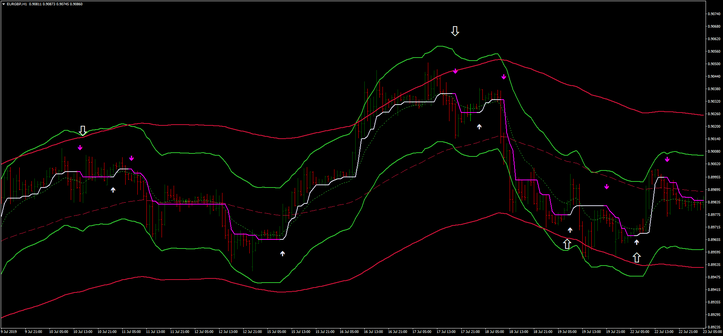

130# Keltner Trend Reversal

Keltner X2 MTF TT (MK) MQ4

Keltener with Half Trend or Breakout Trading

Submit by Federic

Keltner Trend Reversal is a reversal trend strategy based on a double keltner channel based on a single Keltner X2 MTF TT (MK) MQ4 indicator. this indicator can be used either as a breakout channel or as a reversal. Here I propose to use it as a reversal trend together with a Half Trend trend indicator and breakout strategy.

In the reversal strategy the signals are generated when the keltner channel exits the slow Keltner channel, so it is necessary to wait that Half Trend generates a signal opposite to the direction of the market.

Time Frame 15 min or higher.

currency pairs: EUR / USD, GBP / USD, AUD / USD, AUD / CAD, EUR / CHF, EUR / GBP, GBP / JPY, USD / JPY, NZD / USD, NZD / CHF, NZD / CAD, EUR / AUD, AUD / JPY, CAD / JPY, USD / CHF.

Metarader 4 Indicators:

Keltner X2 MTF TT (MK) MQ4 (period fast 15, period slow 30)

Half trend (amplitude 2). please note that half trend is a free indicator that today is sold with many different names such as Duty indicator, Pandorum indicator etc...

Trading rules Keltner Reversal

Buy

The lower channel of the keltner fast comes out towards the bottom of the lower channel of the slow Keltner.

Wait for the Half Trend buy signal to continue to go long until the price touches the opposite end of the slow keltner channel.

Possible price targets the upper channel of the fast Keltner or the central channel of the slow channel.

Place the stop loss below the lower swing.

Sell

The upper channel of the keltner fast comes out towards the top of the upperchannel of the slow Keltner.

Wait for the Half Trend sell signal to continue to go short until the price touches the opposite end of the slow keltner channel.

Possible price targets the lower channel of the fast Keltner or the central channel of the slow channel.

Place the stop loss above the upper swing.

This is a strategy that is very successful in side markets and trend mediums. In long trends it can generate false signals which it then recovers. therefore it is always better to choose currencies that are not in long trend.

Now we propose the breakout strategy based on this Keltner X2 MTF TT (MK) MQ4 indicator.

Half trend in this case is not used.

Trading rules Keltner channels breakout

It is preferable to use time frames greater than 30 min.

Currency pairs in trend.

Buy

Keltner's upper channel of the keltner comes out towards the top of the upper channel of the slow keltner.

The price candle closes above the upper channel of the slow keltner.

Enter the market when the next bar is opened.

Place the initial stop loss at tnear of the middle channel of the slow keltner.

Profit target ratio minimum 1:1 stop loss.

Sell

Keltner's upper channel of the keltner comes out towards the bottom of the lower channel of the slow Keltner.

The price candle closes below the lower channel of the slow keltner.

Enter the market when the next bar is opened.

Place the initial stop loss at tnear of the middle channel of the slow keltner.

Profit target ratio minimum 1:1 stop loss.

Which strategy to use with this Keltner X2 MTF TT (MK) MQ4 indicator depends on your personal trading style. But as often stated on this site breakout strategies although they have a lower profitability or around 50% in the long run are often winning because it is easier to apply winning money management techniques.