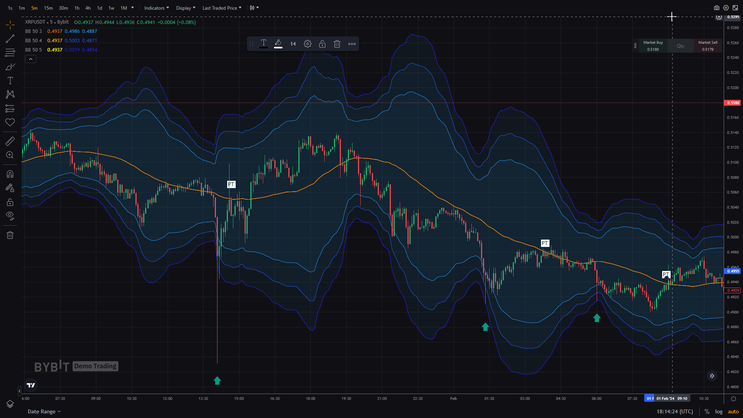

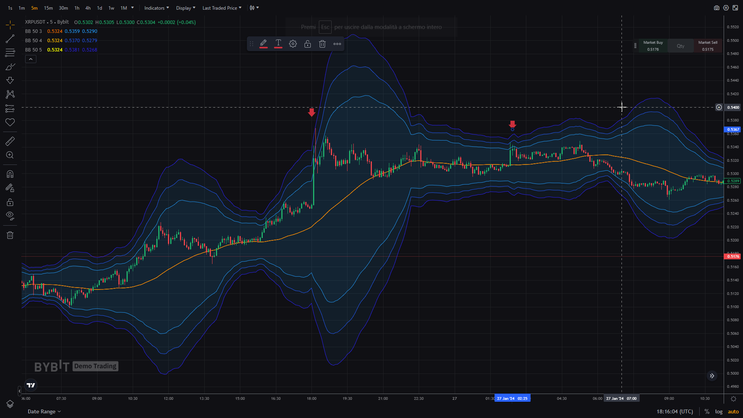

Three Bollinger Bands Strategy for Cryptocurrencies (TradingView)

Bollinger Bands Trading.

Submit by Jonas

The Three Bollinger Bands strategy is designed for trading cryptocurrencies and high-volatility forex pairs, such as GBPJPY, EURCAD, EURNZD, GBPCAD, and GBPNZD, with a focus on short-term time frames ranging from 1 to 5 minutes. This strategy leverages the extreme areas of Bollinger Bands to identify potential entry points, offering a systematic approach for traders.

Setup Strategy:

Pairs: Cryptocurrencies or high-volatility forex pairs (e.g., GBPJPY, EURCAD) with a preference for time frames of 1-3 and 5 minutes.

Time Frames: 5 minutes or higher for cryptocurrencies.

Price Chart: Utilize either Bar Chart or Candlestick Chart.

This strategy is suitable for any type of trading platform.

Indicators:

Implement the following Bollinger Bands settings:

Bollinger Band (50) with a deviation of 3.

Bollinger Band (50) with a deviation of 4.

Bollinger Band (50) with a deviation of 5.

Trading Rules:

Sell:

Initiate a short position at the commencement of the next bar when the price surpasses the upper (5, 50) band.

Buy:

Commence a buy position at the start of the next bar when the price crosses the lower (5, 50) band.

Profit Exit:

Take profit based on a predetermined profit target or exit when the price reaches the middle band.

Stop Loss:

Place the stop loss below/above the extreme band to manage potential losses.

Conclusion:

The Three Bollinger Bands strategy offers traders a systematic approach to capitalize on the extreme areas of Bollinger Bands in volatile markets. By adhering to the outlined trading rules, traders can potentially enhance their risk management and capitalize on short-term price fluctuations in cryptocurrencies and high-volatility forex pairs. You can apply this strategy by opening 4 or more charts.

melih (Monday, 23 September 2024 11:03)

Unfortunately, the system does not work, the price has a hard time reaching the outermost band (50.5).