48# XU Hybrid 3.2 Trading System

Submit by Dimitri 2024 source: www.forex-station.com

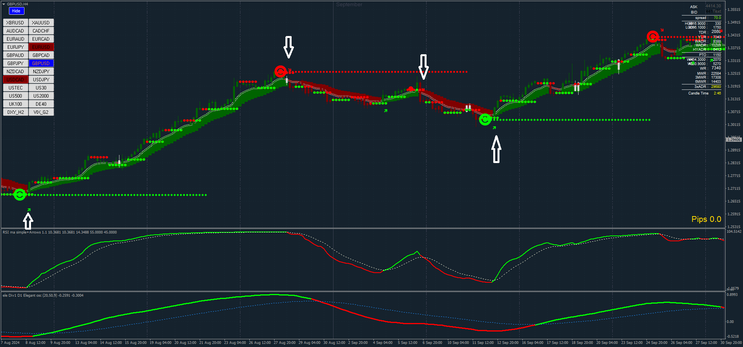

XU Hybrid 3.2 Trading System is a trend momentum forex strategy.

Time Frame:

-

15-minute chart or higher (preferably 30-minute, 1-hour, or 4-hour).

Instruments:

-

Volatile currency pairs (Forex)

-

Nasdaq (US100)

-

Gold (XAU/USD)

-

Oil (WTI/Brent)

-

Dow Jones (US30)

-

S&P 500 (US500)

Indicators Setup:

Main Chart:

-

Lucky Reversal (Swing High/Low Support and Resistance):

-

Plots swing high/low levels and dynamic support and resistance dots on the chart.

-

-

MA Ribbon:

-

Displays a series of moving averages to capture trend direction.

-

Green ribbon signals a bullish trend.

-

Red ribbon signals a bearish trend.

-

-

ADR (Average Daily Range) Info:

-

Weekly, daily, and holiday information about the market's ADR to gauge volatility levels.

-

Sub-window:

-

RSI (Relative Strength Index) with Arrows (Period 16, Mode: Regular RSI):

-

Buy/Sell arrows appear when RSI crosses key levels.

-

Buy signals when RSI arrow points upward.

-

Sell signals when RSI arrow points downward.

-

-

CCI (Commodity Channel Index) Histogram (Default Settings):

-

Positive values indicate bullish momentum (green bars).

-

Negative values indicate bearish momentum (red bars).

-

-

Elegant Oscillator (20, 50, 9 settings):

-

-

Set next timw frame.

-

Green line signals positive momentum (bullish).

-

Red line signals negative momentum (bearish).

-

Trading Rules:

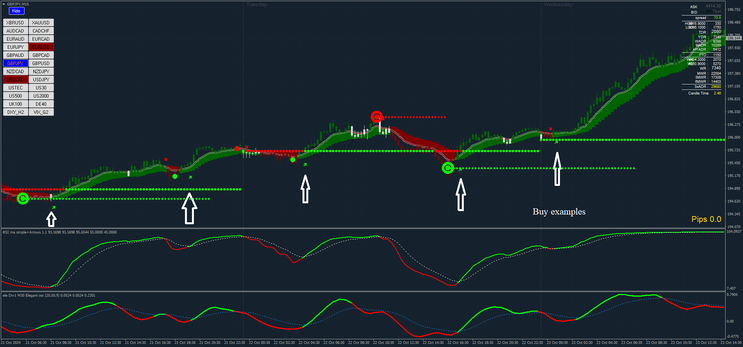

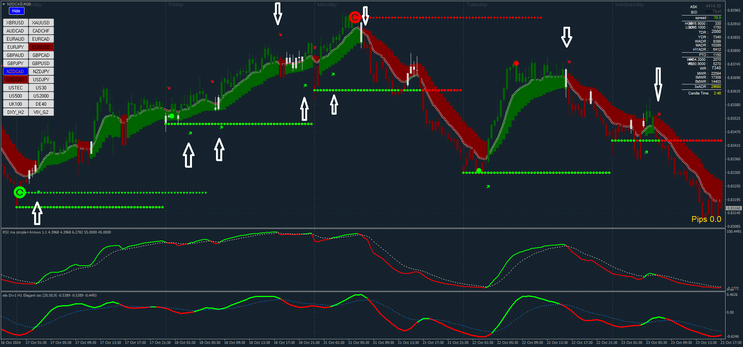

Buy Setup:

-

RSI Buy Arrow:

-

A green RSI arrow appears indicating upward momentum.

-

-

Lucky Reversal Support Dots:

-

Support dots appear below the price, confirming a bullish trend.

-

-

MA Ribbon Color:

-

The MA ribbon must be green, showing a bullish trend.

-

-

Momentum Confirmation:

-

The Elegant Oscillator’s green line indicates positive momentum.

-

Entry:

-

Enter a buy trade when all the conditions above are met simultaneously.

Stop Loss:

-

Place the stop loss at the previous swing low, identified by the Lucky Reversal indicator.

Take Profit Target:

-

Set the profit target using a risk/reward ratio between 1:1.2 and 1:1.6, depending on the volatility of the market. For higher volatility pairs or instruments like Gold and Oil, use 1:1.6.

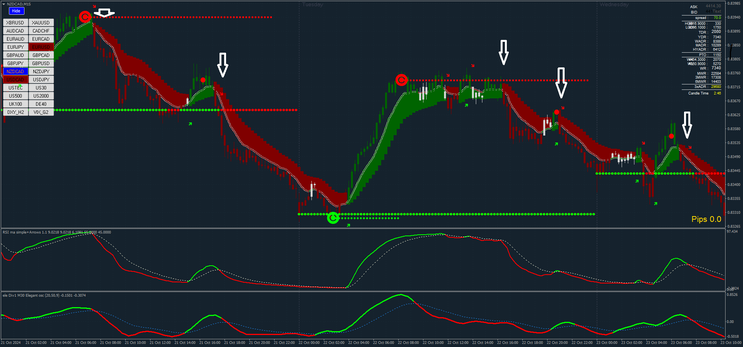

Sell Setup:

-

RSI Sell Arrow:

-

A red RSI arrow appears indicating downward momentum.

-

-

Lucky Reversal Resistance Dots:

-

Resistance dots appear above the price, confirming a bearish trend.

-

-

MA Ribbon Color:

-

The MA ribbon must be red, showing a bearish trend.

-

-

Momentum Confirmation:

-

The Elegant Oscillator’s red line indicates negative momentum.

-

Entry:

-

Enter a sell trade when all the conditions above are met simultaneously.

Stop Loss:

-

Place the stop loss at the previous swing high, identified by the Lucky Reversal indicator.

Take Profit Target:

-

Set the profit target using a risk/reward ratio between 1:1.2 and 1:1.6, depending on market volatility. For highly volatile instruments like Oil, Gold, and Nasdaq, prefer 1:1.6.

Additional Notes:

-

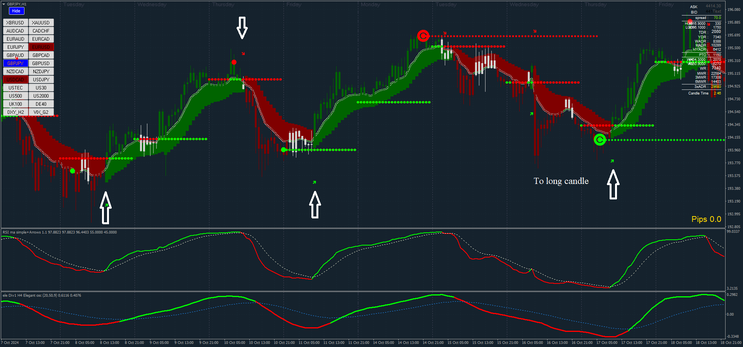

Volatility Consideration:

During times of increased volatility (based on ADR and market session), widen the stop loss and adjust the take profit target accordingly. -

Avoid Trades:

During holidays or low volatility sessions (ADR shows reduced activity), avoid trading as market conditions might not favor strong movements. -

Trade Management:

Consider moving the stop loss to break-even once the trade has moved in your favor by 50% of the take profit distance.

This strategy, Hybrid XU 2.3, combines trend, momentum, and volatility analysis to provide a structured approach to entering and managing trades in various markets. It is essential to practice proper risk management and consider market conditions when applying this strategy.

67# Power Trend - Forex Strategies - Forex Resources - Forex ...

93# CCI Trend Strategy - Forex Strategies - Forex Resources -

81# RSI Trend Following Strategy - Forex Strategies - Forex ...

131# Trend FX Strategy - Forex Strategies - Forex Resources ...

47# Schaff Trend Cycle Strategy - Forex Strategies - Forex ...

39# 4H Trend - Forex Strategies - Forex Resources - Forex Trading

50# On Trend 2 - Forex Strategies - Forex Resources - Forex ...

123# Free Style - Forex Strategies - Forex Resources - Forex ...

47# Schaff Trend Cycle Strategy - Forex Strategies - Forex ...

91# Forex Profit System - Forex Strategies - Forex Resources ...

75# Profit System - Forex Strategies - Forex Resources - Forex

134# Forex Profit System - Forex Strategies - Forex Resources ...

11# Cornflower - Forex Strategies - Forex Resources - Forex ...

105# Cobra System - Forex Strategies - Forex Resources - Forex

79# Disparity System - Forex Strategies - Forex Resources - Forex ...

101# SMA H1 Trading System - Forex Strategies - Forex

130# Colt Forex System - Forex Strategies - Forex Resources ...

88# Riding The Trend after Retracement - Forex Strategies - Forex