154# Reversal Scalping with RSI and TMA

RSI Fast Reversal Scalping

TMA overbought and oversold levels

Excellent strategy also Binary Options high / low

Submit by Joy 22

Reversal Scalping with RSI and TMA is a strategy for fast profit based on

overbought levels of the RSI and TMA bands.

RSI used is a custom indicator for TradingWiew.

However, this strategy can be easily implemented on all trading platforms by adapting the RSI oscillator.

This strategy can also be suitable for trading on binary Options high / low. In other words, the strategy looks for the overbought and oversold levels of the two indicators at the same time, so

when these conditions occur, the signal is generated.

This strategy has high profitability. In scalping mode it is very suitable for Asian markets. Trending markets should be avoided.

Setup strategy

Time frame 3 minutes or higher.

Currency pairs: Synthetic currency pairs, such as EURGBP, EURCHF, AUDNZD, AUDCAD,

AUDCHF, GBPCAD, GBPCHF and others or suitable for, local or medium trend markets.

Expiry time Binary Options High / Low 5 candles.

Tradingview indicators

Triangular Moving Average TMA (35, 60, 4).

RSI smart rsi (default setting with levels 25-75, or 20-80).

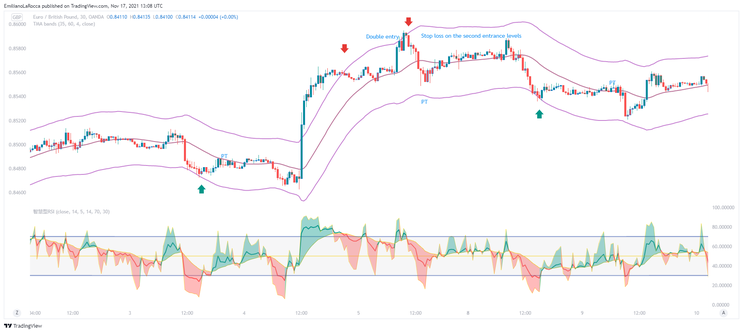

Trading rules Reversal Scalping with RSI and TMA

Buy

The price touches or exits the lower TMAs.

RSI goes below 25 or 20 and when it comes back above and the line turns blue buy.

Sell

The price touches or exits the upper TMAs.

RSI goes above 70 or 80 and when it comes back below and the line turns red sell.

Note: It is also possible to attempt a double entry in the same direction. The stop loss must be entered in relation to the second entry.

Exit position

Place the stop loss at previous swing high/low in relation to the income that I intend to do in the same direction.

Profit target minimum ratio 1:1 stop loss or at the middle band of TMA.

Examples of trades.