657# Range Market Trading

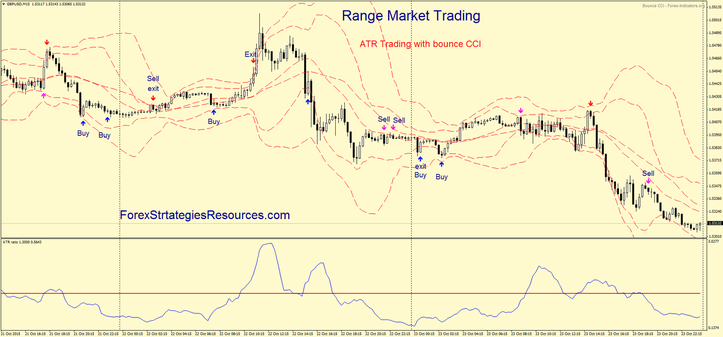

Range Market Trading with ATR Ratio and CCI Bounce

Submit by Neptune 25/10/2015

Range Market Trading why? I think that the financial market are always in a range. This range depends by time frame.

The range depends on the time in which we look at the market. Okay this is my philosophy. Most of the time the market fluctuates within a range.

I propose two ideas on how to trade in these situations range market:

ATR Trading with Bounce CCI indicator.

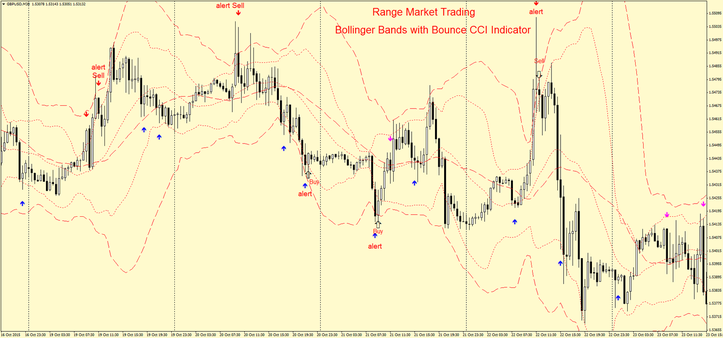

Bollinger Bands with Bounce CCI Indicator.

Time frame 5 min or higher

Financial market:any.

Metatrader Indicators

This setting is for the following time frame: 15 min, 30min, 60 min.

ATR Ratio (shor ATR 7 long atr 47 level 1,3).

Bounce CCI 6 period ( levels: overbougth 170 oversold 170).

Bounce CCI 11 period ( levels: overbougth 50 oversold 50).

Bollinger Bands (20,2).

Bollinger Bands (30,3).

Rules ATR Trading with bounce CCI

When the price is below 1,3 level of the ATR Ratio following the signals of CCI.

Buy

Price is below 1,3 level of the ATR Ratio.

Buy at the buy arrow of the CCI.

Sell

Price is below 1,3 level of the ATR Ratio.

Sell at the Sell arrow of the CCI.

Exit position at the opposite arrow or at the levels of the bands of the BB.

Place stop loss at the previous swing.

Note this strategy works great in the following : (18:00 pm-7:00Am)

Rules Bollinger Bands with Bounce CCI Indicator

Buy

When the price broken the lower band of BB (30, 3), wait the buy arrow of the CCI ,this is as a alert, but entry is at the close of the first with candle inside of the Bollinger bands (30, 3).

Sell

When the price broken the upper band of BB (30, 3), wait the sell arrow of the CCI indicator ,this is as a alert, but entry is at the close of the first black candle inside of the Bollinger bands (30, 3).

Note:arrow ccI can match with the candle of entry

Exit position at the next opposite arrow of the CCI or at the levels of the Bollinger Bands.

Share your opinion, can help everyone to understand the forex strategy