138# RSI Divergence Trading System MT5

Submit by Maximo trader 2024

Objective:

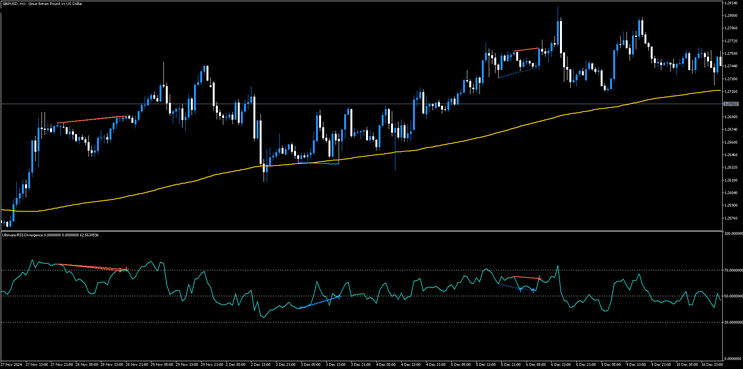

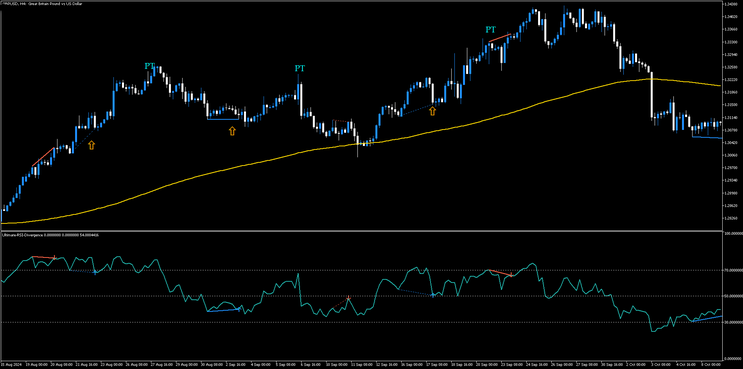

Utilize divergences between the Relative Strength Index (RSI) and price to identify trend reversals or trend continuations, focusing on high-probability signals.

Indicators and Setup

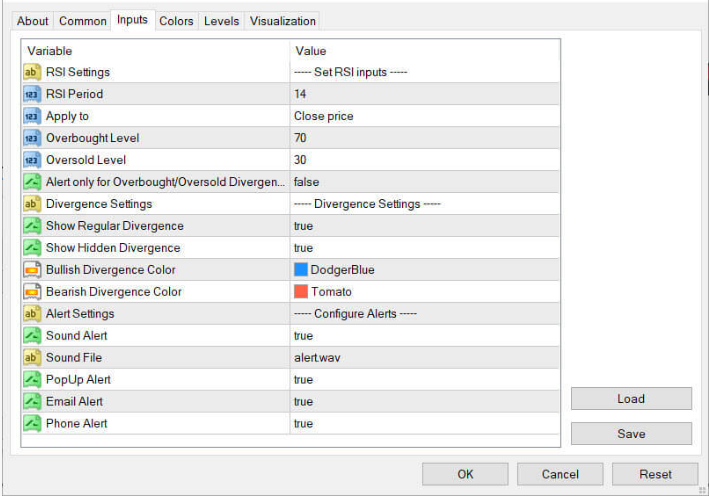

RSI Divergence Indicator

Period: 14 (default)

Overbought Level: 70

Oversold Level: 30

200-Period Moving Average (MA):

Used to identify the primary trend direction.

Timeframes:

Daily (for precision in swing trading and reversals).

Smaller timeframes (H1, H4) for short-term trading.

Optional Filters:

Price action confirmation (e.g., support/resistance, candlestick patterns).

Trading Rules

Buy

1. Bullish Divergence (Trend Reversal Setup):

Condition:

Price makes lower lows, while the RSI makes higher lows (positive divergence).

Filters:

The price is trading above or crossing the 200-MA.

Look for bullish reversal candlestick patterns (e.g., hammer, engulfing).

Entry:

Buy arrow of RSI Divergence

Stop-Loss:

Place the stop-loss below the swing low or recent support level.

Take-Profit:

Target the next resistance level.

Alternatively, use a risk-reward ratio of 1:2.

Sell

2. Bearish Divergence (Trend Reversal Setup):

Condition:

Price makes higher highs, while the RSI makes lower highs (negative divergence).

Filters:

The price is trading below or crossing the 200-MA.

Look for bearish reversal candlestick patterns (e.g., shooting star, bearish engulfing).

Entry:

Sell arrow of RSI divergence.

Stop-Loss:

Place the stop-loss above the swing high or recent resistance level.

Take-Profit:

Target the next support level.

Alternatively, use a risk-reward ratio of 1:2.

3. Hidden Bullish Divergence (Trend Continuation Setup):

Condition:

Price makes higher lows, while the RSI makes lower lows.

Price is trading above the 200-MA (uptrend).

Entry:

Buy when the divergence is confirmed, ideally near a trendline or moving average support.

Stop-Loss:

Below the recent swing low.

Take-Profit:

Use recent swing highs as targets.

4. Hidden Bearish Divergence (Trend Continuation Setup):

Condition:

Price makes lower highs, while the RSI makes higher highs.

Price is trading below the 200-MA (downtrend).

Entry:

Sell when the divergence is confirmed, ideally near a trendline or moving average resistance.

Stop-Loss:

Above the recent swing high.

Take-Profit:

Use recent swing lows as targets.

Risk Management:

Position Sizing:

Risk no more than 1-2% of your trading capital per trade.

Avoid Trading in Strong Trends:

Divergence signals can fail during strong trending markets. Always check the 200-MA direction and avoid trading against the primary trend.

High-Impact News:

Avoid trading around economic news events that could increase volatility.

Avoid trading during high-impact economic news.

Additional Notes:

Use price action confirmation to validate divergence signals for better accuracy.

Divergences work best when combined with trendlines, support/resistance levels, or candlestick patterns.

Test the strategy on a demo account before live trading.

By following these guidelines, you can effectively use the RSI Divergence indicator to spot high-probability reversal and continuation trades while minimizing false signals.

15 min Forex Trading Systems

122# 15 min MTF - Forex Strategies - Forex Resources - Forex ...

104# Vlad System 15 min Day Trading - Forex Strategies - Forex

154# 15 min Strategy - Forex Strategies - Forex Resources -

21# 15 min GBP/USD Range Breakout - Forex Strategies - Forex

130# 15 min Intraday Strategy - Forex Strategies - Forex

225# 15min Scalping - Forex Strategies - Forex Resources - Forex

301# Easy 15min Trading System - Forex Strategies - Forex ...

13# The Trend Setter, Channel Drawing Filter (15min) - Forex ...

228# Range Factor Scalping 15min - Forex Strategies - Forex ...

27# Lindencourt Method 15 TF - Forex Strategies - Forex