19# Best 5 minutes Scalping for Mobile

Submit by Janus Trader

Best 5 minutes scalping strategy is a classic trading system for the trade on the forex market based on Bollinger Band, Moving Average, MACD and RSI.

Setup Strategy

Time frame 5 min 15 min, 30 min, 60 min

Currency pairs (majors)

Trading session (London and New York at 5 and 15 min time frames) do not trade before economic news.

Setup chart with trading indicators:

1. Exponential Moving average(EMA), 9 periods (close) with Green colour

2. Bollinber bands with 20 Deviation 2 period,

4. MACD (12, 26, 2) with default settings

5. Relative strength index(RSI 13 period close).

Now I'll show you how MT4 mobile is configured.

Trading Rules

Basic level

Go Long

1.9 EMA crosses above the middle line of the Bollinger Band.

2. MACD > 0 line or with the histogram approaching the zero line.

3. RSI is above>55 level (at time frame 5 you can also use level 57).

Go Short

1. 9 EMA crosses above the middle line of the Bollinger Band.

2. MACD is < 0 line or with the histogram approaching the zero line.

3. RSI is below <45 level (at time frame 5 you can also use level 43).

Exit position

Stop loss on the previous swing High/low.

Profit Target ratio stop loss from 1:1 at 1:1.5.

Money Management fix 2%.

Now, after having learned the basic rules, we move on to understanding how you can trade and be profitable in the long term. I show the example of three profitable market situations that fit well with the

rules I have established. I take it for granted that the concepts of Divergence and Volatility are known.

MACD divergence

The MACD Divergence fits well with the established rules.

MACD Divergence occurs when there are two or more peaks decreasing or increasing in the MACD histogram.

The proposed MACD setting is specific to easily detect divergences.

Below I show four images of trading with the system based on divergence which as you can see with this setting are very clear.

Example 3 there are two divergences, the first bearish, the second bullish. The bearish divergence on the MACD shows decreasing MACD, peaks with a decreasing histogram, in the second divergence there are decreasing MACD peaks but with a bullish direction highlighted by the red arrow.

In this example there is a bearish double divergence.

Compression of the Bollinger Bands followed by an explosion of volatility.

Example 1

GBPUSD 15 min Bollinger Band compression and bullish volatility explosion.

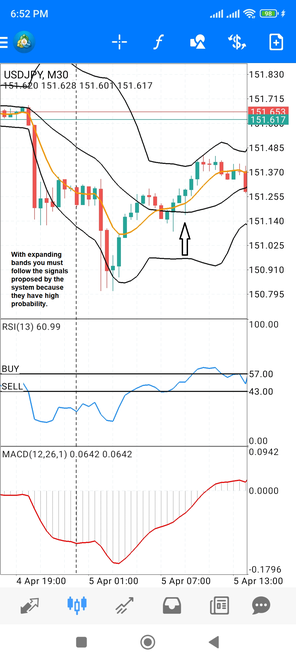

USDJPY 30 min. Compression of Bollinger Bands and explosion of bearish volatility.

Band expansion

In these examples the Bollinger Bands are wide, so, it is best to follow the signals provided by the system, maximum the first three.

In the last example there is first an explosion of volatility of the Bollinger band followed by an expansion of the bands. There are two high probability signals.

In conclusion, my advice to apply this strategy profitably is to be able to trade both in market situations where the Volatility of the Bollinger Bands explodes and in the phases of expansion of the Bands. When you have learned these two entry techniques well you can move on to the next level, that is, learning to learn to trade with divergences.

However, I consider it a success if you can only trade with the explosion of the volatility of the bands.