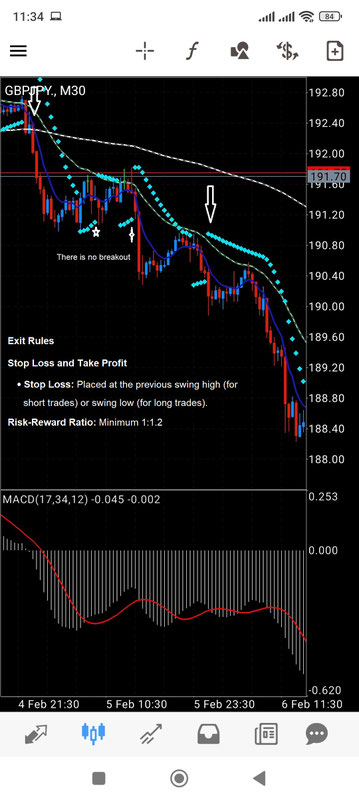

27# Parabolic Breakout Trading System

Submit by Janus Trader 2025

The Parabolic Breakout Strategy is designed for traders who want to capitalize on strong directional moves in the forex market. By combining exponential moving averages (EMA), MACD, and the Parabolic SAR indicator, this strategy ensures that trades align with the prevailing trend while filtering out false breakouts. The approach is particularly effective on volatile currency pairs and works best on a 5-minute or higher time frame.

Trading Instruments: Volatile currency pairs

Time Frame: 15 minutes or higher.

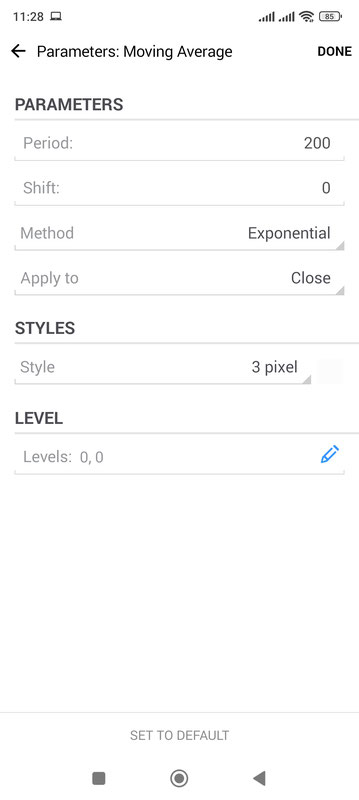

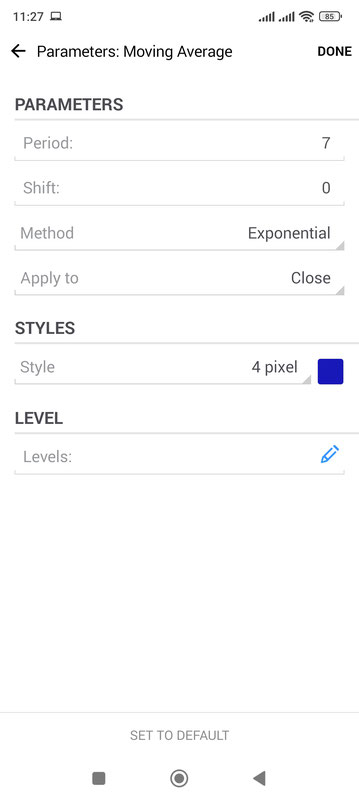

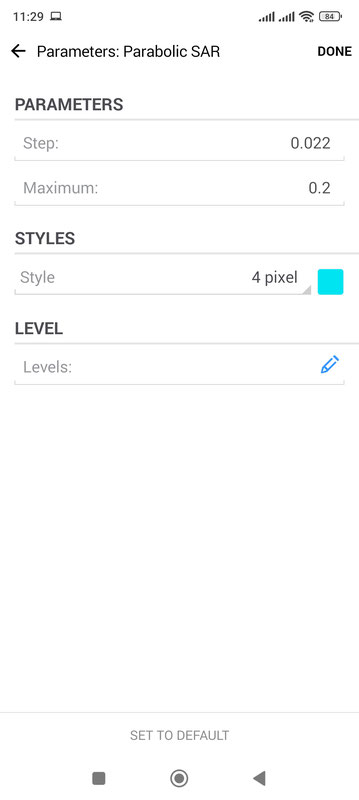

Indicators Used:

-

Exponential Moving Average (EMA): 7, 28, 200 periods

-

MACD (17, 34, 12)

-

Parabolic SAR (0.02, 0.2)

Trading Rules

Trend Definition

-

The trend is determined by the 200-period EMA.

-

Uptrend: Price is above the 200 EMA.

-

Downtrend: Price is below the 200 EMA.

Entry Rules

Buy Setup (Long Position):

-

EMA 7 > EMA 28 > EMA 200 (indicating an uptrend).

-

MACD histogram is above 0 or rising.

-

Parabolic SAR dots appear below the price candles.

-

The primary condition: The closing price of the candle must break the level of the opposite Parabolic SAR dot at close.

Sell Setup (Short Position):

-

EMA 7 < EMA 28 < EMA 200 (indicating a downtrend).

-

MACD histogram is below 0 or falling.

-

Parabolic SAR dots appear above the price candles.

-

The primary condition: The closing price of the candle must break the level of the opposite Parabolic SAR dot at close.

Exit Rules

Stop Loss and Take Profit

-

Stop Loss: Placed at the previous swing high (for short trades) or swing low (for long trades).

-

Risk-Reward Ratio: Minimum 1:1.2

-

Alternative Stop Loss Strategies:

-

A trailing stop can be used following Parabolic SAR dots.

-

Exit manually if the MACD momentum reverses significantly against the trade direction.

-

This strategy ensures that trades are executed only in the direction of the dominant trend, improving the probability of success by combining moving averages, momentum confirmation, and breakout validation through Parabolic SAR.

Now I show you the strategy written in TradingView

We have reproduced the strategy in Pine Script and we release the code to you for free,so with the released code you can optimize the strategy.