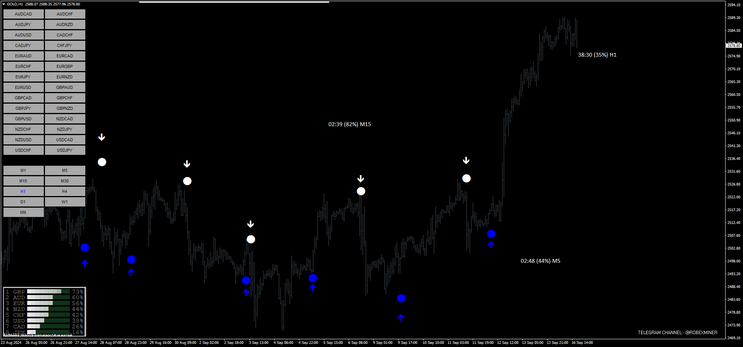

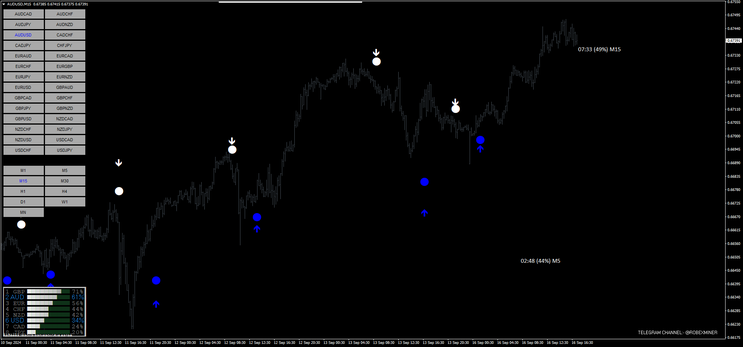

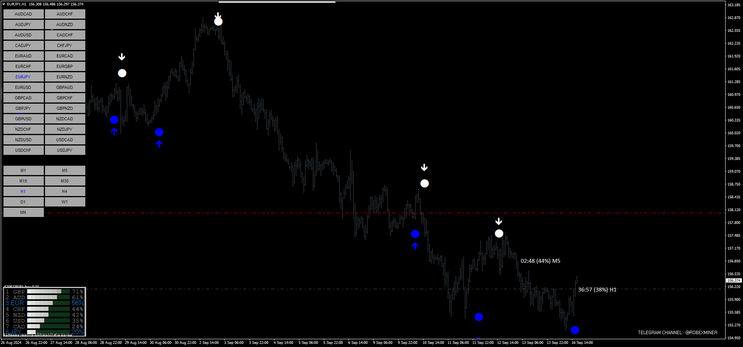

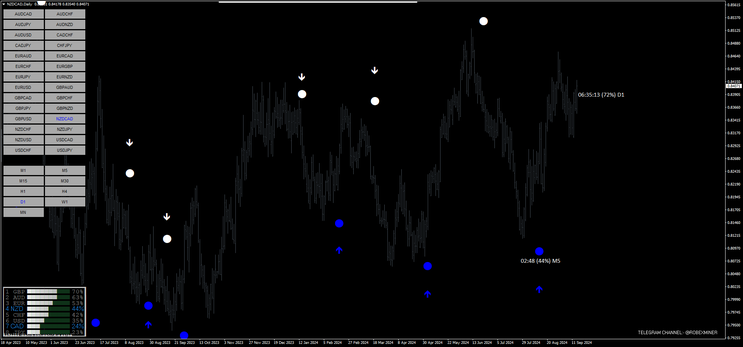

24# Forex Vector Trading System MT4

Forex Vector is a trend momentum strategy for MT4 platform.

1. Initial Setup

-

Platform: MT4 (MetaTrader 4)

-

Indicator: Forex VECTOR Indicator

-

Assets: Forex pairs (but can be extended to indices, stocks, commodities, cryptocurrencies)

-

Time Frame: Can be used on any time frame (1 minute to 1 month), but adjust it according to your trading style (scalping, day trading, or swing trading).

2. Mode Selection

-

Normal Mode: Recommended for most traders, especially beginners. It generates balanced signals with a medium risk-to-reward ratio. This is ideal for day trading or swing trading.

-

Fast Mode: This is for more experienced traders or scalpers. It produces faster signals with a higher risk-to-reward ratio. Use this mode if you prefer quick trades and are comfortable managing the increased risk.

3. Signal Interpretation

-

BUY Signal: The Forex VECTOR Indicator will show a clear "BUY" alert when it detects a potential upward trend.

-

SELL Signal: Similarly, it will give a "SELL" alert when it identifies a possible downward movement.

-

Alerts: The indicator can be set to notify you via email, SMS, or platform pop-ups, which allows you to monitor multiple assets simultaneously without having to stay glued to the screen.

4. Entry Rules

-

BUY Trade:

-

Wait for a BUY signal from the Forex VECTOR Indicator.

-

Confirm the signal using your additional analysis (optional but recommended) such as checking for strong support levels, moving averages, or any other indicator you prefer.

-

Enter the trade on the next candle after the BUY signal.

-

-

SELL Trade:

-

Wait for a SELL signal from the indicator.

-

Confirm the SELL signal with additional analysis (e.g., strong resistance level, trendline break, etc.).

-

Enter the trade on the next candle after the SELL signal.

-

5. Exit Rules

-

Take Profit (TP): Set a target depending on your risk-to-reward ratio.

-

Normal Mode: Aim for a 1:2 or 1:3 risk-to-reward ratio.

-

Fast Mode: Due to higher signal frequency, a tighter TP (1:1.5 or 1:2) can be considered.

-

-

Stop Loss (SL):

-

Place your SL just below the recent support for a BUY trade, or just above the resistance for a SELL trade.

-

Alternatively, set the SL at a fixed percentage of your position size based on your risk tolerance.

-

6. Risk Management

-

Position Sizing: Risk only 1-2% of your total capital on each trade. Adjust your lot size accordingly to ensure that your SL does not exceed this percentage.

-

Trailing Stop: For stronger trends, use a trailing stop to lock in profits as the price moves in your favor.

7. Additional Filters (Optional but Recommended)

-

Trend Confirmation: Use a trend indicator like Moving Averages (MA) to confirm the overall trend direction before taking trades.

-

Only take BUY signals when the price is above the 200-period MA (uptrend).

-

Only take SELL signals when the price is below the 200-period MA (downtrend).

-

-

Support and Resistance: Incorporate support and resistance levels into your analysis to increase the accuracy of entries and exits.

8. Time Frame Selection

-

Scalping: Use the Fast Mode on 1- to 5-minute charts.

-

Day Trading: Use Normal Mode on 15-minute to 1-hour charts.

-

Swing Trading: Use Normal Mode on 4-hour to daily charts.

9. Practice

-

Test the strategy on a demo account to familiarize yourself with the Forex VECTOR Indicator’s signals and market behavior before using real capital.

This approach leverages the indicator’s built-in strengths while incorporating sound risk management practices and additional technical analysis to increase the probability of success.

Breakout Forex Strategies - Forex Strategies - Forex Resources ...

6# London Breakout - Forex Strategies - Forex Resources - Forex

35# London Breakout - Forex Strategies - Forex Resources -

21# 100 pips daily - Forex Strategies - Forex Resources - Forex ...

15 Box Breakout System 2 - Forex Strategies - Forex Resources ...

26# The Retrotrader - Forex Strategies - Forex Resources - Forex ...

14# Box Breakout System - Forex Strategies - Forex Resources ...

4# Intraday Breakout - Forex Strategies - Forex Resources - Forex

22# Asian Breakout II - Forex Strategies - Forex Resources - Forex

10# Asian Breakout - Forex Strategies - Forex Resources - Forex

41# Range Breakout - Forex Strategies - Forex Resources - Forex

17# Range Breakout - Forex Strategies - Forex Resources - Forex

12# Hans Breakout - Forex Strategies - Forex Resources - Forex ...

36# Early Bird - Forex Strategies - Forex Resources - Forex Trading

27# Asian Breakout III - Forex Strategies - Forex Resources - Forex

40# Hans123 Breakout - Forex Strategies - Forex Resources - Forex ...