55# MACD Detector MT5 Strategies

Submit by Dimitri

Overview

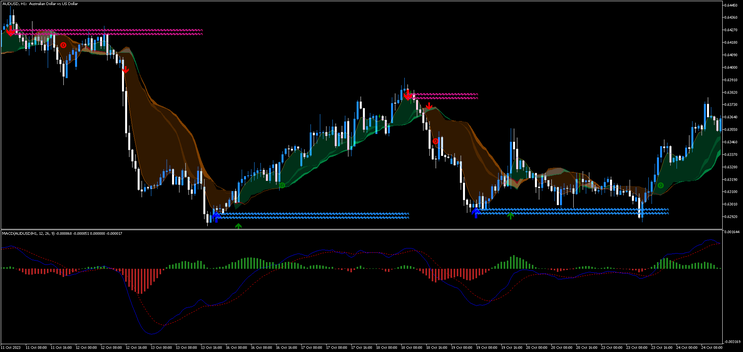

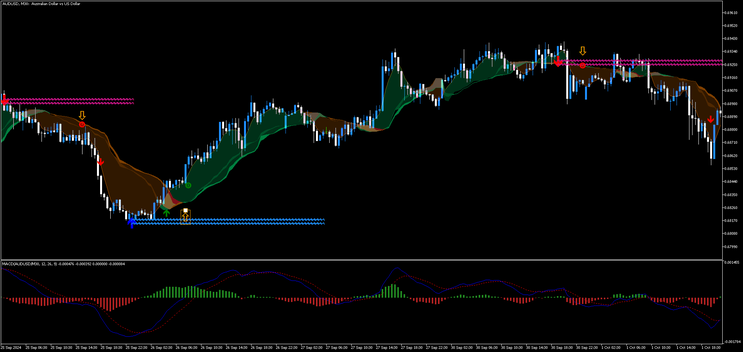

This strategy combines three key indicators on MetaTrader 5 (MT5) to capitalize on trend reversals and trend-following setups. The approach uses the MACD Silencer to identify potential reversals and trend strength, while the Trend Detector confirms trends with visual clouds. Additionally, the Lucky Reversal helps in identifying optimal reversal points to increase accuracy.

Indicators and Settings

-

MACD Silencer (Default Settings)

-

Generates two signals:

-

Trend Reversal Signal: Indicates potential trend reversals.

-

Histogram Signal: Shows if the MACD histogram is greater or less than 0.

-

-

-

Trend Detector (Default Settings)

-

Shows trend direction through colored clouds on candlesticks:

-

Green Cloud: Uptrend.

-

Brown Cloud: Downtrend.

-

-

-

Lucky Reversal (Setting: SRZZ 60)

-

Highlights potential reversal points for entries and exits.

(Remember to enable winnet DLL otherwise it will not display.)

-

Entry Conditions

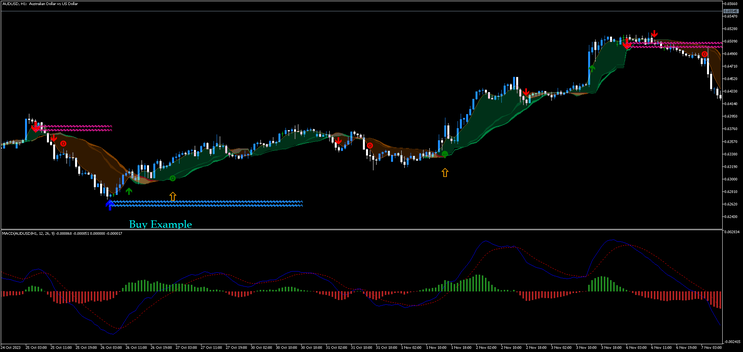

Long Entry

-

MACD Bullish Signals on the main chart.

-

Trend Confirmation: Trend Detector shows a Green Cloud (uptrend).

-

Reversal Confirmation: Lucky Reversal indicator gives a reversal signal in the uptrend direction.

When all three conditions align, enter a Buy position.

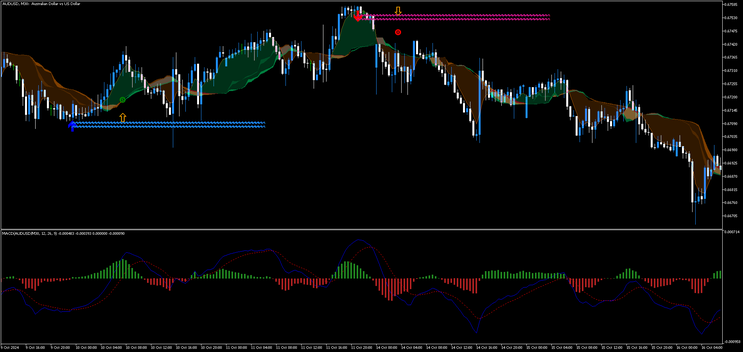

Short Entry

-

MACD Buearish Signals on the main chart.

-

Trend Confirmation: Trend Detector shows a Brown Cloud (downtrend).

-

Reversal Confirmation: Lucky Reversal indicator gives a reversal signal in the downtrend direction.

When all three conditions align, enter a Sell position.

Exit Conditions

Stop Loss

-

Set the Stop Loss at the previous swing high (for short positions) or swing low (for long positions), identified by the Lucky Reversal indicator.

Profit Target

-

Use a Risk-to-Reward Ratio based on the Stop Loss:

-

Standard 1:1 ratio.

-

Optionally adjust to 1:1.3 for larger moves if market momentum supports an extended target.

-

Additional Exit Criteria

-

Close the position manually if:

-

The MACD histogram crosses 0, signaling a potential trend weakening.

-

Trend Detector changes its cloud color, indicating a shift in trend direction.

-

Example Workflow

-

Wait for the MACD Silencer to show a bullish signal.

-

Confirm a Green Cloud from the Trend Detector.

-

Wait for the Lucky Reversal indicator to signal a bullish reversal.

-

Place a Buy position with the Stop Loss at the recent swing low and a Profit Target with a 1:1 or 1:1.3 ratio.

-

For Sell positions, wait for a MACD bearish signals, a Brown Cloud, and a Lucky Reversal indicator to signal a bearish reversal, then enter with a Stop Loss at the recent swing high.

Tips for Optimal Execution

-

Time Frame: The strategy works best on time frames of 1 hour or higher to reduce noise.

-

Volatility Filters: Avoid trading in highly volatile or news-affected periods to prevent false signals.

-

Risk Management: Ensure no more than 1-2% of your account balance is risked per trade.

This structured approach ensures alignment among trend, momentum, and reversal conditions for increased reliability. Test this setup on a demo account to refine and confirm its effectiveness before live trading.