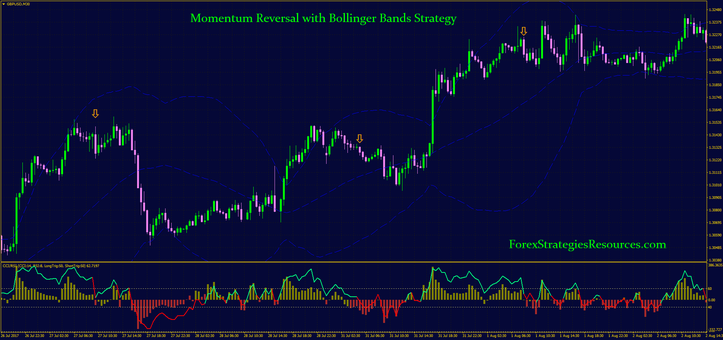

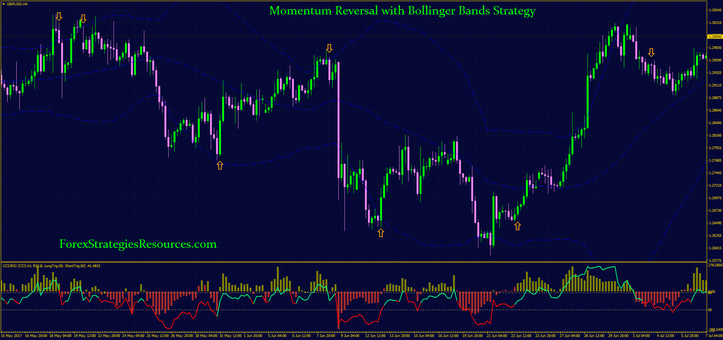

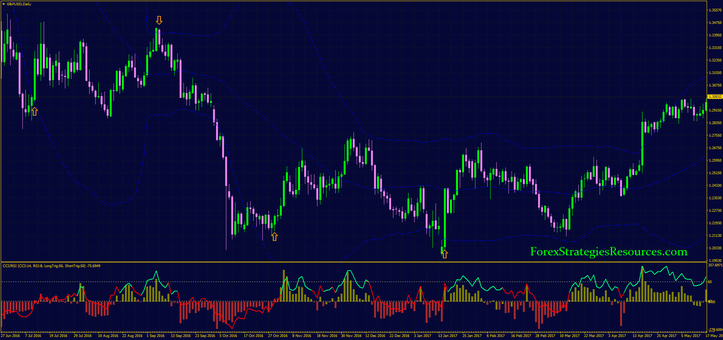

36# Momentum Reversal with Bollinger Bands Strategy

Bollinger Bands Reversal strategy

CCI and RSI for reversal trading

Submit by Dimitry 2017

Momentum Reversal with Bollinger Bands Strategy is a classic strategy with MT4 momentum indicators. The purpose of this trading system is find the condition for reversal trading when the price is out the Bollinger Bands.

Time frame 5 min or higher.

Currency pairs: EUR/USD, EUR/CHF, EUR/GBP, USD/CHF, AUD/USD, USD/CAD, GBP/JPY, GBP/USD, NZD/USD, USD/JPY.

Metatrader Indicators:

Bollinger Bands (period 50, deviations 2.0),

CCI RSI indicator (CCI 14, RSI 8, RSI long 50 + RSI short 50 -),

RSI color (10 period).

Trading Rules Momentum Reversal with Bollinger Bands Strategy

Buy

Price out the low Bollinger Bands.

When the price come back in the Bollinger Bands waith the trigger long of the CCI-RSI and RSI.

Place initial stop loss on the previous swing low.

Make profit with predetermined profit target that depends by pairs, or at the middle band of BB.

Sell

Price out the upper Bollinger Bands.

When the price come back in the Bollinger Bands waith the trigger short of the CCI-RSI and RSI.

Place initial stop loss on the previous swing high.

Make profit with predetermined profit target that depends by pairs, or at the middle band of BB.

Disadvantages: in the strong trend this trading system can generate false signals.

Advantages: in range market and medium trend works good.

In the pictures Momentum Reversal with Bollinger Bands Strategy in action.

Share your opinion, can help everyone to understand the forex strategy.

Mario (Saturday, 18 January 2020 19:28)

Simple and good strategy..Thanks for share..