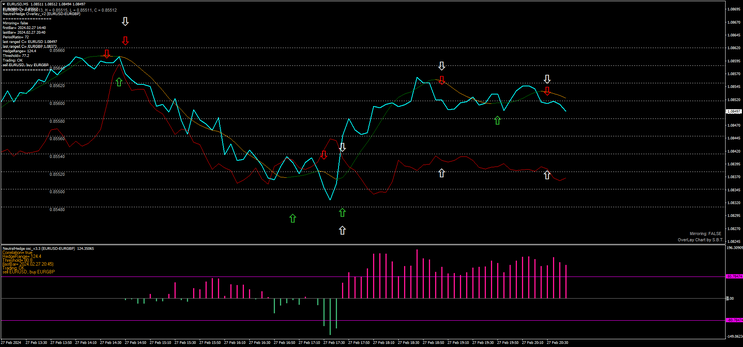

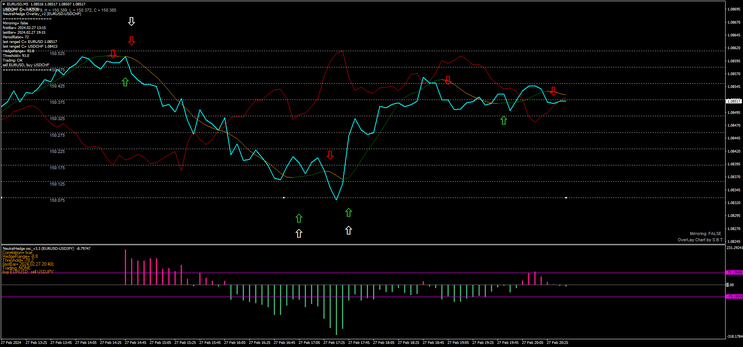

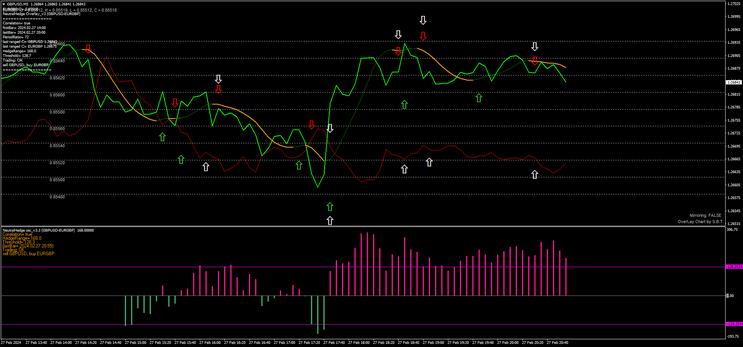

173# Pairs trading with Negative Correlation – Scalping Example

A speculative model for pair trading

Submit by Maximo Trader

In this post I give an example of pair trading based on negatively correlated currency pairs without mutual hedging. The aim of the proposed strategy is to try to capture the moments of directional convergence of the two pairs.

It should be underlined that the proposed model is also valid for positive correlations. We will make further updates in the future.

Setup Strategy

Time frame 5 min or higher.

Reference pairs: GBPUSD-USDCHF, GBPUSD/EURGBP, AUDUSD-USDCAD EURUSD – USDCHF other pairs can also be verified and used.

Metarader 4 indicators:

Overlay Chart with the reference pairs

Neural Hedge Overlay chart

Hedge Divergence Standard Deviation (optional )

Neural Hedge V3.3

HMA 20 periods.

Trading Rules Pairs trading with Negative Correlation

Buy Currency1 and Sell Currency2

Hedge Divergence channel in the low band area. (optional)

Neural Hedge Oscillated magent bars below the lower horizontal line

HMA buy arrow on currency 1.

Sell Currency1 and Buy Currency2

Hedge Divergence channel in the high band area. (Optional)

Neural Hedge Oscillator magenta bars above the top horizontal line

HMA sell arrow on currency 1.

Exit position

Profit Target when the model generates the opposite conditions, default profit for example 5 min time frame EURUSD USDCHF 10 pips.

Neuro Hedge Oscillator reaches zero.

Stop Loss when the model generates the opposite conditions or 15 pips for example 5 min time frame EURUSD USDCHF 10 pips.

In the following images, trading examples.

luis ronald (Monday, 04 March 2024 01:55)

obrigado