23 # Best Reversal Arrow MT4

Submit by Dimitri

Best Reversal arrow is a complex indicator consisting of a set of indicators whose purpose is to generate overbought and oversold entries.

This script is for a custom indicator in MetaTrader that generates signals (arrows) based on various technical analysis indicators and their combined "insync" score. Below is an overview of the key sections and logic of the script:

Key Inputs and Parameters

-

TimeFrame: Defines the timeframe to use (default is the current timeframe).

-

OverBought / OverSold: These define levels for overbought and oversold conditions (e.g., 45 for overbought, -45 for oversold).

-

Volume-Based Indicators: Toggle to use volume indicators (like Money Flow Index and Ease of Movement) to improve signal accuracy.

-

Arrows and Signals: You can control whether to display arrows for buy/sell signals and pre-signals.

Indicator Buffers

The indicator uses a total of 13 buffers to hold data for different parts of the analysis:

-

insync[]: The overall "insync" score which combines various technical indicators. -

insyncUp[]/insyncDn[]: Buffers to store overbought/oversold levels for signal plotting. -

trend[]andtrendsig[]: These are buffers that indicate the trend and pre-signal status (up or down). -

insyncUpa,insyncUpb,insyncDna, and related buffers store the actual points for arrows or signals to be drawn on the chart.

Indicators Used in the Calculation

The script combines several well-known technical analysis indicators:

-

Moving Average (MA): Used for both price smoothing and standard deviation.

-

Commodity Channel Index (CCI): Checks for overbought/oversold conditions.

-

Relative Strength Index (RSI): Evaluates momentum conditions.

-

Stochastic Oscillator: The fast %K and %D lines indicate potential reversals.

-

MACD: The difference between the 12-period and 25-period EMAs.

-

Rate of Change (ROC): Measures the speed of price movement.

-

Detrended Price Oscillator (DPO): A short-term oscillator for identifying cyclical trends.

Volume-based indicators are also used, if enabled:

-

Money Flow Index (MFI): Combines price and volume to assess buying/selling pressure.

-

Ease of Movement (EOM): Evaluates price movement efficiency based on volume.

Arrow and Signal Management

Arrows and signals are plotted on the chart when the calculated trend or pre-signal state changes:

-

If a trend changes from overbought to oversold (or vice versa), it triggers an arrow to be drawn at that bar.

-

Pre-signal arrows are displayed based on the trendsig buffer when the signal changes direction.

-

The script provides a function (

manageArrowandmanageArrowSig) to add or remove arrows dynamically as new data comes in.

Alerts

The script sends alerts (either desktop alerts, email, or mobile notifications) based on significant changes in the trend or pre-signal status. These alerts are customizable and will trigger whenever a new signal is detected.

Signal Scoring

The "insync" score is calculated by evaluating the combined output of all the technical indicators mentioned above:

-

If the value of an indicator suggests an overbought condition, points are added to the score.

-

If the indicator suggests an oversold condition, points are subtracted.

-

The overall score is used to determine whether the asset is in a bullish or bearish state.

Plotting and Smoothing

For smoother plotting, the script uses interpolation between bars and ensures consistent drawing of arrows and signals.

Summary of Core Functions

-

OnInit: Initializes the indicator and sets up the necessary buffers.

-

OnCalculate: The main function that computes the "insync" score, evaluates signals, and plots arrows on the chart.

-

manageArrow / manageArrowSig: Responsible for adding/removing arrows based on signal changes.

-

CleanPoint / PlotPoint: These functions help manage how points (signals) are displayed, ensuring smooth visual representation.

This indicator is designed to be flexible, allowing for multi-timeframe analysis and optional volume-based indicators, making it suitable for various trading strategies.

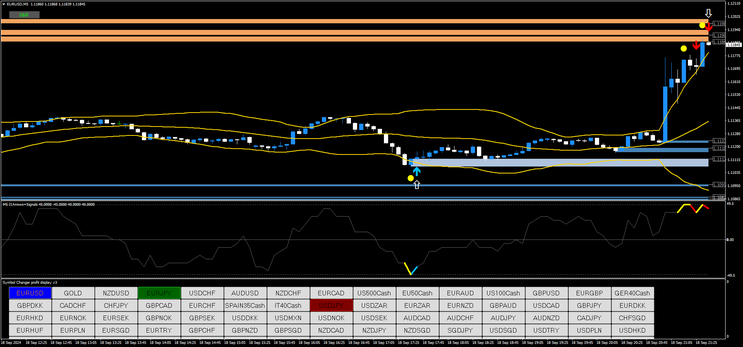

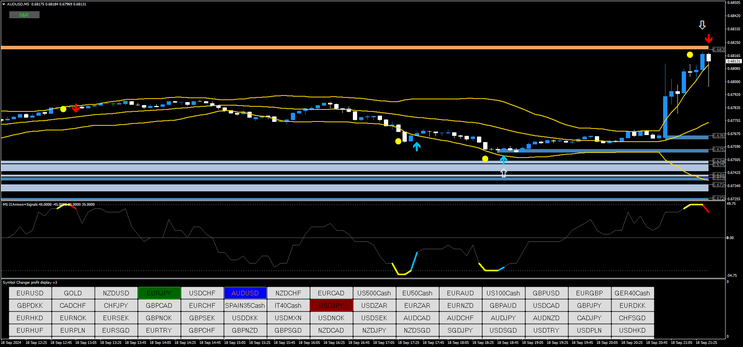

Trading Strategy Using InSync Index and Supply & Demand Indicator for Binary Options and Forex

Overview:

This strategy combines the InSync Index with the Supply & Demand Indicator to improve the accuracy of trade entries and exits. The InSync Index is a momentum oscillator designed to detect overbought and oversold conditions, while the Supply and Demand indicator identifies zones where the price is likely to reverse or consolidate. By combining these two indicators, we aim to pinpoint high-probability reversal and continuation trades in both binary options and Forex markets.

Strategy Objective:

The goal of this strategy is to catch trend reversals and price bounces off supply and demand zones by using the InSync Index to confirm momentum and direction. This combination helps to reduce false signals and improves trade timing.

Timeframe:

-

For Binary Options: 5-minute or 15-minute charts with expiration times 5 candles.

-

For Forex: 1-hour or 4-hour charts for swing trading or shorter timeframes like 5- 15 minutes for scalping.

Indicator Settings:

-

InSync Index:

-

Standard settings (usually 10-period), but can be adjusted based on volatility or asset type.

-

Ranges from -100 to +100, where values above +50 signal overbought conditions and below -50 signal oversold conditions.

-

-

Supply & Demand Indicator:

-

Automatically identifies supply (resistance) and demand (support) zones based on price action.

-

Look for clear, significant zones where price has reacted strongly in the past.

-

3. Bollinger Bands (20 periods, deviations 2.0) optional.

Entry Rules:

-

Call/Buy Setup (Demand Zone and Bullish Signal):

-

Price touches a demand zone (support area identified by the Supply & Demand Indicator).

-

InSync Index value below -50, indicating oversold conditions and a potential reversal.

-

Wait for a bullish price action signal such as a bullish engulfing candle or hammer to confirm the reversal.

-

Binary Options: Enter a "Call" trade once confirmation occurs, aiming for a 15-30 minute expiration.

-

Forex: Enter a long trade, placing a stop loss below the demand zone.

-

-

Put/Sell Setup (Supply Zone and Bearish Signal):

-

Price touches a supply zone (resistance area identified by the Supply & Demand Indicator).

-

InSync Index value above +50, indicating overbought conditions and a potential reversal.

-

Wait for a bearish price action pattern such as a bearish engulfing candle or shooting star to confirm the reversal.

-

Binary Options: Enter a "Put" trade after confirmation, aiming for a 15-30 minute expiration.

-

Forex: Enter a short trade, placing a stop loss above the supply zone.

-

Exit Rules:

-

Binary Options: Allow the trade to expire based on the expiration time (usually 5 candles ).

-

Forex: Use the Supply and Demand zones for setting take profit. You can exit the trade when the price approaches the next opposite zone (supply for long trades, demand for short trades). Place stop loss above/below the Suppy and Demand Zone.

Additional Filters and Confirmations:

-

Trend Filter: Use a 50-period moving average (EMA) to filter trades.

-

Enter only buy trades if the price is above the 50 EMA and it is sloping upwards.

-

Enter only sell trades if the price is below the 50 EMA and sloping downwards.

-

-

Volume Confirmation: To increase the accuracy, consider adding a volume indicator such as the On-Balance Volume (OBV) or Volume Oscillator. Higher volume during price reactions at supply or demand zones strengthens the reversal signal.

-

Divergence: Watch for divergence between price and the InSync Index near supply or demand zones. If the price makes a new high but the InSync Index makes a lower high (bearish divergence), or if the price makes a new low but the InSync Index makes a higher low (bullish divergence), this strengthens the reversal signal.

Risk Management:

-

For Binary Options: Risk a fixed percentage (e.g., 1-2%) of your account balance per trade.

-

For Forex: Use a 1:2 risk-to-reward ratio or higher. Set your stop loss just beyond the supply or demand zone to avoid being stopped out by false breakouts.

Breakout Trading system

Submit by Forexstrategiesresources

TimeFrame: 15 min

Pairs:all

Indicators:

1. Breakout

2. Support and Resistance

3. Weekday

This are 3 indicators necessary for this system.

If they click now with the mouse every indicator individually, and they pull this then in this desired Timeframe.

1.3 What the indicators serve for

The Breakout indicator signals a rank, the course moves within this rank before an outbreak takes place.

The rank is completed every morning about 9.00 o'clock GMT.

The Support and Resistance indicator indicates all Support and Resistance(Support=Unterstützung, Line below. Resistance=Wiederstand, line above.

The weekday indicator is regulated with legal click in the Chart under the option Input.

2. The Traden of outbreaks

The absolutely most profitable kind of the Trading, this is traden from outbreaks. The buying occurs

in him Case always in the restate, so the uppermost point in the Chart, because where the course over and over again bounced off is and has changed the direction or the selling to the Unterstützungsline to itself below considers.

Not only buyers and shop assistants but also a lot of stops lie with these points, of course.

Him break through to the upper line in the Resistance a purchase signal explains, here becomes long.

Order places and in the lower line in the Support it is put short Entry. The rank (number of the Pips between Support and Resistance) is used around the stop Loss and To fix take profit for every order.

2.1 The analysis of a rank

The course forms constantly somewhere a rank in that bounces off, now it is a matter of deciding which rank does not make sense and which. If we look once the following Chart of the EUR / JPY.

All Support and Resistance are provided with numbers, Support as well as also Resistance begin to explain better in each case with 1 around the rank and to show their togetherness.

Support1 and Resistance1 form together a rank of scanty 20 Pips, what completely senselessly is to be placed there long and short order.

To see PDF file in attach into file rar

There if they can choose the respective weekday 1=Montag, 2=Dienstag, 3=Mittwoch,

4 =Donnerstag,

5=Freitag. Then they agree on the basis of 2 lines, one finds itself above the course and they

other below, always the topical today's high and day low-pressure area indicated. This indicator is to be checked very well around the Daily to rank one day from the past to calculate above all one average market volume.

Breakout Forex Strategies - Forex Strategies - Forex Resources ...

6# London Breakout - Forex Strategies - Forex Resources - Forex

35# London Breakout - Forex Strategies - Forex Resources -

21# 100 pips daily - Forex Strategies - Forex Resources - Forex ...

15 Box Breakout System 2 - Forex Strategies - Forex Resources ...

26# The Retrotrader - Forex Strategies - Forex Resources - Forex ...

14# Box Breakout System - Forex Strategies - Forex Resources ...

4# Intraday Breakout - Forex Strategies - Forex Resources - Forex

22# Asian Breakout II - Forex Strategies - Forex Resources - Forex

10# Asian Breakout - Forex Strategies - Forex Resources - Forex

41# Range Breakout - Forex Strategies - Forex Resources - Forex

17# Range Breakout - Forex Strategies - Forex Resources - Forex

12# Hans Breakout - Forex Strategies - Forex Resources - Forex ...

36# Early Bird - Forex Strategies - Forex Resources - Forex Trading

27# Asian Breakout III - Forex Strategies - Forex Resources - Forex

40# Hans123 Breakout - Forex Strategies - Forex Resources - Forex ...

Write a comment

Jack (Tuesday, 18 February 2025 17:22)

Wonderful forex strategy, a smart way to use levels, with good profitability.