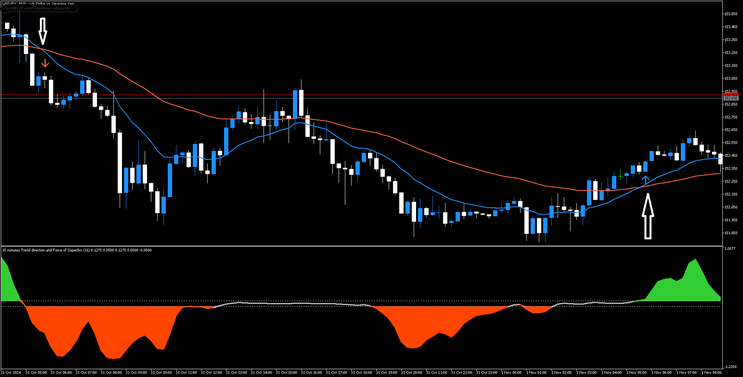

The Trend Direction Force Index (TDFI) Forex Strategy is a trend-following approach for the MT5 platform, focusing on identifying strong trend movements and potential entry and exit points. This strategy is especially useful in volatile currency pairs and is based on the TDFI indicator combined with dual exponential moving averages (EMAs).

Strategy Overview

-

Timeframe: 5-minute or higher

-

Currency Pairs: Volatile pairs

-

Recommended Timeframe: 1-hour or 4-hour, depending on the market’s volatility and your availability.

Required Tools

-

TDFI Indicator with the following settings:

-

Trend Period: 15

-

Trend Multiplier: 2

-

-

15-period Exponential Moving Average (EMA)

-

50-period Exponential Moving Average (EMA)

Required Tools

-

TDFI Indicator with the following settings:

-

Trend Period: 16-20

-

Trend Multiplier: 2

-

-

15-period Exponential Moving Average (EMA)

-

50-period Exponential Moving Average (EMA)

Strategy Logic

1. Identifying the Primary Trend (using the 15 and 50 EMAs):

-

Bullish Trend: The 15 EMA is above the 50 EMA.

-

Bearish Trend: The 15 EMA is below the 50 EMA.

2. Confirming Trend Direction and Force (using the TDFI Indicator):

-

Bullish Signal: TDFI indicator is positive and shows green force, signaling a potential bullish scenario.

-

Bearish Signal: TDFI indicator is negative and shows red force, signaling a potential bearish scenario.

3. Entry Signals

-

Long Entry:

Double MA Buy arrow.

-

Confirm the bullish trend: 15 EMA > 50 EMA.

-

TDFI indicator shows green force or an increase in the positive value.

-

Ideally, the price bounces off a support level or the 15 EMA, reinforcing the long signal.

-

-

Short Entry:

Double MA Sell arrow.

-

Confirm the bearish trend: 15 EMA < 50 EMA.

-

TDFI indicator shows red force or a drop in the negative value.

-

Ideally, the price bounces off a resistance level or the 15 EMA, reinforcing the short signal.

-

4. Exit Signals

-

Close the position if the TDFI indicator changes color (e.g., from green to red or vice versa), indicating momentum weakening.

-

If price moves against your open position and crosses the 50 EMA, consider it a trend reversal signal and exit the position.

-

Optionally, apply a trailing stop to lock in profits if the trend continues favorably.

5. Risk Management

-

Stop Loss: Place the stop loss just below the low (for long positions) or just above the high (for short positions) of the entry candle.

-

Take Profit: Aim for a risk-to-reward ratio of at least 1:2 or 1:3, or use a trailing stop to maximize profit in prolonged trends.

6. Position Management and Adjustments

-

Avoid sideways markets: Avoid opening new trades in a non-trending environment (no clear EMA or TDFI signals).

-

Monitor the TDFI: Regularly check the TDFI trend force. If it weakens or changes color, consider partially or fully closing the position.

Example Application

Let’s say the 15 EMA is above the 50 EMA+buy arrow, confirming a bullish trend, and the TDFI indicator shows green force. Enter a long position when the price bounces off the 15 EMA. Set a stop loss just below the latest swing low, and target a profit at a minimum risk-to-reward ratio of 1:1.2.

Important Note

Test this strategy on a demo account first to adjust it to your risk tolerance and the specific market conditions. It’s critical to practice and refine the strategy to suit your trading style.