136# How to Trade Using Key Order Blocks with Momentum Indicators, MT5 Trading Strategy

In this article, we outline a robust trading strategy designed for short to medium-term trading using the 15-minute time frame or higher. Whether you're a beginner or an experienced trader, this approach provides clear rules for entering and exiting trades. The setup leverages Key Order Blocks, the SR Breakout Indicator, and the Stoch Trend Indicator to identify high-probability trading opportunities. All trades are executed on the Metatrader 5 platform, ensuring precise implementation of this strategy.

Trading Setup

Time Frame:

-

15-minute or higher (30-minute, 1-hour, etc.).

Instruments:

-

Any currency pair (majors, minors, or exotics).

Indicators Required:

-

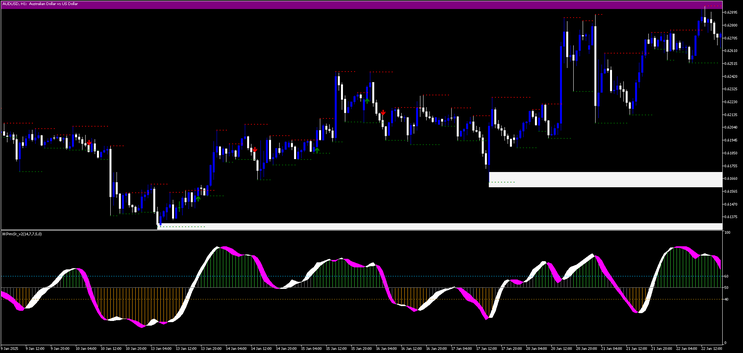

Key Order Blocks:

Identifies critical areas of support and resistance on the chart. These are zones where price is likely to react. -

SR Breakout Indicator:

-

Settings: RSI (7), levels 70-30; CCI (14), levels +60 and -60.

-

The indicator draws arrows on the chart (Buy arrow for a resistance breakout, Sell arrow for a support breakout).

-

Green dashed lines indicate support zones, while red dashed lines indicate resistance zones.

-

-

Stoch Trend Indicator:

-

Default settings.

-

Useful for confirming short- and medium-term price movements by monitoring overbought and oversold levels.

-

Rules for Entry

Buy Trade Setup:

-

Order Block Confirmation:

Price must reach or break through a Key Order Block (support zone). The green dashed line should be visible. -

SR Breakout Signal:

A Buy Arrow must be triggered by the SR Breakout Indicator. -

Stoch Trend Confirmation:

-

The Stoch Trend Indicator must show the stochastic line moving up from oversold levels (below 20).

-

Ensure the stochastic is pointing upwards for momentum.

-

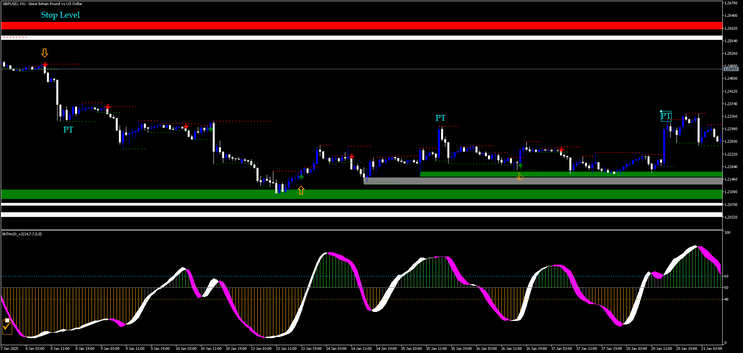

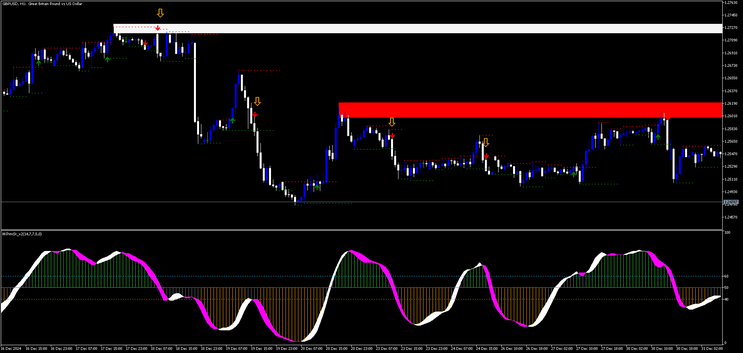

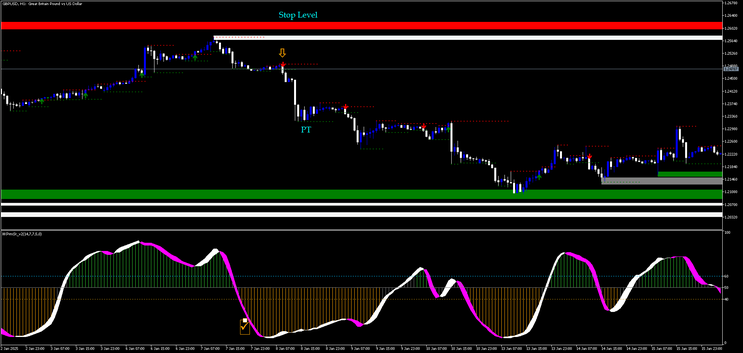

Sell Trade Setup:

-

Order Block Confirmation:

Price must reach or break through a Key Order Block (resistance zone). The red dashed line should be visible. -

SR Breakout Signal:

A Sell Arrow must be triggered by the SR Breakout Indicator. -

Stoch Trend Confirmation:

-

The Stoch Trend Indicator must show the stochastic line moving down from overbought levels (above 80).

-

Ensure the stochastic is pointing downwards for momentum.

-

Take Profit (TP):

-

Set your Take Profit at the nearest significant support (for sell trades) or resistance (for buy trades) zone identified by the Key Order Block.

-

Alternatively, use a 1:1.3 Risk-to-Reward Ratio to maximize profitability while managing risk.

Stop Loss (SL):

-

Place the Stop Loss just below the support zone for buy trades or just above the resistance zone for sell trades.

-

Ensure the SL placement gives the trade some breathing room while protecting against adverse price movement.

Trailing Stop (Optional):

To capture extended moves, consider implementing a trailing stop. Adjust it manually or automatically based on the price’s movement beyond your Key Order Block zones.

Trade Example

Buy Trade Example:

-

On a 15-minute EUR/USD chart, price pulls back to a green dashed support zone identified by the Key Order Block.

-

The SR Breakout Indicator triggers a Buy Arrow as the price breaks through the support zone and starts moving upwards.

-

The Stoch Trend shows the stochastic line rising from below the 20 level, indicating upward momentum.

-

Enter a Buy Position.

-

Set your Stop Loss slightly below the green dashed support zone and your Take Profit at the next resistance zone or use a 1:1.3 Risk-to-Reward Ratio.

Sell Trade Example:

-

On a 1-hour GBP/USD chart, price rallies to a red dashed resistance zone identified by the Key Order Block.

-

The SR Breakout Indicator triggers a Sell Arrow as the price breaks through the resistance zone and starts dropping.

-

The Stoch Trend shows the stochastic line falling from above the 80 level, indicating downward momentum.

-

Enter a Sell Position.

-

Set your Stop Loss slightly above the red dashed resistance zone and your Take Profit at the next support zone or use a 1:1.3 Risk-to-Reward Ratio.

Key Tips for Success

-

Patience is Crucial: Only trade when all conditions align perfectly. Avoid forcing trades when the setup is incomplete.

-

Use Higher Time Frames for Confirmation: For added confidence, verify Key Order Block zones on a higher time frame (e.g., 1-hour or 4-hour charts).

-

Risk Management: Never risk more than 1-2% of your account balance per trade to ensure long-term profitability.

-

Practice on a Demo Account: Before applying this strategy in a live account, practice on a demo account to gain familiarity and confidence.

Conclusion

This trading strategy combines the power of Key Order Blocks, the SR Breakout Indicator, and the Stoch Trend Indicator to identify high-probability setups. By following the rules for entry and exit, traders can improve their decision-making and maximize profitability. Always remember to backtest and apply proper risk management techniques to ensure consistent results over time.

Start implementing this setup on Metatrader 5 and take your trading to the next level!