Master FX Strategy

Trend Following and Breakout Strategy

Taotra based strategy.

Submit by Alexeyev

Master FX Strategy either trend following strategy which can be interpreted yes in trend following or breakout for this reason we have breakout and trend following indicators. the strategy can be divided in two, however I have decided to leave these indicators together because they can be complementary.

Master FX Strategy is trend following strategy which can be interpreted yes in trend following or breakout for this reason we have breakout and trend following indicators. the strategy can be divided in two, however I have decided to leave these indicators together because they can be complementary.

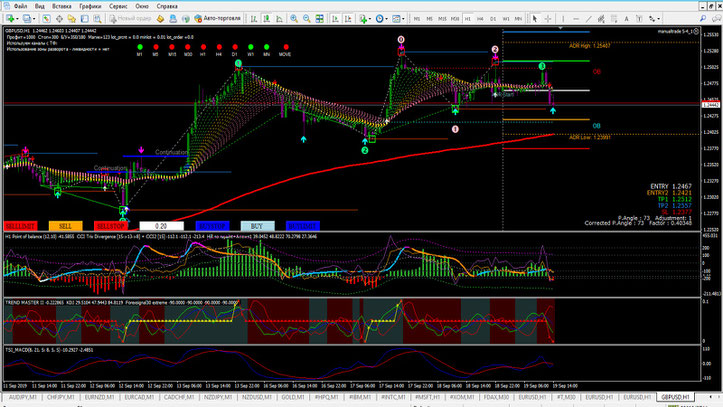

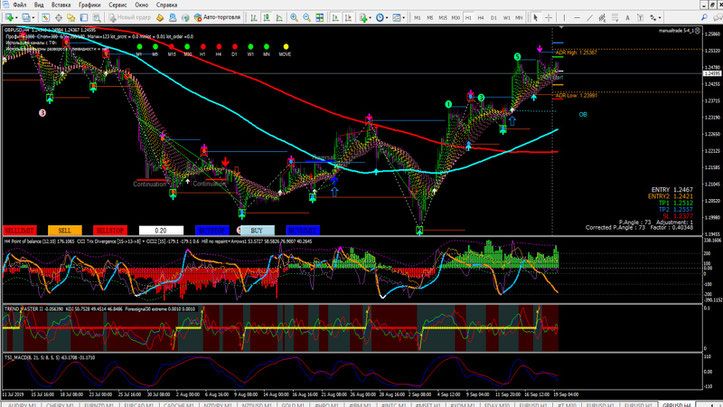

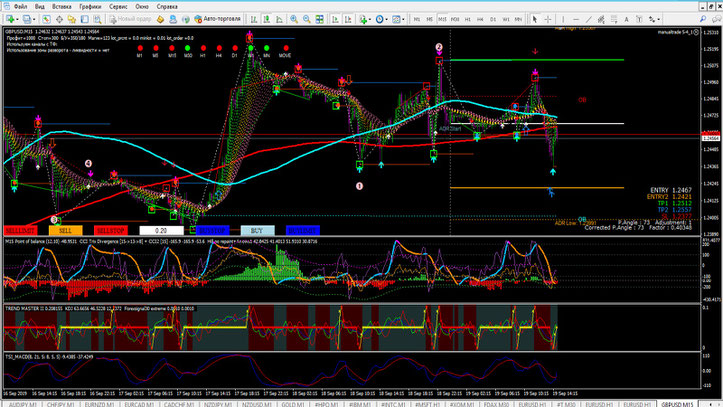

The rule to trade with this system is very simple to follow the trend when there is an agreement of indicators, therefore, either follow the breakout confirmed by two trend indicators or trade in trend when the direction arrows are confirmed by 3 indicators of strength.

Time Frame 30 min or higher

Trading cups are as follows: Gold, Oil, EUR / USD, AUD / CAD, AUD / NZD, NZD / USD, GBP / USD, EUR / JPY, EUR / AUD, EUR / NZD, EUR / GBP, AUD / JPY , NZD / CAD, NZ / JPY, USD / JPY, USD / CHF.

Below are the indicators metatrader 4 used for this system:

123 pattern, Wall paper trend, Binary arrow, CCI Trix Divergence, Cycle pip Reaper, Elliot indicator, Forex System Entry, Forex signal 30. 1, GMC, Hill no repaints arrow 1, KDJ, point of balance, Swing force, Taotra, TSI MACD, ZZ NRP AA TT.

In conclusion, this trading system is also a collection of good metatrader 4 indicators.

The images below illustrate how the system works, as can be easily seen, it can only be traded with the breakout in the direction of the Taotra or it can be traded following the trend with the direction arrows confirmed by the Taotra and other trend indicators.

The momentum indicators that are present such as the CCI and the RSI must be interpreted in a trend following non-reversal sense (otherwise confusion is created).

Share your opinion.