133# HMA Momentum Forex Strategy

I-G-CCI 2 with Stochastic Oscillator Trading.

Stochastic Oscillator overbought is oversold crosses I-G-CCI 2.

HMA filter for entries in the market.

Submit by Janus Trader

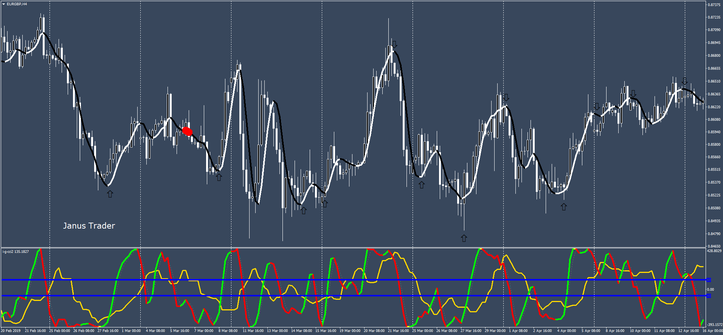

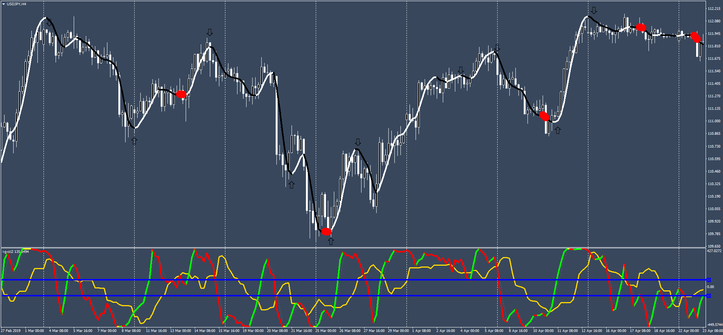

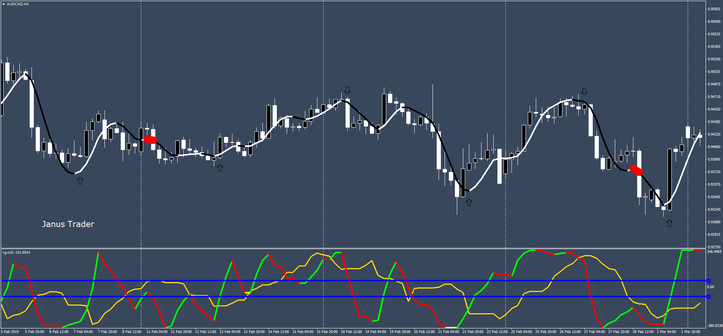

HMA Momentum Forex Strategy is a momentum strategy based on Stochastic Oscillator overbought is oversold that crosses I-G-CCI 2 for to generate signals for trading filtered by Hull Master Moving Average for entries in the market. This strategy was commissioned to me to create an EA on time frame H1, H4 and daily, here I publish the idea that seemed very interesting.

The basic idea of this trading strategy is to generate fast swing signals because the market today is extremely automated and therefore often generate an alternation of contrary bars this thing creates a lot of confusion in the traders. So the idea of hitting a few bars could be a winner.

This is a discretionary strategy.

Time Frame H1, H4, daily.

Currency pairs: EUR/USD, AUD/USD, AUD/NZD, NZD/USD, EUR/AUD, AUD/CAD, EUR/NZD, EUR/CAD, USD/JPY. EUR/GBP, EUR/CHF, USD/CHF.

Best Currency pair: AUD/CAD.

Metatrader 4 Indicators

HMA 14 period (H4 time frame)

Stochastic oscillator (10, 3, 3, LWMA) overbought >60 oversold<40;

I-G-CCI 2 14 period.

Trading Rules HMA Momentum Forex Strategy

Buy

Stochastic Oscillator is oversold <40 crosses upward I-G-CCI 2.

HMA black color.

Sell

Stochastic Oscillator is overbought >60 crosses downward I-G-CCI 2.

HMA white color.

Exit position options:

Fast profit predetermined with ratio stop loss 1:1.

Initial stop loss on the previous swing high/low.

HMA Momentum Forex Strategy with these configurations is not suitable for trading at low time frames below H1.

This trading system is suitable for side markets and medium trends.

Look for the side markets with the currency strenght and choose those currency pairs that are in the central positions. Important!

Money Management applies three steps Martingala multiplier 1.5 or 1.7.

In the pictures HMA Momentum Forex Strategy in action.

Share your opinion.

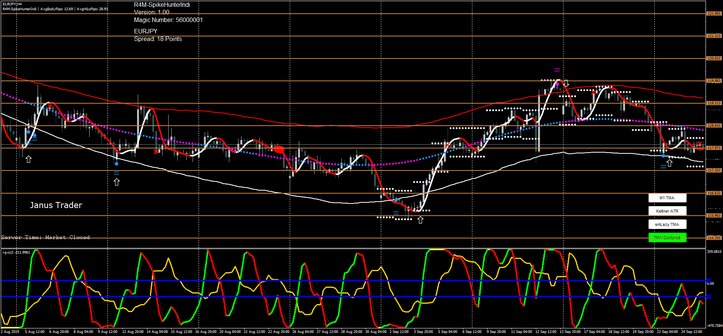

R4M SpikeHunter filter

I added a filter that looks for areas of overbought and oversold R4M SpikeHunter which has three distinct filter solutions:

1) keltner ATR; sm Lazy TMA; TMA centered.

The purpose of this filter is to increase the profitability of the trading system and to look for those areas of price that the ability to generate trades with greater chance of success.

Buy

First

Blue dot of R4R4M SpikeHunter.

Second

Stochastic Oscillator is oversold <40 crosses upward I-G-CCI 2.

HMA black color.

Sell

First

Orchid dot of R4R4M SpikeHunter.

Stochastic Oscillator is overbought >60 crosses downward I-G-CCI 2.

HMA red color.

This is a winning strategy.