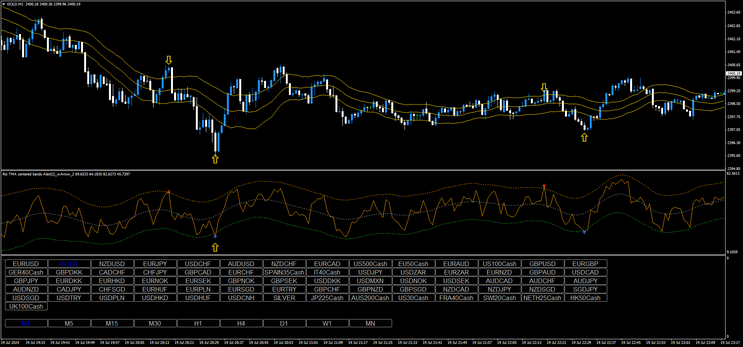

41# TMA RSI and Keltner Channel for 1 minute scalping and Binary Options.

Submit by Joy22 21/07/2024

Binary Options Trading Strategy Using TMA RSI and Keltner Channel

TMA RSI with Keltner Channel is a trading strategy suitable for 1 minute time frame for scalping and trading on High/Low Binary Options

Time Frame 1 minute or higher.

expiry time 10-15 candles.

Currency pairs: volatile.

1. Setup of Indicators on MT4

TMA RSI Indicator:

This indicator combines the TMA bands and the RSI to provide trading signals.

Configure the TMA RSI indicator as specified in the uploaded .mq4 file.

Keltner Channel:

Configure the Keltner Channel with a 20-period exponential moving average (EMA) and an average true range (ATR) multiplier of 2.0 to define the upper and lower bands.

Strategy Rules

Call Option (Buy)

The RSI of the TMA RSI indicator should be below 30, suggesting that the market is oversold.

Keltner Channel Confirmation:

The price should touch or exceed the lower band of the Keltner Channel, indicating a possible reversal zone.

Input Signal:

Enter a Call position when the buy arrow appears.

(opening of the next bar).

The price should touch or exceed the lower band of the Keltner Channel, indicating a possible reversal zone.

Put Option (Sell)

The RSI of the TMA RSI indicator should be above 70 , suggesting that the market is overbought.

Enter a Put position when the sell arrow appears.

(opening of the next bar).

The price should touch or exceed the upper band of the Keltner Channel, indicating a possible reversal zone.

The same entry rules apply to scalping.

We are publishing the Pine Script version on the TradingView website soon.

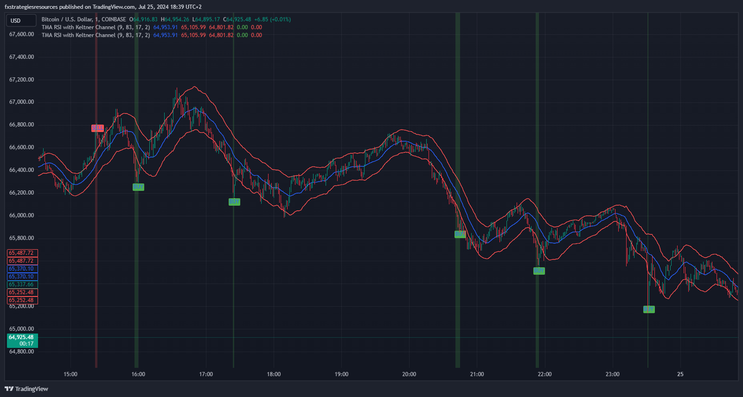

TMA RSI Keltner -TradingView-

Indicator Name: TMA RSI with Keltner Channel

Description:

The TMA RSI with Keltner Channel is a custom indicator that combines the Triple Moving Average (TMA), Relative Strength Index (RSI), and Keltner Channel to help identify potential trading opportunities.

Key Features:

TMA: Smoothes price action and helps identify the prevailing trend.

RSI: Measures the speed and change of price movements. Identifies overbought (83) and oversold (17) conditions.

Keltner Channel: A volatility-based envelope set above and below an EMA. Uses a 20-period EMA and an ATR multiplier of 2.0.

Trading Signals:

Buy Signal: When RSI crosses above the oversold level and the price touches or breaches the lower band of the Keltner Channel.

Sell Signal: When RSI crosses below the overbought level and the price touches or breaches the upper band of the Keltner Channel. Background Highlights: Light green when RSI is oversold. Light red when RSI is overbought. Usage: Suitable for 1-minute scalping and binary options trading with expiration times of 10-16 candles. Combines trend-following, volatility, and momentum analysis.

Note: Test the indicator on a demo account before live trading. Adjust settings to fit your trading style and risk management preferences.

How to Add the Indicator to Your Chart:

Copy the Pine Script code.

Open TradingView and go to the Pine Editor.

Paste the code into the Pine Editor.

Save the script and add it to your chart.

I would like to point out that the best sentiment and open source environment is always that of MT4.

TradingView is not an open source friendly environment.

Jack (Sunday, 20 October 2024 15:44)

"This strategy is a real game-changer! My results have skyrocketed since I started using it. Tested and it works amazingly well!"