150# VWAP Trading Strategy for MT5

By Maximo Trader 2025

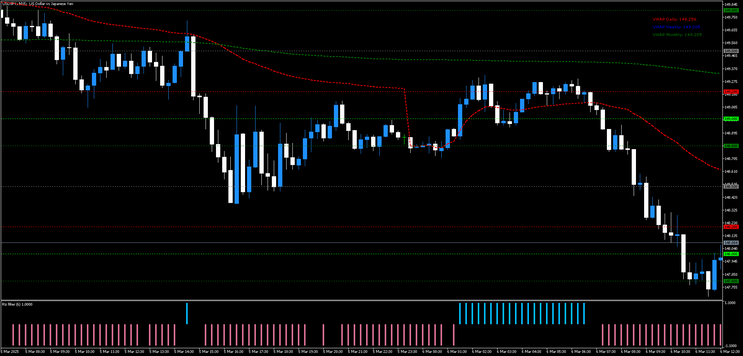

VWAP Trading Strategy for MT5 is intraday trading strategy utilizes the Volume Weighted Average Price (VWAP) to assess market direction and sentiment. VWAP is a crucial tool used by institutional traders to determine fair value levels, making it a powerful trend-following indicator. This strategy is enhanced with an RSI filter (6-period) to confirm momentum and trend strength.

Setup:

-

Platform: MetaTrader 5 (MT5)

-

Timeframe: 15-minute or 30-minute

-

Currency Pairs: Any

-

Indicators Used:

-

VWAP (Default settings)

-

Relative Strength Index (RSI) - 6 periods (used as a trend filter)

-

How to Trade:

🔹 BUY Setup:

-

Price is above the VWAP (indicating bullish sentiment).

-

RSI confirms momentum with a blue bar (indicating strength in the uptrend).

-

Look for price rejection at the VWAP level for added confirmation.

✅ Enter a BUY trade once all conditions align.

🔹 SELL Setup:

-

Price is below the VWAP (indicating bearish sentiment).

-

RSI confirms momentum with a red bar (indicating strength in the downtrend).

-

Look for price rejection at the VWAP level for added confirmation.

✅ Enter a SELL trade once all conditions align.

Exit Rules:

🔸 Stop-Loss:

-

Place SL at the previous swing high for SELL trades or swing low for BUY trades.

🔸 Take-Profit:

-

Profit ratio between 1:1 and 1:1.3 relative to stop-loss.

-

Consider key levels as potential target zones.

Key Considerations:

✔️ Confirm trade signals with other technical indicators

for added reliability.

✔️ Avoid trading in choppy, ranging markets

without clear VWAP direction.

✔️ Monitor price rejections at VWAP to identify strong entry points.

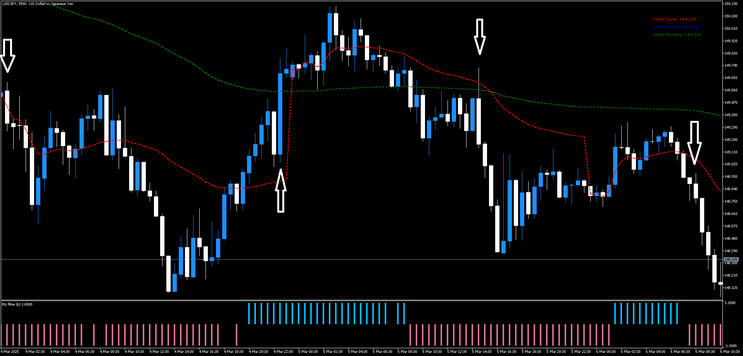

150# RSIOMA and CCI Strategy

by joy22 (Written by joy22)

Time Frame 15min or higher.

Currency Pairs: all.

Indicators:

6 EMA,

34 EMA,

RSIOMA v.2 (14),

CCI (14)

Long Entry:

6M>34EMA, RSIOMA>80 and CCI>100

Short Exit:

6M<34EMA, RSIOMA<20 and CCI>-100

Exit Position:

For Buy when RSIOMA cross down;

For Sell when Rsiom Cross up.

Place Stop loss 2 pips above or below ema.

Predetermined Profit Target ratio 1:1.2 with stop loss (if stop loss is 30 pips the profit target is 60 pips.

Note: If on is earnig 60 pips is recommended to insert the trailing stop of the 20 pips.

In the pictures RSIOMA and CCI Strategy forex system in action.