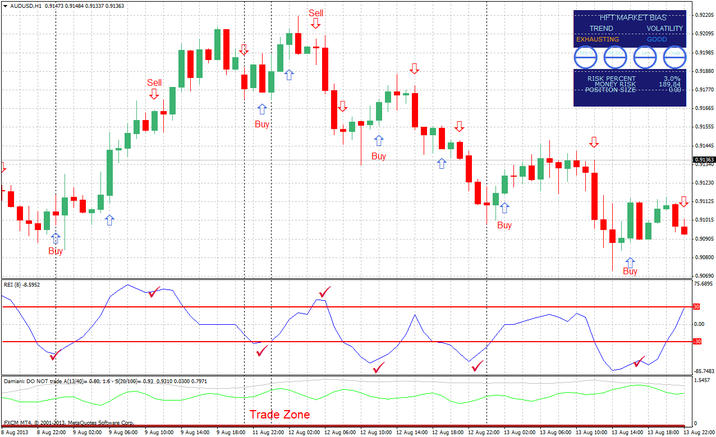

106# Range Expansion Index (REI) Trading System

Divergence with Range Expansion index (REI)

Submit by Joy 22 19/08/2013

Calculates Tom DeMark's Range Expansion Index.

Going above 60 and then dropping below 60 signals price weakness.

Going below -60 and the rising above -60 signals price strength.

For more info see The New Science of Technical Analysis.

I have modified the Tom DeMark's Range Expansion Index for Forex Market.

Going above 30 and then dropping below 30 signals price weakness.

Going below -30 and the rising above -30 signals price strength.

Time Frame H1 or higher.

Currency pairs:any

Range Expansion index (REI) (8 period);

FXCX Divergence, Entry signals(2,5,2, true H1 – setting H4 and daily 2, 4,2, true,);

Damiani Volameter (Threshold level 1.6) to determine the trade zone area. The trade zone area is when the grey line is > green line.

Trading Rules: Divergence with Range Expansion index (REI).

Buy

-

The price is in the trade zone area;

-

Range Expansion index (REI) is below -30;

-

For Entry wait the firs buy arrow FXCX Divergence, Entry signal.

Sell

-

The price is in the trade zone area;

-

Range Expansion index (REI) is below -30;

-

For Entry wait the firs buy arrow FXCX Divergence, Entry signal.

Exit position

Discretionary. Fast profit target predetermined,that depends by time frame and currency pair.

Initial Stop loss on the previous swing.

Range Expansion Index (REI) Trading System: Indicators and Template.

Share your opinion, can help everyone to understand the Range Expansion Index (REI) Trading System.

New Template for Range Expansion Index (REI) Trading System becouse arrow FXCX Divergence, Entry signal is very hard for to use. The new indicator that i add is

HFT2 no repaint it is simple. See Picture.