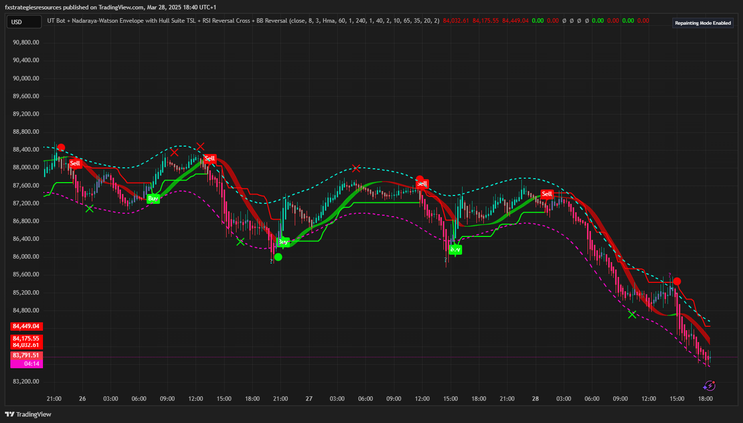

110# UT Bot + Nadaraya-Watson Envelope with Hull Suite

By Maximo Trader 2025

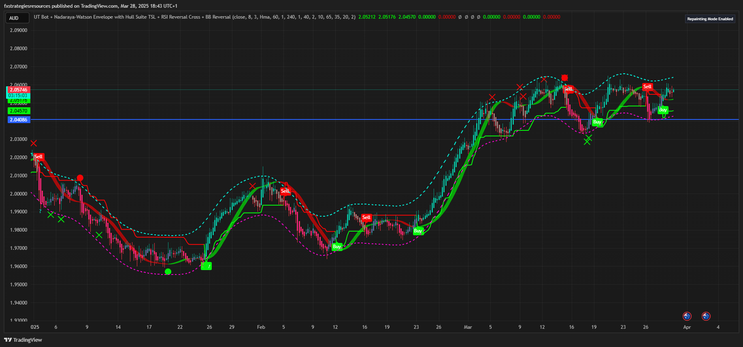

UT Bot + Nadaraya-Watson Envelope with Hull Suite strategy combines multiple indicators to identify optimal entry and exit points in the market. The tools used are:

UT Bot to generate buy and sell signals based on an adaptive trailing stop.

Nadaraya-Watson Envelope to identify dynamic support and resistance zones.

Hull Suite TSL to confirm trends and reversals.

Setup Strategy

Time Frame 2 min or higher.

Currency pairs: any

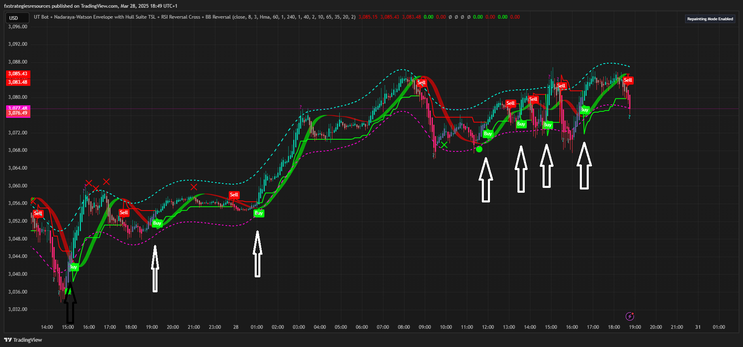

Long Entry Rules (Buy Position)

A buy signal occurs when all the following conditions are met:

UT Bot generates a buy signal (crossover of price above the ATR Trailing Stop).

The price is above the lower band of the Nadaraya-Watson Envelope.

The Hull Moving Average (HMA) is green (indicating an uptrend).

Short Entry Rules (Sell Position)

A sell signal occurs when all the following conditions are met:

UT Bot generates a sell signal (crossunder of price below the ATR Trailing Stop).The price is below the upper band of the Nadaraya-Watson Envelope.The Hull Moving Average (HMA) is red (indicating a downtrend).

Exit Rules (Closing Positions)

Take Profit:

Target profit at 1.5x - 2x the risk taken.

Close the position if the price reaches the upper band (for long) or the lower band (for short) of the Nadaraya-Watson Envelope.

Stop Loss:

Below/above the UT Bot trailing stop.

Or below/above the lower/upper band of the Nadaraya-Watson Envelope.

Additional Filters and Confirmations, important.

Multi-Timeframe Confirmation: Use the Hull Moving Average value on a higher timeframe (e.g., 4H) to confirm the trend.

Avoid Trading in Ranging Markets: If the price moves within the Nadaraya-Watson Envelope without a clear direction, avoid entering trades.

Conclusion

This strategy provides a reliable mix of signals by integrating multiple indicators. It is essential to backtest the strategy before applying it in live market conditions.