42# Vwap Trading Method MT4, MT5, TradingView

Janus Trader 2025

The Volume Weighted Average Price (VWAP) is more than just a technical indicator — it's a cornerstone of institutional trading, providing a reliable benchmark for price relative to volume. By combining price action with volume flow, VWAP offers valuable insight into market sentiment and fair value. In this article, we explore two robust trading strategies that leverage VWAP and its standard deviation bands: VWAP Trend Rider and VWAP Snapback. Designed for MT4, MT5, and TradingView platforms, these strategies are tailored to help traders navigate both trending and mean-reverting market conditions with precision. Whether you're aiming to ride strong momentum or capitalize on price overextensions, this guide offers clear, rule-based approaches to enhance your intraday trading edge.

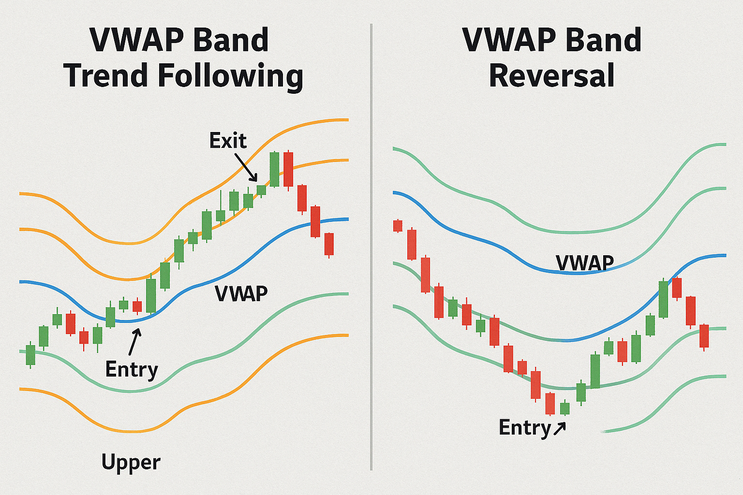

Strategy 1: VWAP Band Trend Following

Name: VWAP Trend Rider

Type: Trend-Following

Recommended Timeframes: 5-minute (5m) and 15-minute (15m)

Indicators Used

-

VWAP (Volume Weighted Average Price)

-

VWAP Bands (±1 standard deviation and ±2 standard deviations)

Long Setup (Bullish Trend)

Entry: Price breaks above +1σ or +2σ VWAP band.

Confirm: Strong bullish breakout candle with high volume.

Entry: Pullback to +1σ or VWAP.

Stop Loss: Below VWAP or low of breakout candle.

Take Profit: +2σ or predefined risk/reward.

Short Setup (Bearish Trend)

Entry: Price breaks below –1σ or –2σ VWAP band.

Confirm: Strong bearish breakout candle with high volume.

Entry: Pullback to –1σ or VWAP.

Stop Loss: Above VWAP or high of breakout candle.

Take Profit: –2σ or predefined risk/reward.

Strategy Logic

This approach aims to capture momentum as the price pushes away from the mean (VWAP) with strength. The VWAP bands serve as dynamic support and resistance zones, helping confirm both breakout and pullback levels.

Long Setup (Oversold Reversal)

Entry: Price touches or pierces –2σ or –3σ VWAP band.

Confirm: Reversal pattern (e.g. hammer, bullish engulfing).

Entry: On bullish signal candle.

Stop Loss: Just below –3σ or recent swing low.

Take Profit: VWAP (mean reversion).

Short Setup (Overbought Reversal)

Entry: Price touches or pierces +2σ or +3σ VWAP band.

Confirm: Bearish pattern (e.g. shooting star, bearish engulfing).

Entry: On bearish signal candle.

Stop Loss: Just above +3σ or recent swing high.

Take Profit: VWAP.

Strategy Logic

This strategy capitalizes on mean reversion — the idea that prices tend to return to a fair value after excessive movement. VWAP bands help traders time entries during sharp downward spikes, providing structure to an otherwise risky reversal setup.

⚖️ Comparison

|

Feature |

Trend Following (VWAP Trend Rider) |

Reversal (VWAP Snapback) |

|---|---|---|

|

Market Condition |

Trending (strong direction) |

Ranging or overextended |

|

Risk Profile |

Moderate (trend continuation) |

Higher (catching falling knife) |

|

Reward Profile |

Can catch large moves |

Faster but smaller gains |

|

Entry Frequency |

Moderate |

High (more setups) |

|

Ideal Volume |

High/increasing |

Spikes followed by fade |

|

Stop Placement |

Logical (below trend) |

Tight, needs discipline |

|

Drawdown Risk |

Lower in strong trend |

Higher during trend continuation |

|

Psychology |

Patience for pullbacks |

Quick reaction and confidence |

Tips & Best Practices

-

Use volume as confirmation: Especially for breakouts, above-average volume strengthens the signal.

-

Avoid low-liquidity sessions: VWAP is volume-sensitive; use it during active market hours.

-

Always wait for the pullback in trend-following setups — chasing price can lead to poor entries.

-

Combine VWAP with price action like candlestick patterns for more confluence.

-

Backtest on your platform before going live — performance can vary slightly between MT4, MT5, and TradingView due to VWAP calculation methods.

Common Mistakes to Avoid

-

Entering too early before confirmation (e.g., entering before price breaks the VWAP band).

-

Placing wide stop losses without respecting structure or volatility.

-

Forcing trades in choppy or low-volume markets.

-

Ignoring the broader trend — reversal strategies work best against sharp but temporary moves, not sustained downtrends.

-

Overusing VWAP bands on every timeframe — stick to one or two key timeframes to avoid confusion.

42# Faizumi 2.1 modified Trading System

Submit by Forexstrategiesresources

Faizumi 2.1 modified is new version of popular trading system, Faizumi.

Time Frame: 4H .

Pair:all.

Metatrader Indicators:

Advance ADX

ADXhds

THV Mtf bar

Gold Finger

Long Entry:

When Appairs Gold Fnger signal buy and ADX advanced is greater than the previous bar and ADXhds is green.

Short Entry:

When Appairs Golden Finger signal sell and ADX advanced is greater than the previous bar and ADXhds is red.

Exit:

place stop loss at higher or lower previus of entry;

trailing stop;

profit target;

reversal Gold Finger signal.

In the picture Faizumi forex system in action.

190# DOLLY + ISAKAS + NINA - Forex Strategies - Forex

284# ISAKAS CS - Forex Strategies - Forex Resources - Forex ...

53# Isakas Sekelper - Forex Strategies - Forex Resources - Forex

172# ISAKAS Rebirth - Forex Strategies - Forex Resources - Forex

173# Trading System, ISAKAS II V.2 - Forex Strategies - Forex ...

171# ISAKAS II - Forex Strategies - Forex Resources - Forex

165# Isakas Osentogg - Forex Strategies - Forex Resources -

335# Dolly 10,11,12 - Forex Strategies - Forex Resources - Forex

190# DOLLY + ISAKAS + NINA - Forex Strategies - Forex

310# Dolly 13 - Forex Strategies - Forex Resources - Forex Trading

257# Dolly 2 - Forex Strategies - Forex Resources - Forex Trading

32# Dolly Modified - Forex Strategies - Forex Resources - Forex ...

318# Ultima Secret V.1 - Forex Strategies - Forex Resources -

339# Gold Miner and Stochbars Strategy - Forex Strategies - Forex

20# Fx Faizumi - Forex Strategies - Forex Resources - Forex

Trading System Metatrader 4 III