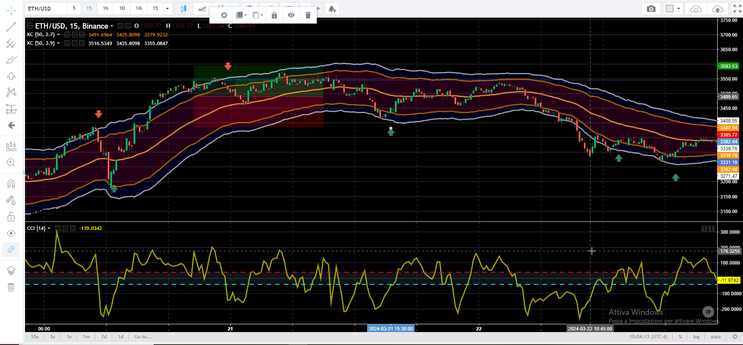

176# Keltner Channel Reversal with CCI

Reversal Trend Strategy

Submit by Janus Trader

Keltner Channel Reversal with CCI is a trend reversal forex strategy also suitable for trading on Crypto, Indices and Commodities.

The aim of the strategy is to define the dynamic overbought and oversold areas with the Keltner channels.

The strategy works on all Time frames and is suitable for scalping.

Strategy Setup

Time Frame 1 minute or higher.

Currency pairs: any.

Indicators:

Keltner Channel period 50, Kv 2.7;

Keltner Channel period 50, Kv 3.9;

CCI 14 period with levels -40 buy and -40 sell;

Trading Rules

The price must break out of the Keltner bands.

Buy

Price breaks out of the lower 3.9 band.

The price re-enters the bands and closes above the lower 2.7 band.

This price movement must also be confirmed by the CCI which, coming from below, breaks the level of -0.4.

Sell

Price breaks out of the upper 3.9 band.

The price falls within the bands and closes below the lower 2.7 band.

This price movement must also be confirmed by the CCI which, coming from above, breaks the level of +0.4.

Exit position

Profit target on the central band or stop loss ratio 1:1.

The initial stop loss must be placed above or below the 3.9 Keltner band + the spread and any optional pips in relation to the type of money management used.