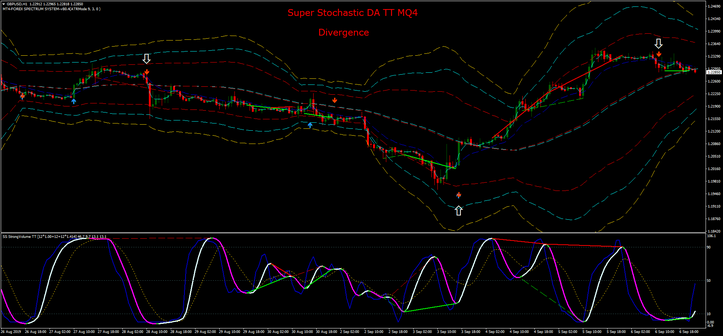

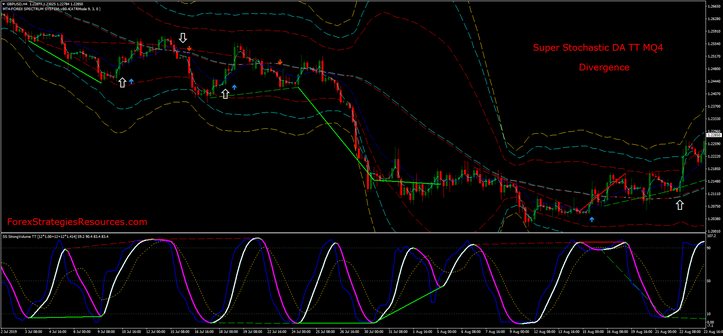

131# Super Stochastic DA TT MQ4

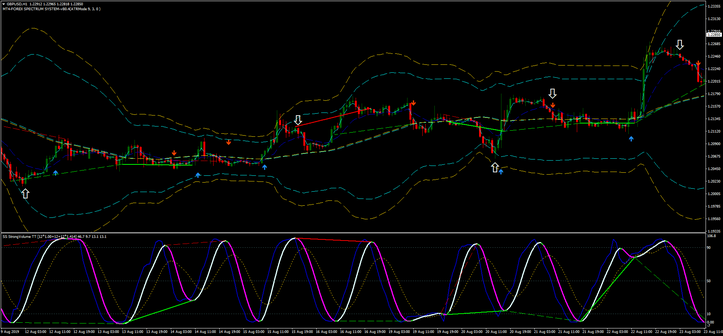

Divergence Trading

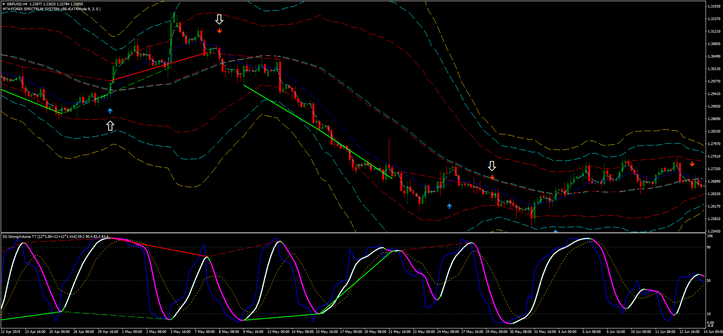

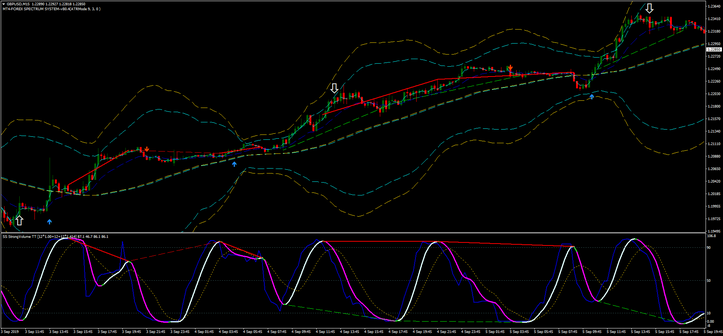

Super Stochastic DA TT MQ4 as filter.

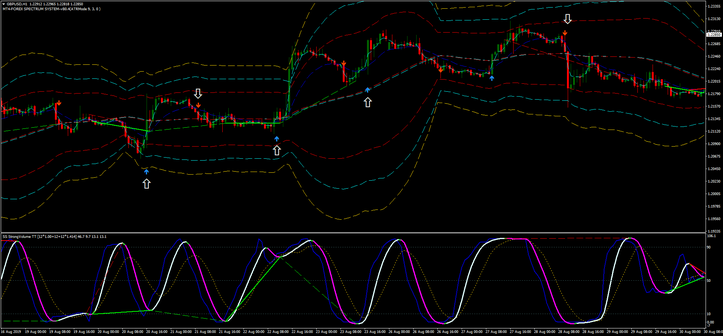

Super Stochastic DA TT MQ4 for trading n the overbought or oversold areas

Submit by Janus Trader

Super Stochastic DA TT trading indicator - only the price, volume, and their divergences. The indicator has high efficiency and accuracy also as filter of signals and for trading in the overbought or oversold areas.

Currency pairs: EURUSD, EURJPY, EURGBP, EURCAD, GBPUSD, GBPJPY.

The Super Stochastic DA TT indicator is one of Tankk’s developments,

Despite its name, the Super Stochastic DA TT indicator, in addition to its appearance, has nothing to do with Stochastic. It incorporates the principle of using divergence of price and volume.

The Super Stochastic DA TT indicator implements four types of calculation, visual display of divergences, as well as smoothing for the signal line.

Super Stochastic DA TT indicator is a great way to improve your trading strategy, increasing the accuracy and efficiency of trading signals.

How to use Super Stochastic DA TT MQ4?

The first way to use this oscillator mq4 is the classic one of trading with divergence.

If you want to use with the divergences it is recommended to use the time frames from 30 min or higher because the time frame divergences others provide more reliable signals.

A second way to use this indicator efficiently is as a signal filter.

As a signal filter or to trade in the overbought or oversold areas, the indicator can be used from the 5 min or higher time frame.

To give an example of using this indicator I used a part of a template already existing on this site. Because with this template it is suitable to be used both as a divergence and as a filter of signals or trading in overbought and oversold zones.

Metatrader 4 indicators

Exponential moving average 3 period close.

Exponential moving average 14 period close.

Bollinger Bands period 50, deviation 2.0.

Bollinger Bands period 50, deviation 3.0.

Bollinger Bands period 50, deviation 4.0.

Trading rules with Super Stochastic DA TT MQ4

Divergence

It 's preferable to follow the divergences when the oscillator has crossed areas of overbought and oversold.

Buy

Bullish divergence lines on the indicator, enter in the market when the fast moving average crosses up the slow moving average or when the buy arrow appears (at the opening of the next candle).

Sell

Bearish divergence lines on the indicator, enter in the market when the fast moving average crosses down the slow moving average or when the sell arrow appears (at the opening of the next candle).

Super Stochastic DA TT MQ4 Filter of Signals

It 's preferable to follow the divergences when the oscillator has crossed areas of overbought and oversold.

Buy

Buy Arrow of Entry Exit trend. (This arrow is as example)

Super Stochastic DA TT MQ4 crosses upward from the bottom.

Sell

Sell Arrow of Entry Exit trend. (This arrow is as example)

Super Stochastic DA TT MQ4 crosses downward from the top.

Super Stochastic DA TT MQ4 Overbought and oversold trading zones

Buy

The price goes beyond the lower bollinger band with deviation 3 (candle close), and Super Stochastic is in the oversold zone. Buy when Super Stochastico crosses upwards.

Sell

The price goes beyond the upper bollinger band with deviation 3 (candle close), and Super Stochastico is in the overbougth zone. Sell when Super Stochastico crosses downwards.

Share your opinion

Divergence Trading

Super Stochastic DA TT MQ4 as filter.

Super Stochastic DA TT MQ4 for trading n the overbought or oversold areas