119# Dtosc Contrarian trading with Martingala

Contrarian trading FX

Submit by Kelly 04/2017

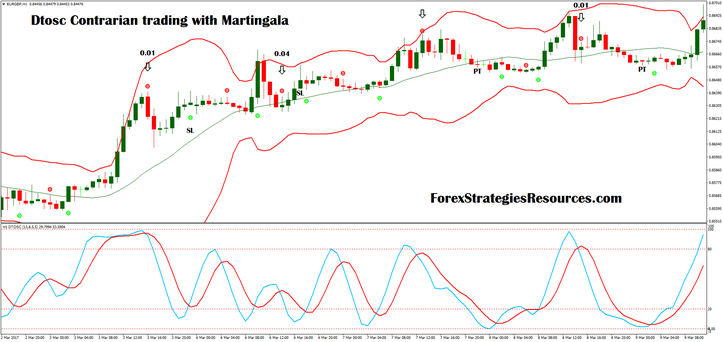

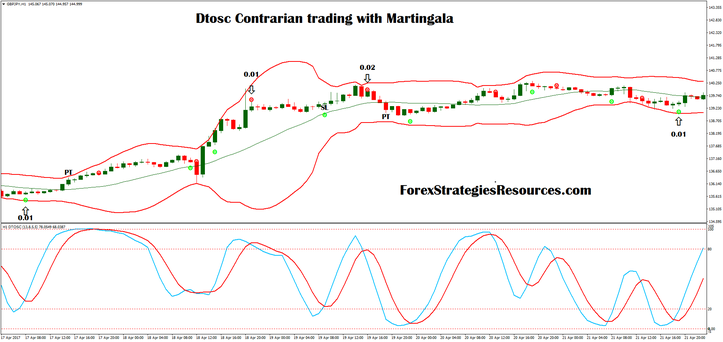

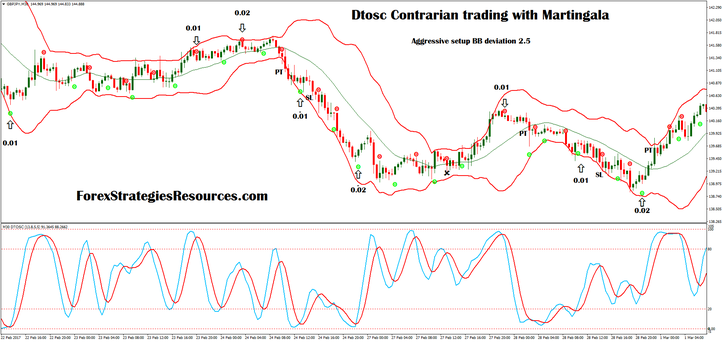

Dtosc Contrarian trading with Martingala is a trading system based on Dtosc oscillator and Bollinger bands.

The principle on which this system is based is the return of the price to the central moving average of the Bollinger Bands. So when price goes away from the average then tends to return to the central moving average.

What is Dtosc? a version of the Stochastics RSI created by Rober Miner and presented in his book, High Probability Trading Strategies. The setup proposed are:

8,5,3,3 13,8,5,5 21,13,8,8 34,21,13,13, 13,5,3.

Time Frame 5 min or higher.

Currency pairs::any.

Metatrader Indicator:

Dtosc oscillator (period RSI 13, period stocastic 5, period sk 5, period sd 3).

Bollinger Bands (20, 3.0 deviation).

Aggressive setup is Bollinger bands with deviations 2.5.

With aggressive setup it is advisable to decrease the martyral multiplier.

Trading Rules Dtosc Contrarian trading with Martingala

Buy

When the price breaks or touches the lower Bollinger band wait for entry the buy signal dot of the Dtosc oscillator.

Sell

When the price breaks or touches the upper Bollinger band wait for entry the sell signal dot of the Dtosc oscillator.

If the entry candle goes beyond the middle band does not consider the entry (optional)

Make prodit at the middle band or at opposite band of the Bollinger bands or at the opposite dtosc alert.

Place initial stop loss above/below the the upper/lower band.

Money management with martingala range multiplier that you can use is (1.5 -max 2.0)

example progression 2.0: 0.01 – 0.02 – 0.04 – 0.08, - 0.16 – 0.32 – 0.64 – 1.28 – 2.56.

With this system you can risk using the Martingale. Because it has a low volatility in the distribution of profitability. This means that after some mistakes it is very likely to predict a positive trade.

The precise definition of stop loss and take profit with martingala should be modulated in relation to currency and time frame.

This trading system is an idea for an Expert Advisor there are the information for build it.

In the pictures Dtosc Contrarian trading with Martingala in action.

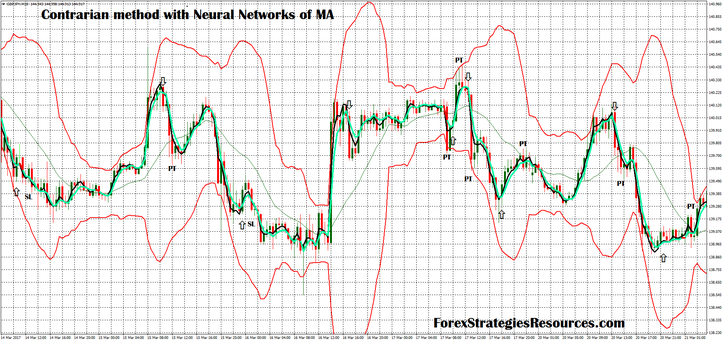

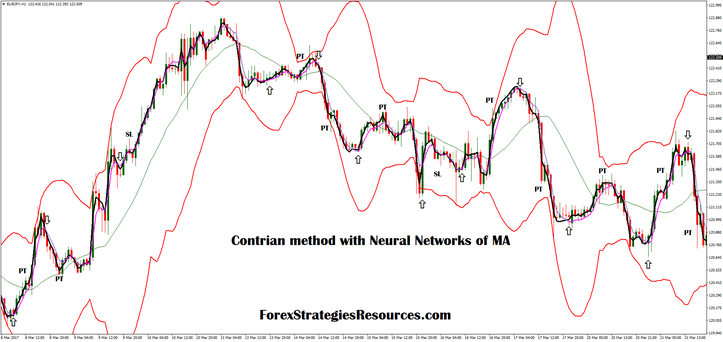

Contrian method with Neural Networks of MA

Contrian method with Neural Networks of moving average.

The same rule for entry.

Metatrader Indicators

MA (5,51.1)

NMA neural networks of MA

Bollinger Band (20, 3.0 deviation).

Buy

When the price breaks or touches the lower bollinger band wait for entry NNMA crosses signal line upward.

Sell

When the price breaks or touches the upper bollinger band wait for entry NNMA crosses signal line downward ward.

In the folder there are two templates.

Happy trading.

Share your opinion, can help everyone to understand the forex strategy.