118# Momentum Trend Strategy for Profitable Day & Swing Trading

By Maximo Trader 2025

Momentum Trend Strategy is designed to capitalize on market momentum, making it suitable for both day trading and swing trading. By combining multiple indicators, it helps traders identify high-probability trade setups based on trend direction and market sentiment.

I have created two different templates:

-

One optimized for day trading (short-term trades on lower timeframes).

-

One tailored for swing trading (holding positions for a longer period).

Strategy Setup

Timeframes

-

Day Trading: 5 min, 15 min

-

Swing Trading: 30 min, H1, H4

Preferred Market

-

Currency Pairs: Best suited for volatile forex pairs to take advantage of strong price movements.

Trading Platform

-

MT4 (MetaTrader 4)

Indicators Used

-

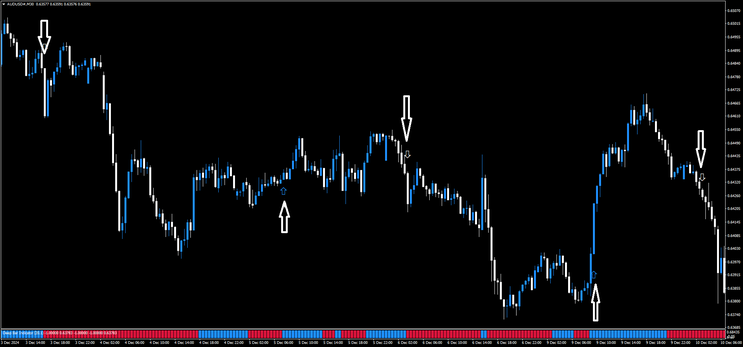

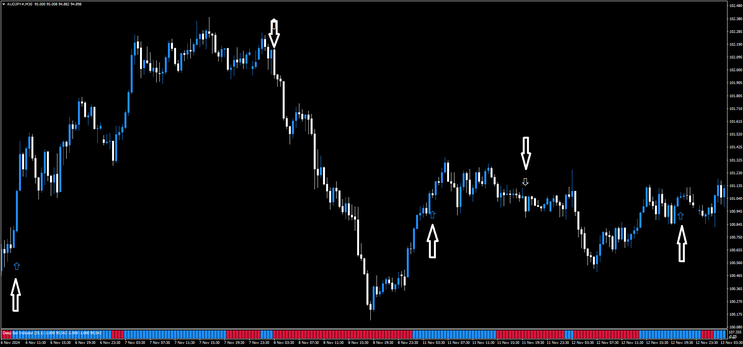

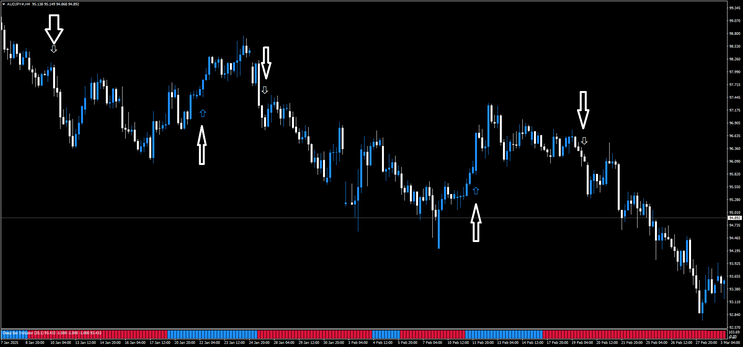

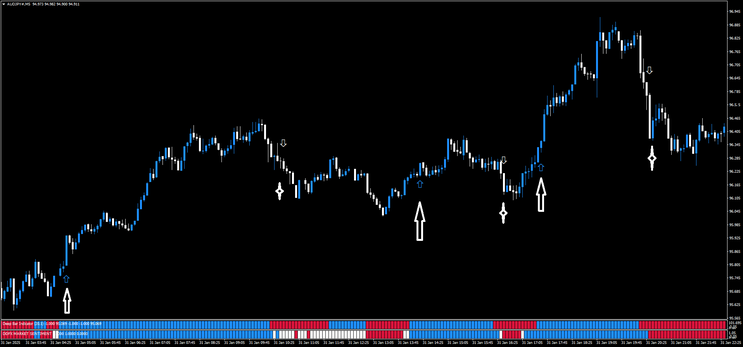

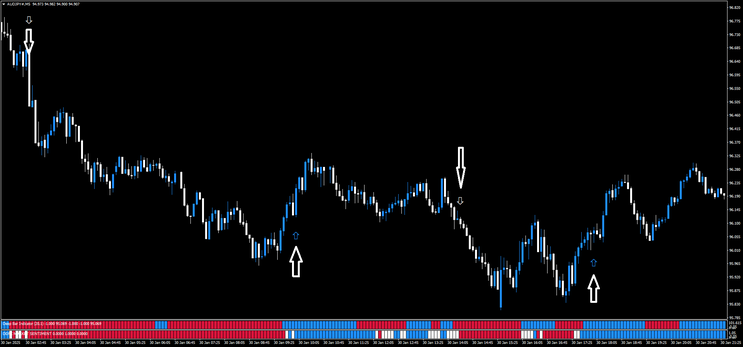

Arrow Buy and Sell (default settings): Signals potential buy and sell opportunities based on price action.

-

Deep Bar (20,1): Measures trend strength and confirms momentum.

-

Sentiment Indicator (default settings): Helps gauge overall market sentiment, confirming the validity of a trade setup.

Trading Rules

Swing Trading Setup

This approach is ideal for traders looking for longer-term trades based on higher timeframe trends.

Buy Setup (Long Position)

-

A buy arrow appears on the main chart.

-

The Deep Bar indicator shows a blue bar, confirming bullish momentum.

Sell Setup (Short Position)

-

A sell arrow appears on the main chart.

-

The Deep Bar indicator shows a red bar, confirming bearish momentum.

Day Trading Setup (5-15 min Timeframe)

Day trading requires faster execution and additional confirmation to filter out noise from price movements.

Buy Setup (Long Position)

-

A buy arrow appears on the main chart.

-

The Deep Bar indicator shows a blue bar (trend confirmation).

-

The Sentiment Indicator also shows a blue bar, indicating strong buying pressure.

Sell Setup (Short Position)

-

A sell arrow appears on the main chart.

-

The Deep Bar indicator shows a red bar (trend confirmation).

-

The Sentiment Indicator also shows a red bar, indicating strong selling pressure.

Exit Strategy & Risk Management

Stop Loss Placement:

-

Place the stop loss below/above the previous swing high/low to protect against sudden market reversals.

Profit Target Strategy:

-

Use a risk-reward ratio of 1:1.1 to 1:1.5 to ensure a balanced approach to profits and risk.

-

Trailing Stop can be used to secure additional gains if the price moves in favor of the trade.

Final Thoughts

This Momentum Trend Strategy combines trend confirmation, sentiment analysis, and strict risk management to create a robust trading system. It is effective for both day traders looking for quick profits and swing traders aiming for larger market moves.

By following these rules and maintaining discipline, traders can increase their probability of success while managing risks effectively.