Turtle Trading with momentum

Turtle Channel Trading

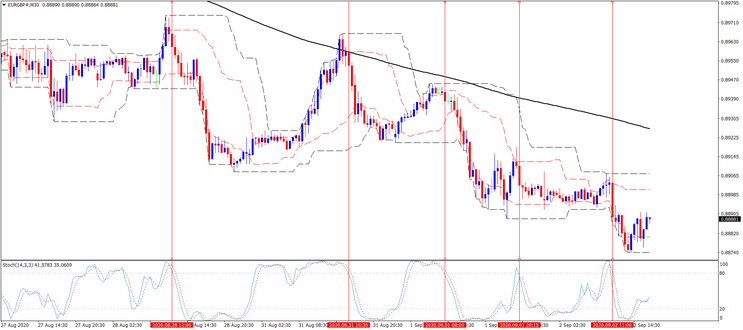

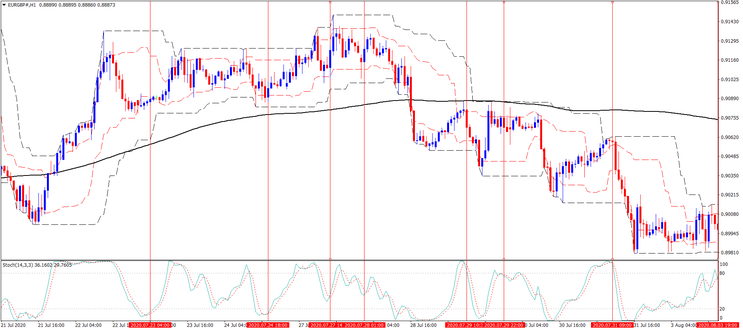

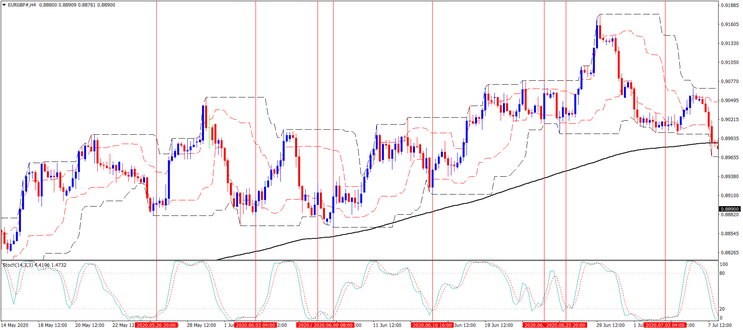

Turtle Channel with slow SMA and Stochastic

Submit by Aurora

The Turtle Trading strategy is a famous trading system based on two donchian channels successfully applied with a daily time frame on futures, commodities and treasury bonds. There is a large bibliography about it. I present a trend following, non-breakout variant that can also be applied to lower time frames. Also in this case the strategy proved to be very profitable.

Setup Strategy

Time Frame 15 min or higher.

Currency pairs:any.

Metatrader 4 indicators

Turtle Channel Method (50-20)

Turtle Channel Method (50-16)

Other platform as TradingView Ninja Trader or MT5

Donchian Channels 20 period, close.

Donchian Channels 55 period, close.Simple moving average 200 periods, close.

Oscillator Stochastic (21,8, 5), close.

Simple moving average 200 periods, close.

Oscillator Stochastic (21,8, 5), close.

Time Frame 30 min 60 min, 240 min Stochastic Oscillator

Oscillator Stochastic (14,3, 3), close.

Trading Rules The Turtle Trading with Momentum.

Trades only in the direction of the trend.

Trend up if the price is above 200 simple moving average.

Trend down if the price is below 200 simple moving average.

Buy

Trend upward.

When the price retraces on the lower channels the stochastic crosses upward. (This is the timing).

Sell

Trend downward.

When the price retraces on the upper channels the stochastic crosses downward. (This is the timing).

Exit position

Place Initial stop loss below/above the Donchian Channels 55 periods.

Profit Target minimum ratio stop loss 1:1.

In the pictures Turtle Trading with momentum

Telegram Channel: https://t.me/freeforexresources

Share your opinion