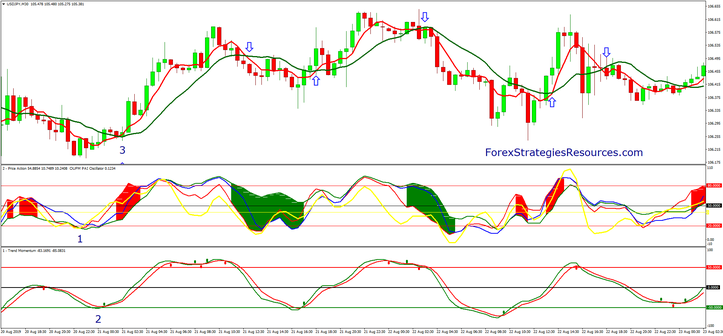

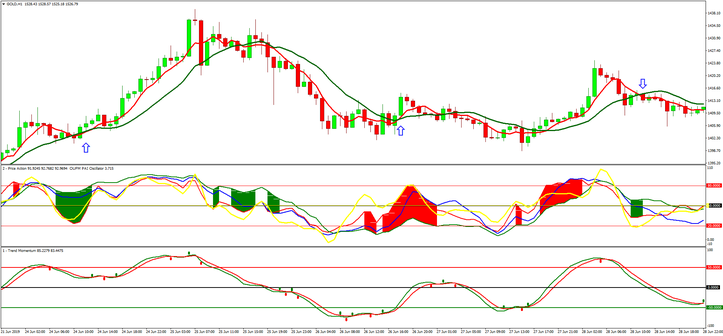

129# Forex Mastery Strategy

Trend Momentum Trading System

Momentum price action of overbought and oversold

Submit by TopFx

Forex Mastery Strategy is a trend momentum strategy with price action of overbought and oversold. Therefore by definition this strategy is particularly suitable in side markets and in medium trend. In markets with strong trends it generates false signals.

Forex Mastery strategy generates long signals when the momentum indicators are oversold and then there is the intersection of the fast moving averages upwards. On the contrary it generates short signals when the two momentum indicators are overbought and then there is the crossing of the moving averages downwards.

This strategy is suitable for day trading and swing trading.

time frame 15 min or higher.

Currency pairs: major and minor; commodities such as oil, gold and silver.

Metarader 4 Indicators:

Simple moving average 5 period, close.

Simple moving average 13 period, close.

In the same window forex mastery price action indicator and forex mastery pay oscillator.

Forex mastery trend momentum.

The previous indicator Forex mastery are defaul setting.

Trading rules Forex Mastery Strategy

Buy

Forex Mastery price action and pay oscillator are below of -20 (line yellow and green)

Forex Mastery trend momentum is below -50 and crossing upward.

Simple moving average 5 crosses upward simple moving average 13 period (timing for entry).

Sell

Forex Mastery price action and pay oscillator are above of 80 (line yellow and green)

Forex Mastery trend momentum is below +50 and crossing downward.

Simple moving average 5 crosses downward simple moving average 13 period (timing for entry).

Exit position

Place initial stop loss at the previous swing high/low.

Profit Target minimum ratio 1.1 stop loss or close position at opposite cross of simple moving average.

Other interpretation

Buy

It forms a green concave of the indicator price action,

trend momentum crosses upwards.

The 5-period moving average crosses the moving average 13 periods upwards.

Sell

It forms a red concave of the indicator price action,

trend momentum crosses downwards.

The 5-period moving average crosses the moving average 13 periods dpwnwards.

This second method is more based on the randomness of events, therefore from this perspective it could deviate from the quantum as it does not interpret the indicators in a linear way but in a probabilistic sense.

Exit position as the previous.