735# Double MACD Momentum

Double MACD Trading

Submit by Maximo Trader

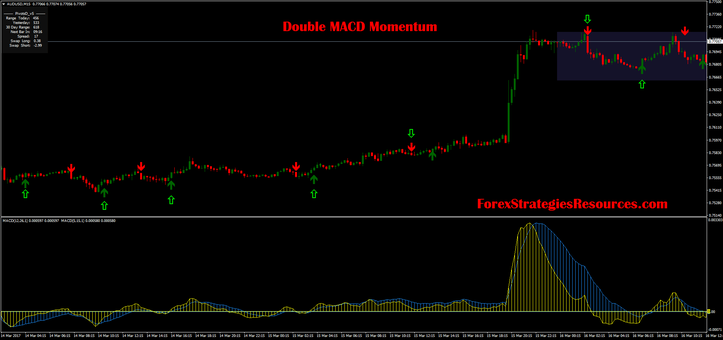

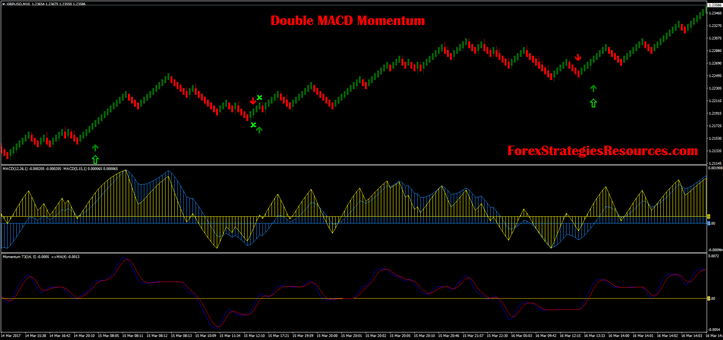

Double MACD Momentum are two ideas for trading based on double MACD as filter.

The first template is more conservative. The second is more aggressive, this strategy is also for intraday trading.

The main differences between two templetaes are:

the different arrows, the first templete has also a momentum filter, the first template works good with renko chart and median renko chart (box size 5 pips or higher).

Time Frame 15 min

Currency pairs: majors.

Metatrader indicators:

Arrow 001;

Arrows and Curves;

MACD 12, 26, 1;

MACD 5, 15, 1;

Pivot Polints Levels;

Momentum T3 (14, 5).

Trading Rules Double MACD Momentum

First

Buy

Arrow 001;

Green bar;

MACD 12, 26, 1 >0

MACD 5, 15, 1 >0

Momentum T3 (14, 5)>MA

Sell

Arrow 001;

Red bar;

MACD 12, 26, 1 <0

MACD 5, 15, 1 <0

Momentum T3 (14, 5)<MA

Make profit with ratio 1.2v stop loss.

Place initial stop loss on the previous swing high/low.

Second

Buy

Arrow buy

MACD 5, 15, 1 > MACD 12, 26, 1

Sell

Arrow sell

MACD 5, 15, 1 < MACD 12, 26, 1

Exit at the opposite arrow or at the pivot points levels.

With these strategies you can use the Martingale because they have a low variability in profitability.

In the pictures Double MACD Momentum in action.

Rick (Friday, 10 September 2021 20:49)

How do we get both MACD histograms centered on the zero line on the indicator as they are not flush with one another when moving the chart sideways and when changing time-frames? Much appreciated.