31# Swing Trading Forex NNFX

Submit by Janus Trader

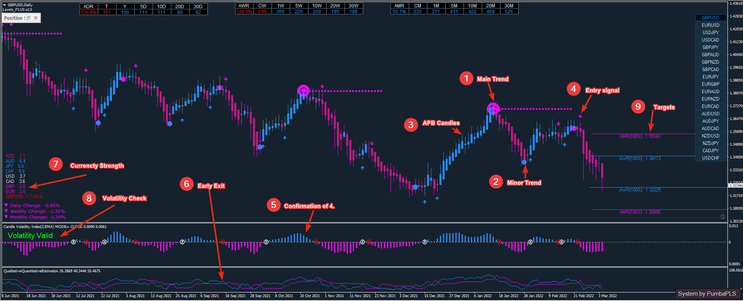

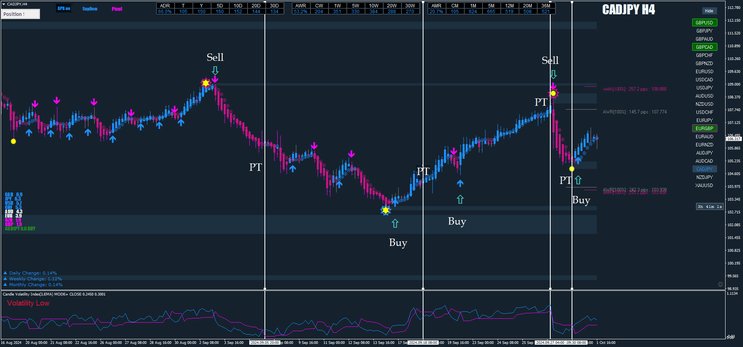

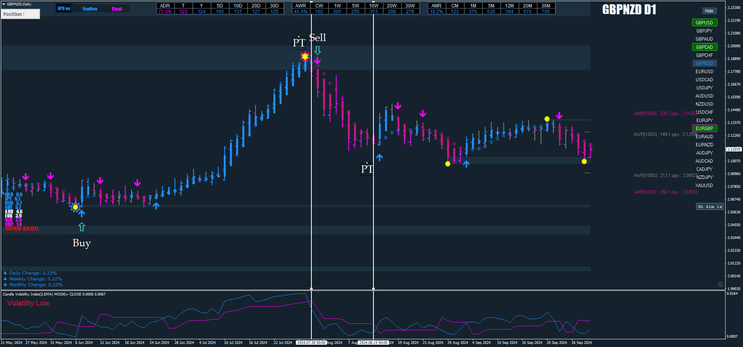

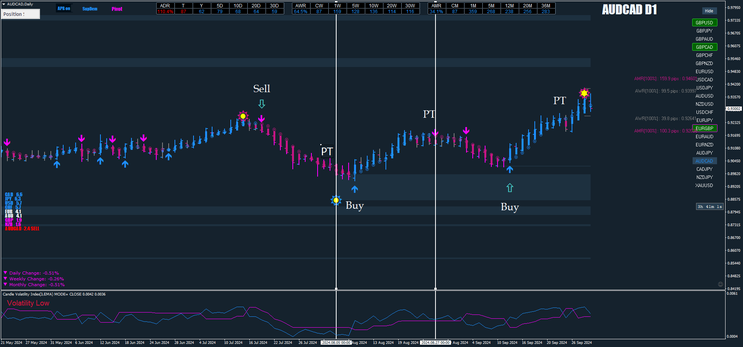

This swing trading strategy, based on the No Nonsense Forex (NNFX) approach, utilizes a combination of custom Metatrader 4 indicators designed for trend-following and price action trading. It's a highly accurate and flexible system suitable for beginners and experienced traders alike. The strategy offers a clear setup and trade management process, focusing on H4, and Daily timeframes. It can be applied to any currency pair.

Strategy Setup

-

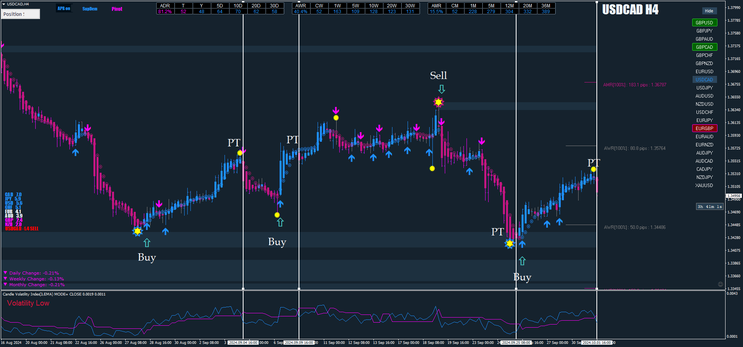

Timeframe: H1, H4, and Daily. Best TF Daily.

-

Currency Pairs: Any.

-

Platform: Metatrader 4.

Indicators Used

-

Percentage Change DVM: Measures dynamic volatility.

-

Level Plus: Custom support and resistance indicator.

-

Zwinner Andrea: Provides buy and sell signals via arrows.

-

APB Candle: Colored candles for trend direction (blue for bullish, red for bearish).

-

Currency Strength: Measures the strength of individual currencies.

-

FL 08 dots above and below the candle,

-

FL09,

-

FL11: Main Trend and Secondary Trend (Zig Zag-based): Confirms overall market trend.

-

Currency Changer 5.1: Quickly switches between currency pairs.

-

Super Dem Box Button: Identifies supply and demand zones.

-

Snorm Background: Shows trend direction through background shading.

-

Candle Volatility: Measures real-time volatility of price movement.

-

Qualitative Quantitative Estimation (QQE): Oscillator used for trade confirmation and exit signals.

Trading Rules

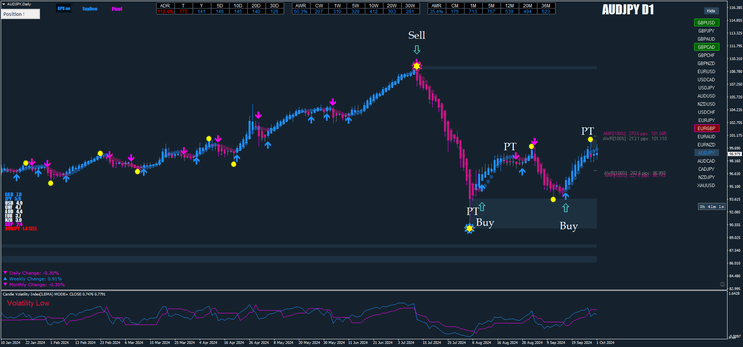

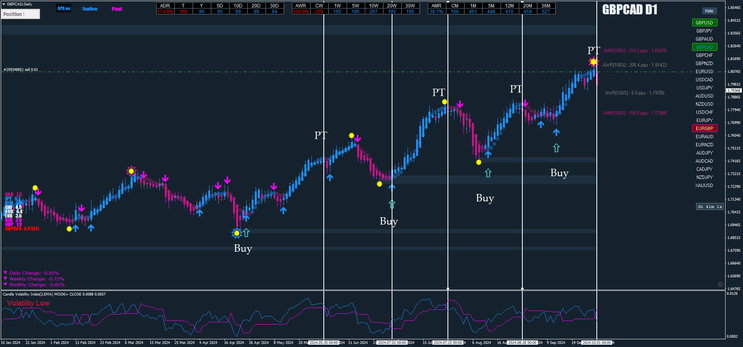

Buy Setup

-

Valid Volatility Alert in the sub-window.

-

Support Zone below the candles (optional, but strengthens the setup).

-

Main Trend shows a yellow dot with a star below the candle, indicating a bullish trend.

-

APB Candle must be blue to confirm upward momentum.

-

Zwinner Andrea Buy Alert: Look for a buy arrow.

Entry Trigger: Once the conditions above align, enter a buy trade.

Sell Setup

-

Valid Volatility Alert in the sub-window.

-

Resistance Zone above the candles (optional, but strengthens the setup).

-

Main Trend shows a yellow dot with a star above the candle, indicating a bearish trend.

-

APB Candle must be red to confirm downward momentum.

-

Zwinner Andrea Sell Alert: Look for a sell arrow.

Entry Trigger: Once the conditions above align, enter a sell trade.

Exit Strategy

-

Stop Loss: Set it at the previous swing high (for sell trades) or swing low (for buy trades).

-

Profit Target: Use a risk-reward ratio between 1:1.2 and 1:1.4.

-

Qualitative Quantitative Estimation (QQE) Exit:

-

For buy trades, exit when the blue line crosses downwards.

-

For sell trades, exit when the magenta line crosses downwards.

-

-

Opposite Signal Exit: Exit the trade if an opposite Zwinner Andrea arrow appears.

Trade Management

-

Stop Loss Adjustments: Consider moving the stop loss to break even after a significant move in your favor.

-

Partial Take Profits: If your platform allows, take partial profits at key support/resistance levels or at a set number of pips to secure gains.

This strategy leverages custom indicators to ensure high-probability trade setups and precise entries/exits. It works well in trending markets and can be optimized for different currency pairs and timeframes by adjusting the risk-reward ratio and indicator settings.

This is a winning forex strategy.

22# Perky Scalper - Forex Strategies - Forex Resources - Forex ...

122# Trading System, The 80'S - Forex Strategies

39# QQE MTF Filter - Forex Strategies - Forex Resources - Forex ...

92# Taotra - Forex Strategies - Forex Resources - Forex Trading ...

93# GMMA - Forex Strategies - Forex Resources - Forex Trading ...

84# Gold Miner - Forex Strategies - Forex Resources - Forex ...

2# 5 Min Blue Trend Rider - Forex Strategies - Forex Resources ...

114# Trading System, Ratis - Forex Strategies

Art of Forex - Forex Strategies - Forex Resources - Forex Trading ...

66# Trend Hunter - Forex Strategies - Forex Resources - Forex ...

7# FXOvereasy System - Forex Strategies - Forex

Resources ...