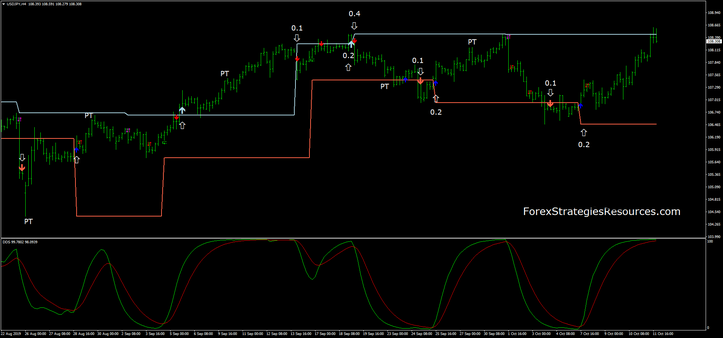

89# DB DSS Breakout

Breakout Momentum Strategy

Martingale Strategy

Submt by Maximo Trader

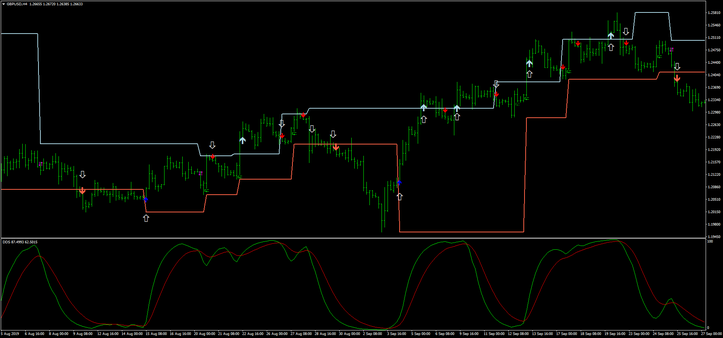

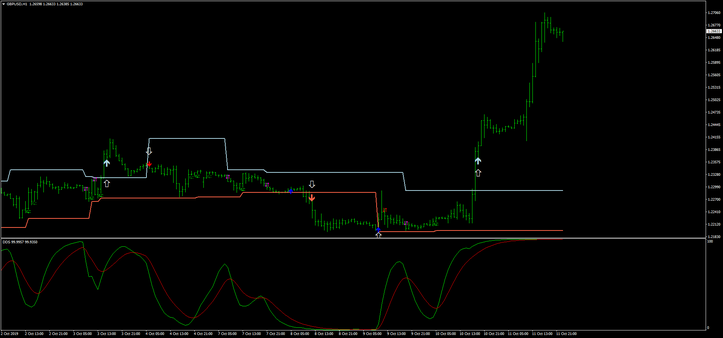

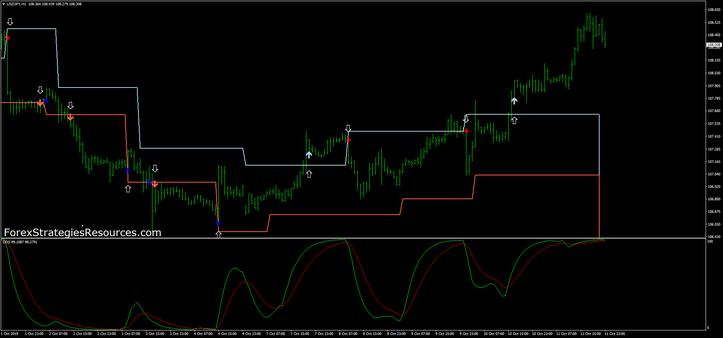

DB Dss Breakout is a Breakout Momentum strategy which can also be used with a money management Martingale. DB DSS breakout is based only on two indicators DB Breakout and on the DSS smoothed stochastic oscillator. The principle of this strategy is simple, you enter the market when the arrow direction coincides with the DSS oscillator crossover, so the entry timing does not always coincide with the arrow appearance, but when the two indicators are aligned.

You can apply martingale from 1.5 to 2.0 up to a maximum of 6 martingale steps, or Martingale 1.1 1-2-3-4-5-6.

Time frame 15 min or higher.

Currency pairs: EUR/USD, GBP/USD, USD/JPY, USD/CAD, AUD/USD, AUD/NZD, AUD/JPY NZD/USD, EUR/NZD, EUR/AUD, EUR/CAD, NZD/JPY, NZD/CAD, EUR/GBP, EUR/JPY, AUD/CAD, GBP/CAD, GBP/JPY, Gold, Silver, S&P500. DOW. AUS200.

Metatrader 4 Indicators:

DSS (8, 13, 9);

DB pivots (default setting), note: this indicator sucks a lot of ram and could be inserted and reinserted.

Trading Rules DB DSS Breakout

Buy

DB pivots arrow buy.

DSS crosses upward.

Enter the market when the two indicators coincide.

Sell

DB pivots arrow sell.

DSS crosses downward.

Enter the market when the two indicators coincide.

Exit position

Place initial stop loss on the previous swing high/low.

Profit target ratio stop loss 1:1 or at the level pivot line.

If the breakout is outside the pivot levels you can also exit at the opposite intersection of the DSS.

The characteristic of this system is that it is also found after some false signal (also filtered) to always align with the trend.

This is a winning strategy.

In the pictures DB DSS Breakout in action.

Share you opinion.