14# Envelopes with Stochastic. Day Trading Strategy For Mobile.

Envelpes as Support and resistance dynamic.

Price Action Momentum for high volatility market and mean reversion currency pairs.

Submitby Janus Trader

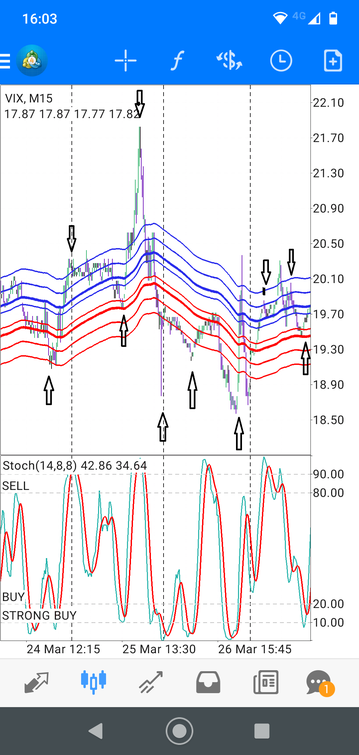

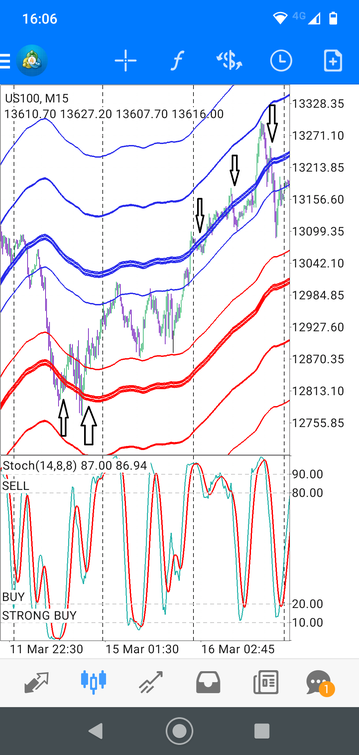

Envelopes with Stochastic is a price action momentum strategy, for day trading and suitable for mobile Metatrader app mobile. This trading system can trade both very volatile instruments and mean reversion instruments (it's simpler). My advice is to start using this strategy with mean reversion instruments like EURGBP, EURCHF, and the like. Then you have learned the technique well and are familiar with money management techniques (lots) you can trade on highly volatile instruments such as the VIX index.

This is a winning strategy you just have to learn how to use it and compared to trend following and breakout techniques it has a lower psychological impact.

The fundamental principle of this strategy is to wait for the price to bounce on the envelopes and enter with the agreement of the stochastic.

The reference envelopes are from the double group to the external ones. In particular, it should be noted that when the price leaves the envelopes they are a great opportunity.

Setup Strategy

Time Frame 15 min.

Currency pairs: any, Indices, Vix, and Commodities.

Indicators

Envelopes setting:

1. period 60, deviation 0.900, Method smoothed, close;

2. period 60, deviation 2.5, Method smoothed, close;

3. period 60, deviation 0.45, Method smoothed, close;

4. period 60, deviation 0.88, Method smoothed, close;

5. period 60, deviation 0.85, Method smoothed, close;

6. period 60, deviation 0.83, Method smoothed, close;

7. period 60, deviation 1.67, Method smoothed, close;

8. period 60, deviation 1.68, Method smoothed, close;

Stochastic oscillator (14,8,8, close), levels 10 strong buy, 20, buy, 80, sell, 90, strong sell.

Trading rules Envelopes with Stochastic.

General rules:

Wait for who the price bounces on the envelopes starting from the median ones with double lines with deviation 0.88-0.83.

When the price is out of the envelopes, enter the stochastic cross from the extreme areas.

Buy

Price bounces on the lower bands, the stochastic crosses upwards.

When the price is out of the bands wait for the stochastic crossing upwards starting from the extreme areas.

You can do up to three entrances in the same direction in sequence on the stochastic crosses.

Enter the stop loss on the previous lower swing.

Sell

Price bounces on the lupper bands, the stochastic crosses downwards.

When the price is out of the bands wait for the stochastic crossing downwards starting from the extreme areas.

You can do up to three entrances in the same direction in sequence on the stochastic crosses.

Stop Loss

Place the stop loss just beyond the envelope band opposite to your trade direction. For a long trade, set the stop loss slightly below the lower envelope band. For a short trade, set the stop loss slightly above the upper envelope band. This helps to protect against significant adverse movements beyond the expected price range.

Take Profit

Set the take profit at a point where the price is likely to reach but not exceed the next envelope band in the direction of your trade. For a long trade, this would be slightly below the upper envelope band. For a short trade, this would be slightly above the lower envelope band. This approach aims to capitalize on price movements within the expected range defined by the envelopes.

Additionally, you can use the stochastic indicator to refine these levels:

When the stochastic oscillator overbought (for a short trade) or oversold (for a long trade) conditions, it can signal a potential reversal, indicating a good point to take profit.

If the stochastic indicator crosses the signal line against your trade direction, consider this as a potential exit signal to protect your gains or limit losses.

Always adjust the stop loss and take profit levels based on the specific market conditions and volatility.

This is a winning strategy not suitable for beginners which however can be configured on all desktop trading platforms MT5, MT4, Trading View, Pro Real Time, Metastock, Tradestation etc.

Examples of trades.