123# Stochastic Crossing with FXDD Strategy

Trend Momentum Trading

Stochastic timing entry in trend

Submit Barlow Stefan

Stochastic Crossing with FXDD Strategy is a trend momentum strategy based on Stochastic indicator as timing for entry, ma channel and FXDD indicator.

The purpose of this strategy is find the best entries in trend with stochastic oscillator. Stochastic Crossing with FXDD Strategy is suitable for day trading or for swing trading.

Time Frame 5 min or higher.

Currency pairs: GBP/USD, GBP/JPY, AUD/USD, EUR/USD, USD/CAD, EUR/NZD, USD/CHF, NZD/USD, USD/JPY.

Metatrader Indicators:

Stochastic Crossing (30, 10, 10),

Fast Trend indicator,

Simple moving average 10 period, high,

simple moving average 10 period, low.

Trading Rules Stochastic Crossing with FXDD Strategy

Find the pairs in trend!! First condition.

Buy

Price action close above MA high.

Fast trend indicator 4 bars green.

Stochastic crossing indicator buy arrow.

Initial stop loss below last swing low.

Exit at the next opposite signal or with predetermined profit target that depends by time frame and pairs.

Sell

Price action close below MA high.

Fast trend indicator 4 bars red.

Stochastic crossing indicator sell arrow.

Initial stop loss above last swing high.

Exit at the next opposite signal or with predetermined profit target that depends by time frame and pairs.

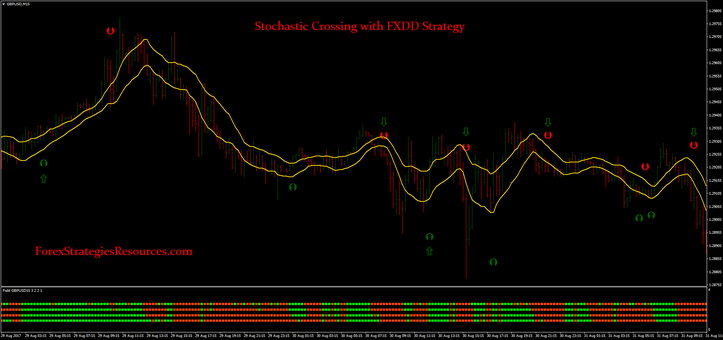

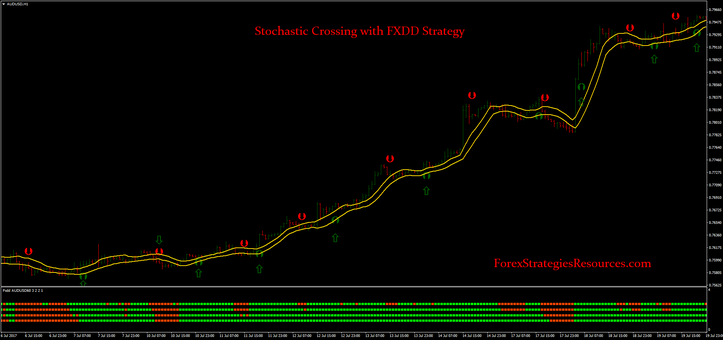

In the pictures Stochastic Crossing with FXDD Strategy in action.

Share your opinion, can help everyone to understand the forex strategy.