22 # King Gold Pro Trading Strategy

Submit by Lorenz

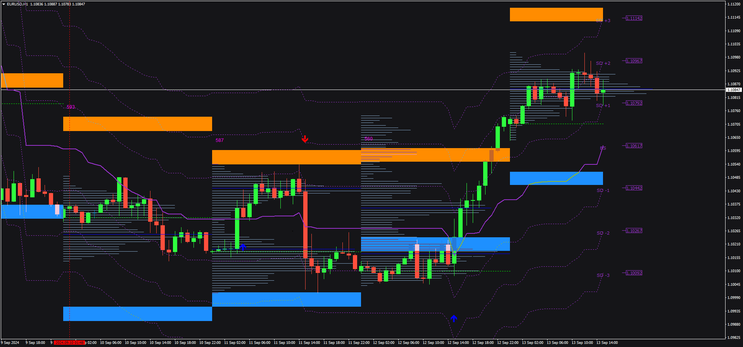

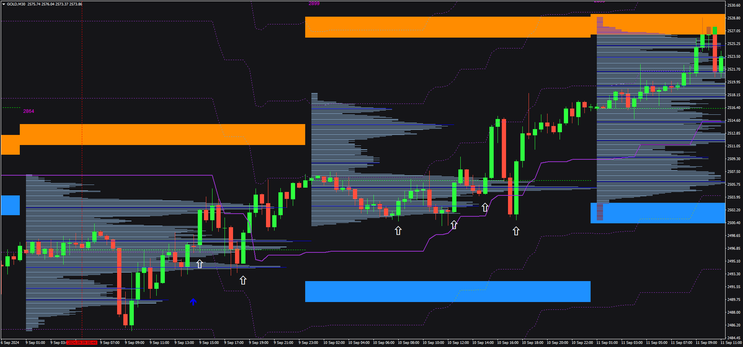

The King Gold Pro trading strategy is built on five key indicators that help identify high-probability trading opportunities in the market. These indicators include:

-

Standard Deviation Channels: Used to identify overbought and oversold areas.

-

Support and Resistance Zones: Crucial levels where price tends to react.

-

Volume Market Profile: Highlights where most trading has occurred, providing insight into key price levels.

-

Trend Indicator: Helps gauge the overall market direction.

-

Key Volume Level (Blue Line): This line represents a key level based on market volume, serving as an important threshold for trading decisions.

Setup

Time Frame 30 min or higher.

Currency pairs: any.

Trading Rules:

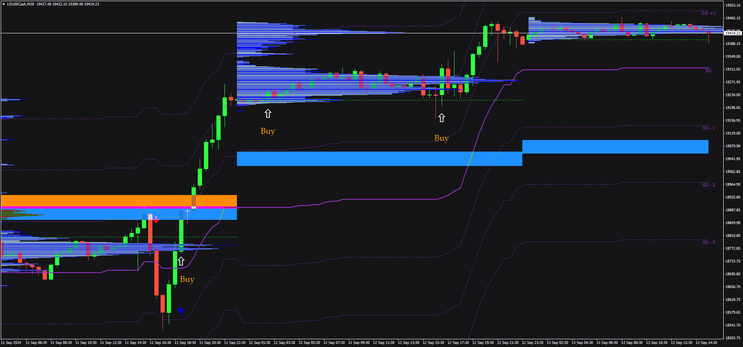

Buy Setup

-

A buy arrow appears, indicating a potential upward market direction.

-

The candle closes above the blue line, confirming that the price has breached a key volume-based level.

-

Buy at the opening of the next candle after the close above the blue line.

-

The standard deviation channels can also help verify if the price is bouncing off oversold areas, strengthening the buy signal.

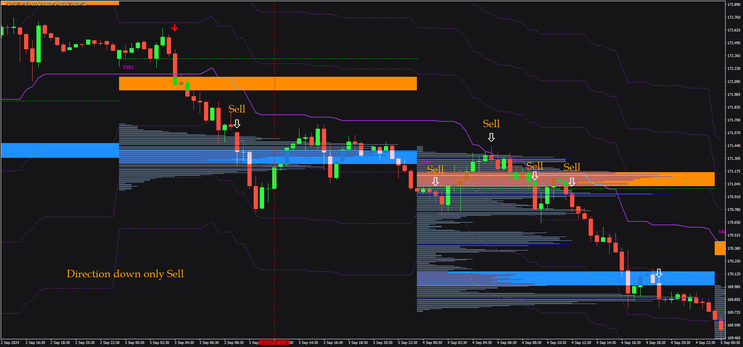

Sell Setup

-

A sell arrow appears, indicating a potential downward market direction.

-

The candle closes below the blue line, confirming that the price has dropped below a key volume-based level.

-

Sell at the opening of the next candle after the close below the blue line.

-

Use the standard deviation channels to verify if the price is at an overbought area, further validating the sell signal.

Additional Guidelines

-

The arrows do not represent exact entry points but rather the overall market direction. These arrows can recalibrate based on new data, so it’s advisable to frame price movement using the standard deviation channels.

-

Support and resistance zones can be used as exit points or for setting stop-loss levels.

-

If the recalculating nature of the arrow indicator is not preferable, consider replacing it with a fixed direction arrow from other available indicators.

Risk Management

-

Stop-loss can be placed just below the nearest support level for buy trades or above the nearest resistance for sell trades.

-

Consider using trailing stops based on volatility or standard deviation channel levels to lock in profits as the trade moves in your favor.

-

Always manage your risk-to-reward ratio (at least 1:1.2) to ensure that potential profits outweigh potential losses.

This strategy leverages volume-based key levels (blue line) for trade confirmation, while also incorporating directional indicators, support/resistance zones, and market volatility (via standard deviation channels) for a well-rounded trading approach.

Perky Scalper Forex Trading System

Submit by Jeff

Rules for Entry:

Wait for this get above 10 bell rings at 9+

See:

the tick Chart wait for it to slope the correct way.

The Forexmetro:

is the entry and exits

Slope:

Never trade against this green=buy

I Use This enter sometimes it is a bit slow good

luis ronald (Tuesday, 17 September 2024 04:09)

brigado