Scalping Momentum Mobile Strategy

Strength, Momentum Strategy

MACD, RSI, Bollinger Bands Trading

Submit by Maximo Trader

Scalping Momentum Mobile Strategy is a Momentum Strategy for day trading. The signals are generated by momentum indicators but are confirmed at the time frame above 30 min or H30. This strategy is suitable for volatile currency pairs, VIX, Gold, and indices.

Setup Strategy

Trading Type: Day Trading, scalping.

Timeframes: 5 minutes (M5), 15 minutes (M15), 30 minutes (M30) and 1 hour (H1).

Trade Execution Timeframe: 5 minutes (M5) (confirmation 15 min) 15 minutes (confirmation 30 min), and 30 minutes (confirmation 60 min) .

Indicators:

Bollinger Band (20 period, deviation 2.0).

Relative Strength Index (RSI) 14 periods, close.

Stochastic Oscillator (5, 5,5, close)

MACD (12, 26, 9).

Trading rules Scalping Momentum Mobile Strategy

Sell

Stochastic Oscillator (Blue Line) must reach the 80 level

RSI (Black Line) must reach the 70 level

MACD histogram forms a peak

The price must touch the upper Bollinger Band

Candlestick rejections forms

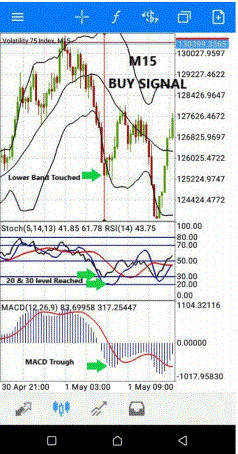

Buy

Stochastic Oscillator (Blue Line) must reach the 20 level

RSI (Black Line) must reach the 30 level

MACD histogram forms a trough

The price must touch the lower Bollinger Band

Candlestick rejections forms

Exit position

Place initial stop loss below/above the previous swing high/low.

At the middle or opposite band of Bollinger Bands, or with ratio stop loss 1:1.5.

Examples of trades.