Cobra Algo + TMA Overlay - Forex Strategies - Forex Resources - Forex Trading-free forex trading signals and FX Forecast

111# Cobra Algo + TMA Overlay Trading Strategy

by Joy22 update 2025

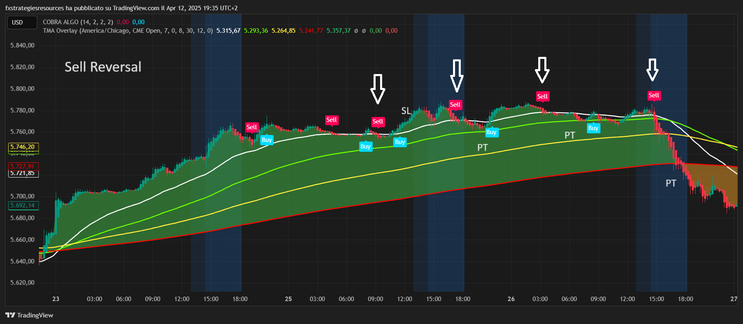

In this article, we explore the Cobra Algo trading system in combination with the TMA Overlay, a visual template designed to simplify market structure and trend analysis.

We present two distinct trading strategies that can be executed using the same chart setup:

-

Trend-following strategy – for capturing directional moves in line with the broader momentum

-

Reversal strategy – for identifying high-probability turning points when the market shifts direction

Both strategies rely on the Cobra Algo signals and the TMA central band (white line) as the core of decision-making, offering a versatile approach suitable for various market conditions.

Setup Strategy

Time frame 5 min or higher.

Currency pairs:any.

Platform: TradingView.

TradingView Indicators Used:

-

Cobra Algo (Settings: 14, 2, 2, 2);

-

TMA Overlay (default setting).

Trading Logic:

🔹 Trend Continuation Entries

-

Buy when the Cobra Algo gives a signal above the white central TMA line and price respects the green/yellow band.

-

Sell when a Cobra Sell signal appears below the white line and price stays under the yellow/red bands.

-

Use the green and red background of the TMA channel as trend confirmation zones.

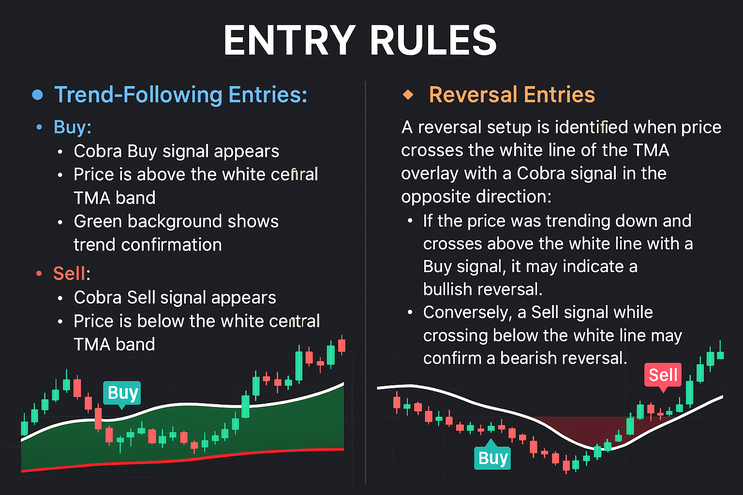

Entry Rules

🔹 Trend-Following Entries:

-

Buy:

-

Cobra Buy signal appears

-

Price is above the white central TMA band

-

Green background shows trend confirmation

-

-

Sell:

-

Cobra Sell signal appears

-

Price is below the white central TMA band

-

Red background confirms downtrend

-

🔸 Reversal Entries

-

A reversal setup is identified when price crosses the white line of the TMA overlay with a Cobra signal in the opposite direction.

-

For example:

-

If the price was trending down and crosses above the white line with a Buy signal, it may indicate a bullish reversal.

-

Conversely, a Sell signal while crossing below the white line may confirm a bearish reversal.

-

-

Reversal Entries:

-

Buy Reversal:

-

Cobra Buy signal

-

Price crosses above the white TMA central band (coming from below)

-

-

Sell Reversal:

-

Cobra Sell signal

-

Price crosses below the white TMA central band (coming from above)

-

-

Exit early if price fails to stay above/below the white band after the entry (invalidates the reversal)

Exit position

Stop loss above/below the previous swing high/low.

Profit target ratio stop loss 1:1 to 1:1.13.

Tips:

-

Avoid entries when price is within the TMA central zone (close to the white line) without a clear direction.

-

Stronger trades appear when the Cobra signal coincides with a sharp break of the central line or a retest.

-

Use additional timeframes to confirm trend strength and avoid low-volume periods.

Conclusion

Whether you're trading in the direction of the trend or looking to catch clean reversals, the Cobra Algo + TMA Overlay setup allows you to approach both styles using a single unified template.

This dual strategy framework helps you stay consistent in execution while adapting to different market phases—making it an ideal system for scalpers, day traders, and swing traders alike.

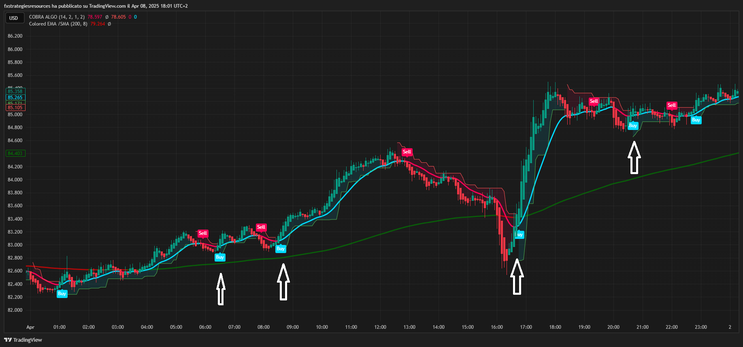

111# Cobra Algo Trading Strategy TradingView

Submit by Janus Trader 2025

The COBRA ALGO Trend Strategy is designed for traders looking to follow the prevailing market momentum with precision and confidence. By combining the COBRA ALGO indicator’s dynamic Buy/Sell signals with a colored 200-period EMA filter, this strategy ensures trades are only taken in the direction of the dominant trend. The result is a clean, rule-based system that avoids choppy conditions and focuses on high-probability entries.

Setup Strategy

Platform: TradingView.

Indicator: COBRA ALGO (Settings: 14, 2, 1, 2).

Time Frame: 5 minutes or higher .

Major Crypto Currency Pairs, Indices, Gold and JPY.

Buy Entry Rules

Enter a Long Position (Buy) when all the following conditions are met:

-

A Buy signal appears from the COBRA ALGO (blue label).

-

The price is above the EMA 200, and the EMA 200 is colored green (indicating an uptrend).

-

The red trend ribbon flips to aqua, confirming bullish momentum.

-

The price is above or crossing above the dynamic support (aqua trail line).

Sell Entry Rules

Enter a Short Position (Sell) when all the following conditions are met:

-

A Sell signal appears from the COBRA ALGO (pink label).

-

The price is below the EMA 200, and the EMA 200 is colored red (indicating a downtrend).

-

The aqua trend ribbon flips to red, confirming bearish momentum.

-

The price is below or crossing below the dynamic resistance (red trail line).

Exit Rules

Option 1: Signal-Based Exit

-

Close the position when the opposite signal appears (e.g., Sell after a Buy).

Option 2: Trailing Exit

-

Use the dynamic trail (aqua/red band) as a trailing stop.

-

For long: Exit if the candle closes below the aqua trail.

-

For short: Exit if the candle closes above the red trail.

-

Stop Loss & Take Profit

-

Stop Loss:

-

For long: Just below the recent swing low.

-

For short: Just above the recent swing high.

-

-

Take Profit:

-

Use a 1:1 to 1:1.3 Risk/Reward ratio.

-

Or exit at key support/resistance levels identified on higher timeframes.

-

111# MJ Regression Channel Strategy and Fx Sniper Ergodic Trading System

Time Frame: 1H or 4H

Pairs:all

Indicators: MJ RegressionChannel

Fx sniper ergodic (2, 5, 3)

This will draw 2 channels. Strategy with this is simple: look at channel margins. You can enter if the price break the channel and is confirmed by FX sniper Ergodic, or if the price get a rejection from the margins of the channels ( and is confirmed by FX sniper Ergodic).

Stop Loss is at the channel margin

Profit target for entry after rejection is or middle channel or opposite margin channel.

Profit Target for breaks channel is when FX sniper crosses in opposite direction.

-

#1

hello,

i agree with your system have an Expert advisor for this system

25# Channel Strategy - Forex Strategies - Forex Resources -

123# ATR Channels Strategy - Forex Strategies - Forex

13# Donchian Channels - Forex Strategies - Forex Resources ...

13# Fibopivot Channel Strategy - Forex Strategies - Forex ...

11# Keltner Channels and EMA - Forex Strategies - Forex ...

31# ADX and Moving -Average Channel - Forex Strategies - Forex

16# Moving Average Channel and Parabolic Sar - Forex

77# Two MA Channel - Forex Strategies - Forex Resources -

111# Mj Regression Channel and FX Sniper Ergodic CCI - Forex ...

66# Envelope Reversal - Forex Strategies - Forex Resources -

5# Channel Breakout and Moving Average - Forex Strategies ...

153# Dynamic Channel, Contrarian Strategy. - Forex Strategies ...

2# Volatility breakout channel - Forex Strategies - Forex

17# Bollinger Bands and Equidistant Channel - Forex Strategies ...

10# SRDC Method Level II - Forex Strategies - Forex Resources ...

12# SRDC Method Level III - Forex Strategies - Forex Resources ...

9# SRDC Method Level I - Forex Strategies - Forex Resources ...

Volatility Forex Strategies - Forex Strategies - Forex Resources ...

2# Volatility breakout channel - Forex Strategies - Forex

123# ATR Channels Strategy - Forex Strategies - Forex Resources

7# ATR Breakout - Forex Strategies - Forex Resources - Forex ...

6# ATR Channel Breakout - Forex Strategies - Forex Resources ...

2# Renko with I-Regression bands - Forex Strategies - Forex ...

125#Silver Trend with I-regression method - Forex Strategies -

178# I-Regression System - Forex Strategies - Forex Resources ...

96# MQLPRO stoc/cci/VB - Forex Strategies - Forex Resources ...

108# New Infinity - Forex Strategies - Forex Resources - Forex ...

12# Renko with DTOSC and Past Regression Deviated - Forex ...

325# Past Regression Deviated Method - Forex Strategies - Forex

104# Center of Gravity - Forex Strategies - Forex Resources - Forex

123# ATR Channels Strategy - Forex Strategies - Forex Resources

107# Novus Orsa - Forex Strategies - Forex Resources - Forex ...

58# TMA Bands MTF - Forex Strategies - Forex Resources - Forex

111# Mj Regression Channel and FX Sniper Ergodic CCI - Forex

39# 5 min Channel - Forex Strategies - Forex Resources - Forex ...

La mia ditta

La mia ditta