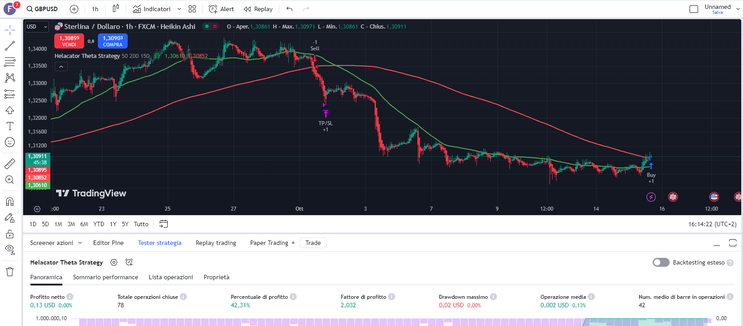

28# Helacator Theta Forex Strategy

Submit by Alexander

Objective:

The Helacator Theta strategy aims to capitalize on trend-following opportunities by using candlestick patterns combined with moving averages. This strategy identifies key points

of entry based on trend confirmations from the 50-period and 200-period moving averages, in combination with the "Three White Soldiers" for bullish setups and "Three Black Crows" for bearish

setups.

Setup Strategy

Currency pairs: Volatile.

Time Frame 30 min, H1, H2, H3, H4.

Buy Setup

-

Trend Filter:

The price must be above both the 50-period (MA50) and 200-period (MA200) simple moving averages. This indicates a bullish trend. -

Entry Timing:

Enter a buy position when the "Three White Soldiers" candlestick pattern is detected (three consecutive bullish candles), signaling strong upward momentum. -

Stop Loss:

Place the stop loss below the lowest of the previous swing low. -

Take Profit:

The take profit can be set at a risk-reward ratio of 1:2. -

Alternatively, you can use a trailing stop once the price moves favorably to lock in profits.

Sell Setup

-

Trend Filter:

The price must be below both the 50-period (MA50) and 200-period (MA200) simple moving averages, indicating a bearish trend. -

Entry Timing:

Enter a sell position when the "Three Black Crows" candlestick pattern is detected (three consecutive bearish candles), signaling strong downward momentum. -

Stop Loss:

Place the stop loss above the previous swing high. -

Take Profit:

The take profit can be set at a 1:2 risk-reward ratio, or use a trailing stop to maximize profit as the price continues to decline.

Additional Features:

-

Cooldown Period:

The Helacator Theta includes a cooldown filter to avoid taking multiple signals within a short time frame. This ensures that new signals are only generated after a specified number of candles have passed since the previous trade.

Now I will show you some examples of a strategy based on this indicator written by me. The setting is the same of previous.