117# RSI Arrow with MACD Strategy for MT4

By Joy22 2025

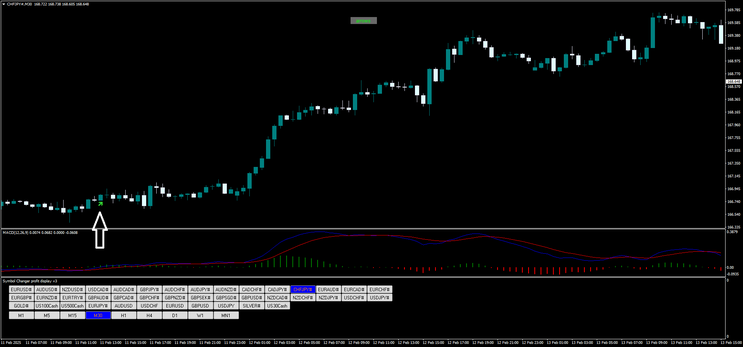

The RSI Arrow with MACD Strategy is a classic trend momentum trading approach designed for the MetaTrader 4 platform.

This strategy combines the Relative Strength Index (RSI) for entry timing and the Moving Average Convergence Divergence (MACD) as a trend confirmation filter.

Strategy Setup:

Time Frames: 15-minute, 30-minute, 60-minute, and 240-minute charts.

Currency Pairs: Any.

Platform: MetaTrader 4.

Indicator Settings:

MACD: Default settings.

RSI: Period 7, applied to close prices.

Trading Rules:

Buy Conditions:

An RSI buy arrow appears on the chart.

The MACD lines cross upwards, confirming the bullish trend.

Sell Conditions:

An RSI sell arrow appears on the chart.

The MACD lines cross downwards, indicating a bearish trend.

Exit Strategy:

Stop Loss: Placed at the previous swing high (for sell trades) or swing low (for buy trades).

Take Profit: Defined by a risk-reward ratio between 1:1.1 and 1:1.3relative to the stop loss.

Conclusion:

This strategy efficiently combines momentum and trend confirmation indicators to enhance trade accuracy.

By aligning RSI entry signals with MACD trend confirmation, traders can filter out false signals and improve trading consistency.

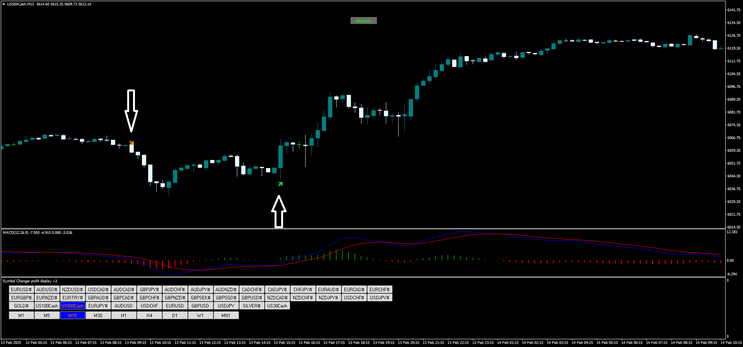

117# Tiong 7 Forex System

Submit by Joy22

Time Frame: 30.

Pairs: all.

Indicators:

MACD

Stochastic on price

ZIG and ZaG

Camarilla

Long Entry:

if there is a round yellow or a green arrow on the chart, a zig-zag new sticks and will be reversed, Stoch green spheres, and MACD crosses up below the zero.

Short Entry:

if there is a round yellow or a red arrow on the chart, a zig-zag new sticks and will be reversed, Stoch red spheres, and MACD crosses down above the zero.

Exit:Position

When Stochastic cross in opposite position, or on Camarilla level pivot.

In the picture Tiong 7 forex system in action.

Share your opinion, can help everyone to understand the forex strategy.