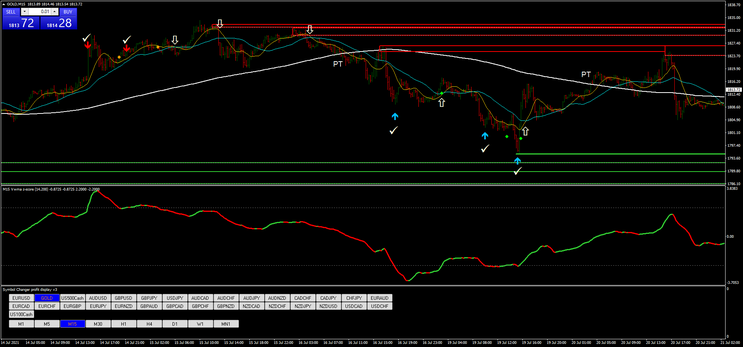

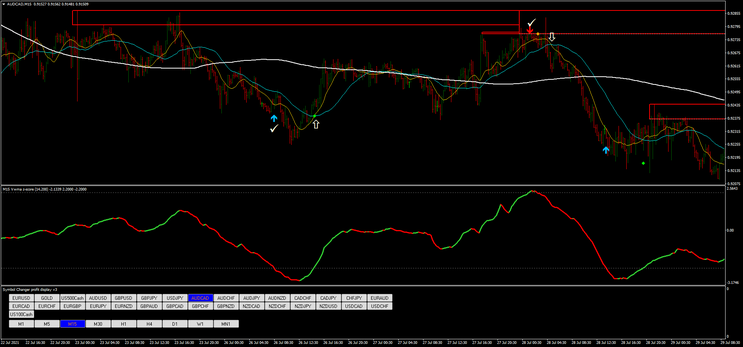

149# Z-Score Mean Reversion Institutional Strategy

High Profitable Strategy

Always win the market

Submit by Joy22

Z-Score Mean Reversion is an Institutional strategy, based on the principle of return on average which has always been used by hedge funds also in other types of strategies such as statistical arbitrage. These types of return-on-average strategies are statistical trading systems that can be supervised on all aspects with a high probability of success. The system proposed here is very simple but very effective based on the 200-period mobile meia and the Z-score (i.e. the measure of the deviance from the mean),

Setup Strategy

Time frame 15 minutes or higher.

Currency pairs:any.

Metatrader 4 Indicators

Zone indicator

Simple Moving Average 11 periods,median.

Simple Moving Average 32 periods,median.

Simple Moving Average 200 periods,median.

Z-score period 200, overbought 2.2, oversold -2.2

Symbol Changer

Metatrader 4 indicators

Trading rules Z-Score Mean Reversion Institutional Strategy

Buy

Zone support below the price (optional).

Price below 200 Simple Moving Average.

Z-Score arrow buy.

SMA 11 periods crosses upward SMA 32 periods.

Sell

Zone Resistance above the price (optional).

Price above 200 Simple Moving Average.

Z-Score arrow sell.

SMA 11 periods crosses downward SMA 32 periods.

Exit position

Make profit before or when the price touches the moving

average of 200 periods.

Place initial stop loss belo / above the previous swing high / low.

Examples of trades.

FSR (Monday, 14 April 2025 15:50)

There is no such Z-score for MT5. You need to convert or rewrite the code.

david (Friday, 11 April 2025 23:30)

hi do you have for mt5 ?