146#Synery Method Trading System

Submit by JanusTrader

SYNERGY Trading Method

The Synergy Trading Method was developed by Dean Malone and is an effective Forex trading method developed to simplify trading decisions with high probability precision. It combines the market forces of Price Action, Trend, Momentum and Market Strength to produce higher probability trades. The Synergy trading method depicts...in real-time...the interaction of these market forces providing traders the means to make trading decisions with greater confidence and less emotional hassle.

With Synergy, traders identify and use two important trading components in real-time: Price Action and Sentiment.

Price Action is market movement, such as the oscillation of Open, High, Low and Close prices. Too often, traders are mesmerized by trivial price flucuations and lose sight of the underlying trend of the market. Many traders tend to jump in and out of the market instead of staying with the trade as a trend develops. Synergy is designed to eliminate price distortions. It reveals periods of market strength and trend and periods of consolidation.

Sentiment is the intuitive feeling or attitude of traders and investors in the market. For example, if the sentiment of the market is bullish, then traders and investors expect an upward move in the market. Often, sentiment is an indication of optimism or pessimism in the market based on recent news announcements or political events. The Synergy method uses a hybrid custom indicator developed to show postive (buyers) sentiment or negative (sellers) sentiment.

Working in unison, Price Action and Sentiment give traders a distinct trading advantage. When both are in agreement, favorable trading conditions exists. For instance, when price action is showing upward movement with buyers sentiment, there is higher probability of a Long position having a favorable outcome. Similarly, when price action has a downward movement in conjunction with sellers sentiment, a short position has a favorable outcome.

Aim of this thread is to backtest and optimize the strategy and finally to make an EA out of it. In this first post you find the up-to-date indicators and templates.

First backtests show that the strategy works best on the 1H or 30M timeframe with the GBPUSD, EURJPY, EURUSD, GBPJPY, USDCHF, USDJPY and CADJPY. Here are some average results:

GBPUSD: ~ 160 pips per month

EURJPY: ~ 104 pips per month

EURUSD: ~ 100 pips per month

GBPJPY: ~ 95 pips per month

USDCHF: ~ 85 pips per month

USDJPY: ~ 82 pips per month

CADJPY: ~ 75 pips per month

To setup this strategy, please unzip Synergy.zip and copy all indicators into \experts\indicators\ in your metatrader directory. Then copy the template into \templates in your metatrader directory. After restarting metatrader and choosing the template you can see arrows and crosses which shows entries and exits according the trading method. Each cross displays a number which means the profit or loss of the closed trade. The yellow numbers at the end of the chart displays the overall result when every signal was traded. But be careful: due to some technical problems with the template at the beginning of a chart no guarantee can be given. A filled arrow shows the first time a new trade can be entered. A hollow arrrow means "add to buy" it is only used as a confirmation signal.

For backtesting the some options of SynergyInd indicator can be adjusted:

UseEntry68_32: When this is true, the indicator enters a long position even when RSI is above 68 or a short position when RSI is below 32.

UseSmallerExit: When this is true, the system closes a position when the actuall candle is smaller than the previsous candle. "DefineSmaller" needs to be a value.

ReqRedYellowCombo: When this is true, the TSL must be above the MBL before entering a long position or the TSL must be below the MBL before entering a short position.

UseVolExpanding: If this is true, positions are only opened when volatility increases (measured by the Bellinger Bands of the TDI).

UseChaikin: If this is true, positions are only opened when colatility increases (measured by the Chaikin's Volatility indicator).

Use4Trend: If this is true, long positions will only be opned when the 4H trend is up and short positions will only be opened when the 4H trend is down.

Use Alert: ... I think everybody knows this feature.

So far the following settings seem to work most suitable: UseEntry68_32 false, UseSmallerExit false, ReqRedYellowCombo false, UseVolExpanding true, UseChaikin false, Use4Trend false.

To get faimilar with the Synergy trading method, please read the pdf in the appendix or have a look at the webinar, which can be found.

Share your opinion, can help everyone to understand the forex strategy.

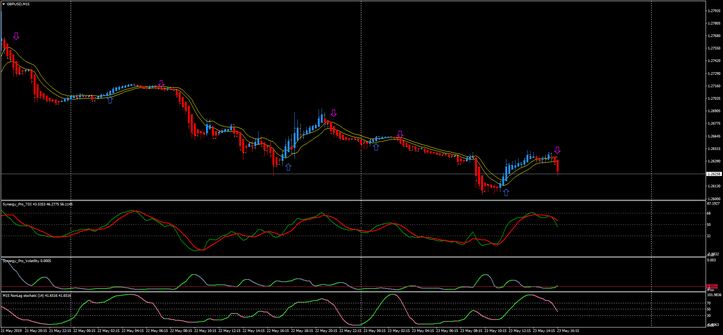

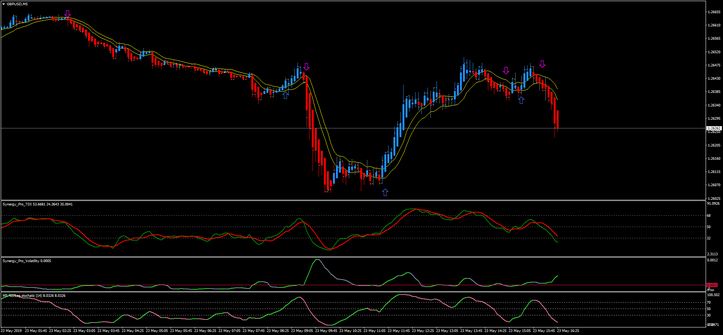

Synergy Pro Strategy

update 23/05/2019

I have been trading Demo with this system for some time now and it’s okay so far. The problem with it is that because it is manual, I miss a lot of trades and also find it very difficult to monitor other pairs at the same time.

I would be grateful if you could put these indicators into an EA such that anytime Synergy Pro TDI crosses, followed by Synergy PRO APB Spike, an increase in Volatility above the Threshold as indicated by Synergy PRO Volatility and finally, supported by Stochastic direction, a trade will be entered into.

SELL Conditions

As in the image

-

TDI crosses down

-

Volatility shoots up above the set threshold

-

Stochastic showing down move

-

APB spikes for SELL Entry

BUY Conditions

As in the image

-

TDI crosses up

-

Volatility shoots up above the set threshold

-

Stochastic showing up move

-

APB spikes for BUY Entry

Forex Method

231# Stochastic MTF Method with m-candle (Scalping) - Forex ...

236# David Bradshawfx Scalping

40# Scalping Method - Forex Strategies - Forex Resources - Forex

120# The Secret Method 2.7 - Forex Strategies - Forex Resources

146# Synergy Method - Forex Strategies - Forex Resources - Forex

60# Magic Bands: Scalping Method - Forex Strategies - Forex ...

32# The Secret Method - Forex Strategies - Forex Resources -

37# 30pips Method - Forex Strategies - Forex Resources - Forex ...

27# Lindencourt Method 15 TF - Forex Strategies - Forex

11# SRDC Method Level II with Fibo - Forex Strategies - Forex ...

94# Forex Soloist Method - Forex Strategies - Forex Resources ...

47# 5min Method - Forex Strategies - Forex Resources - Forex ...

102# The Dance Trading Method - Forex Strategies - Forex ...

61# The Retracement Market Method - Forex Strategies - Forex ...

30# Triangle Trading Method - Forex Strategies - Forex Resources

89# The Outsider Method - Forex Strategies - Forex Resources ...

226# Fozzy Method - Forex Strategies - Forex Resources - Forex ...

12# SRDC Method Level III - Forex Strategies - Forex Resources ...

231# Stochastic MTF Method with m-candle (Scalping) - Forex ...

45# B.O.S.S. Breakout Method - Forex Strategies - Forex

4# Abid Method - Forex Strategies - Forex Resources - Forex ...

13# Breakout H1 Method - Forex Strategies - Forex Resources ...

186# Hakeem's forex Intraday Method - Forex Strategies - Forex ...

42# Stochastic Trading Method I “ Basic Momentum” - Forex ...

154# The Bat Method - Forex Strategies - Forex Resources - Forex

74# Sidus Method V.2 - Forex Strategies - Forex Resources -

34# Hoover Method - Forex Strategies - Forex Resources - Forex ...

46# Stochastic Trading Method V, “Spudfyre” - Forex Strategies ...

44# Stochastic Trading Method III “ MTF Scalp ” - Forex Strategies ...

95# 5 min Method - Forex Strategies - Forex Resources - Forex ...

279# OAN FX Method - Forex Strategies - Forex Resources -

160# Sexy Stochastic method Boxingislife - Forex Strategies -

73# Sidus Method - Forex Strategies - Forex Resources - Forex ...

119# Sperandeo Victor, Trendline Method - Forex Strategies -

325# Past Regression Deviated Method - Forex Strategies - Forex

36# Valeo FX Method - Forex Strategies - Forex Resources - Forex

347# Arno Forex trend following Method - Forex Strategies - Forex

31# MC Method - Forex Strategies - Forex Resources - Forex ...

192# 5 min Trading Guide - Forex Strategies - Forex Resources ...

Lehlogonolo Ramaele (Sunday, 18 February 2024 10:19)

I need that robot