18# Binary Arrow Backtest

Submit by Dimitri

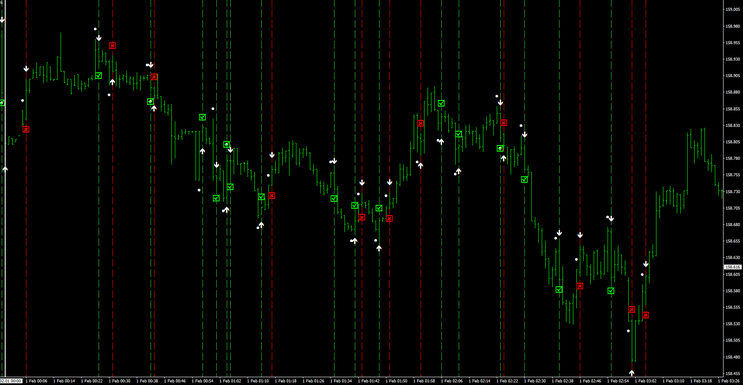

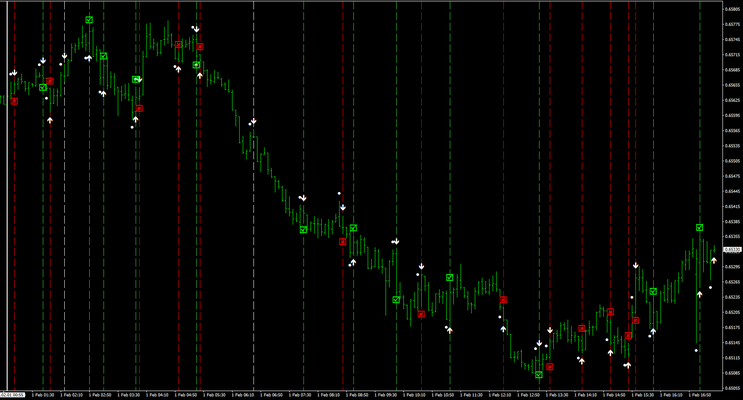

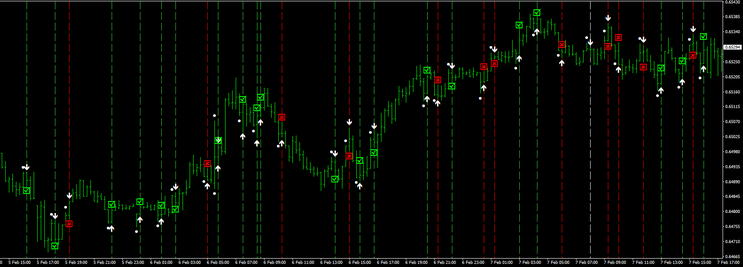

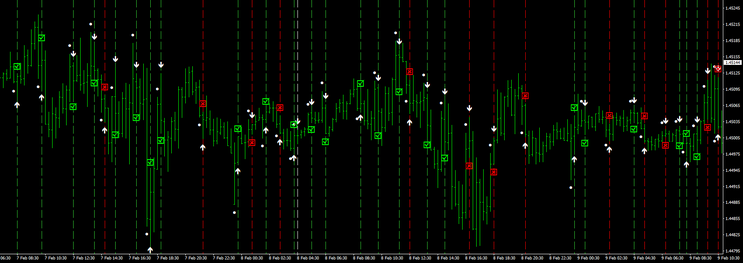

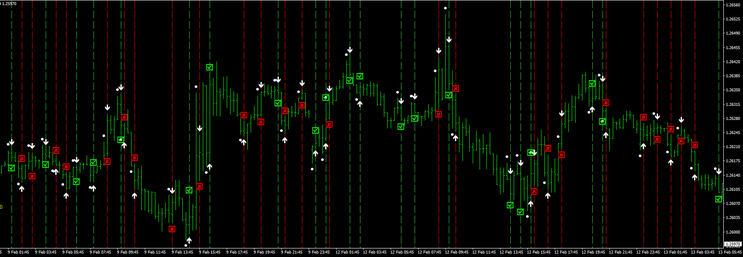

Overview: The strategy is based on a custom indicator that provides an alert in the form of a white circle drawn on the chart. The alert anticipates a trading signal, and at the opening of the next candle, you enter a position—either a Buy or a Sell. After the trade is opened, an arrow appears, confirming the direction (Buy or Sell).

This strategy is designed to trade binary options with an expiration of 1 candle. The key is to understand the difference between the behavior of the indicator in backtests versus real-time trading.

Step-by-Step Strategy:

1. Understanding the Signal:

-

White Circle: This is an alert, not the final signal to enter a trade. The white circle draws on the current candle to suggest that a potential setup is forming.

-

Next Candle: You enter the trade at the opening of the candle following the white circle.

-

Arrow Confirmation: After entering the trade, an arrow appears, confirming the direction of the signal (either Buy or Sell).

2. Trading Rules:

-

Timeframe: Use a timeframe appropriate for short-term trading (e.g., 1 minute or 5 minutes) since the expiration is only 1 candle.

-

Expiration: Each trade will expire after 1 candle. If you’re trading a 1-minute chart, the expiration of each option is 1 minute.

-

Entry:

-

Wait for the white circle to appear during the current candle.

-

As soon as the next candle opens, enter the trade based on the anticipated signal (Buy or Sell).

-

Buy Signal: Enter a Buy position at the opening of the next candle.

-

Sell Signal: Enter a Sell position at the opening of the next candle.

-

3. Backtest Charts vs. Real-Time Behavior:

-

In backtests, the white circle and arrow might appear neatly, giving a visual understanding of how the trades would have worked in the past. This makes it easier to analyze historical performance.

-

In real-time, the behavior might be more dynamic. The white circle gives you advance notice, but the arrow confirming the direction may appear after you've already entered the trade.

-

Important: Backtests can show more perfect signals than you will experience in real-time trading. The goal is to familiarize yourself with how the indicator "paints" these signals in live conditions.

-

4. Managing Expectations in Real-Time:

-

Lag in Signal Confirmation: Be prepared that the arrow will only appear after entering the trade, and it can occasionally differ from what you anticipated based on the white circle.

-

Market Conditions: The indicator may behave differently under varying market conditions (ranging vs. trending markets), so understand its performance in both types of markets through backtesting and forward testing.

5. Risk Management:

-

Fixed Percentage Risk Per Trade: It’s advisable to use a fixed percentage of your account balance per trade (e.g., 1-2% of your capital) to avoid overexposure.

-

Loss Limitation: If the strategy results in consecutive losses (e.g., 3-5 in a row), stop trading and reassess market conditions or strategy performance.

Example of Strategy in Action:

-

White Circle Alert: A white circle appears on the current candle. You know this is an indication that a signal might be forming.

-

Next Candle (Opening): At the opening of the next candle (after the white circle), you immediately take action:

-

If the white circle suggests a potential upward move, you enter a Buy trade.

-

If the white circle suggests a potential downward move, you enter a Sell trade.

-

-

Arrow Confirmation: After you’ve entered the trade, an arrow appears to confirm the direction of the signal. This is a form of post-entry validation.

Market Conditions: Avoid trading in highly volatile or unpredictable market conditions (e.g., during major news releases).

-

Currency Pairs/Assets: Stick to assets that are stable and liquid (e.g., major forex pairs, high-volume stocks, or indices).

-

Practice on a Demo Account: Since the real-time indicator behaves differently, practice on a demo account to familiarize yourself with how the indicator operates in live market conditions.

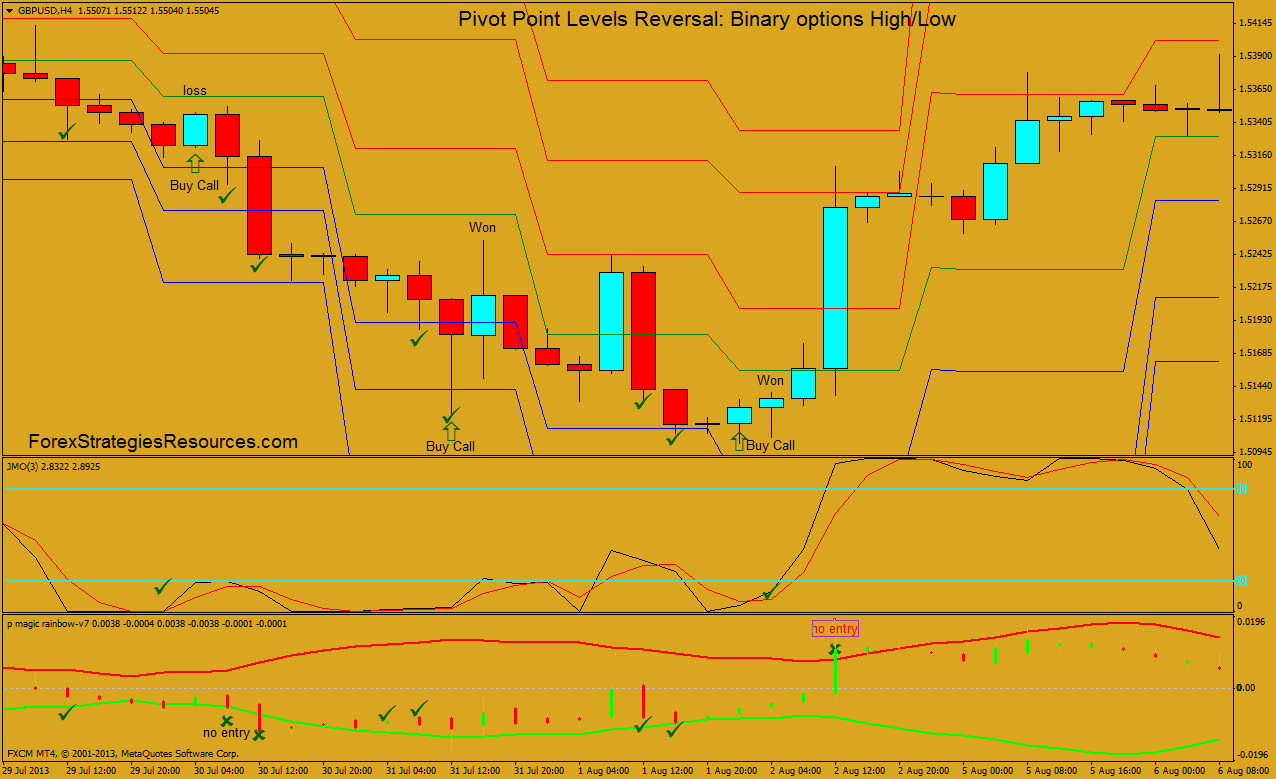

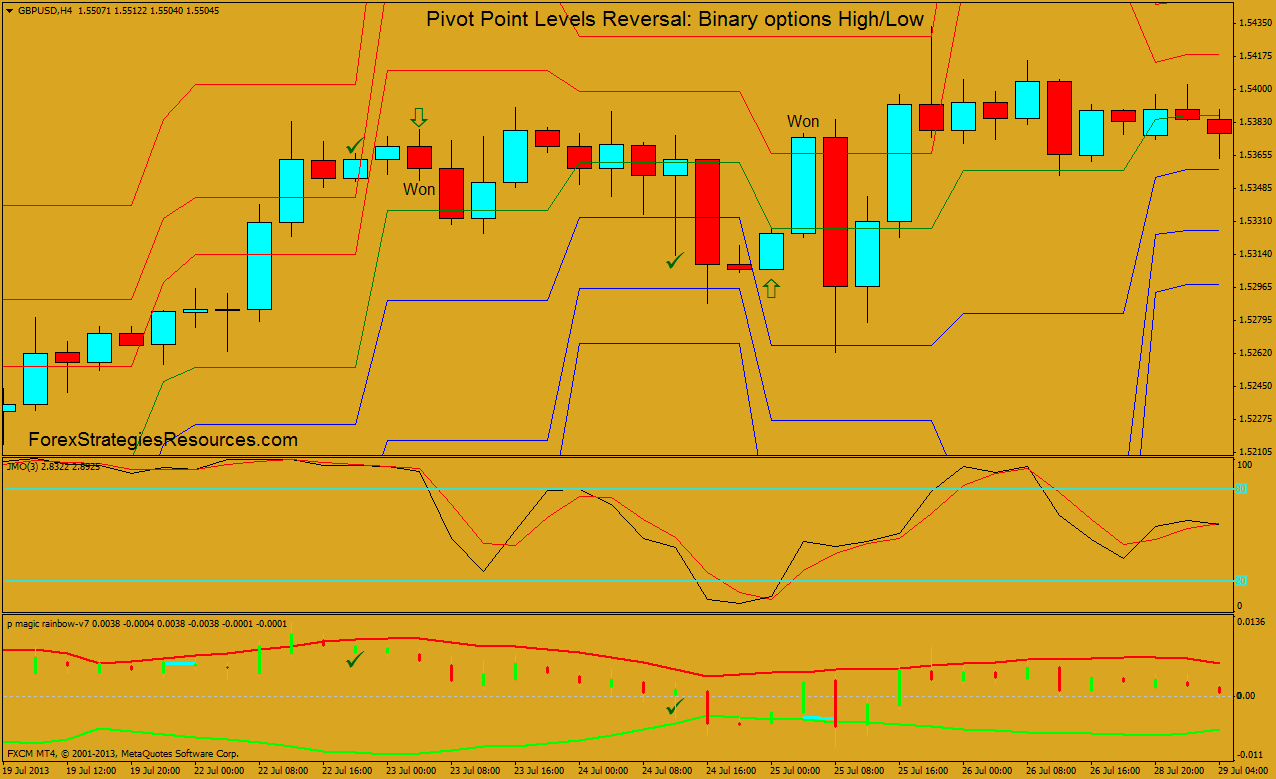

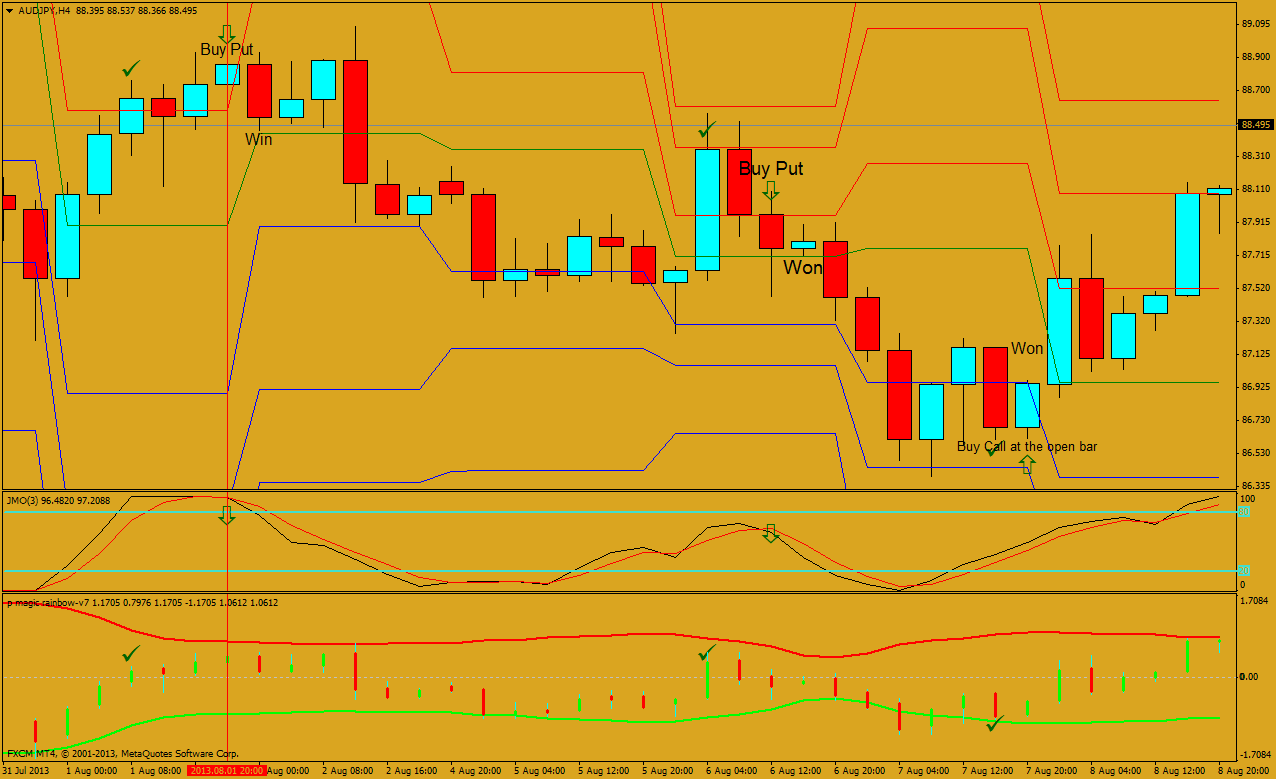

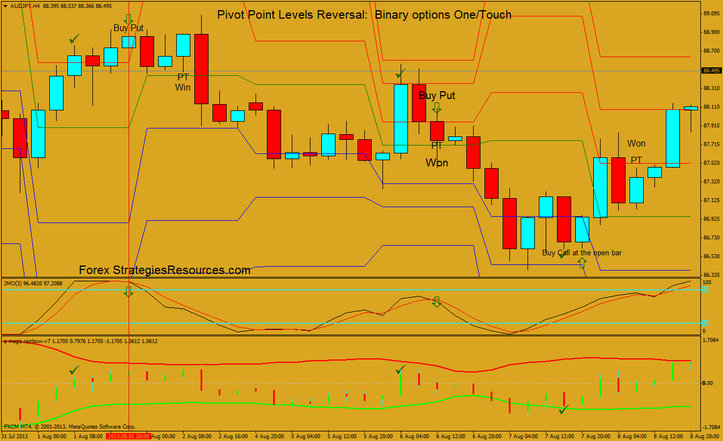

Binary Options Strategy: Pivot Point Levels Reversal

Pivot Point Levels Reversal: Binary options High/Low

Submit by Maximo Trader 10/08/2010

This Strategy Binary Options is based on the metatrader indicators: JMO and Pivot Points Levels but is inspired at 1hr trading system Levels Reversal but i have add a new indicator for filter(P.magic rainbow v.7).

Time Frame 240 minutes: Exiperes time 240 min or 480 depends by depends on the risk that one is willing to accept.

Currency pairs any.

Markets: Forex, Stocks, CFD, Futurex, Gold, Silver and Oil.

Metatrader Indicators:

Pivot points Levels,

JMO indicator.

P-magic Rainbow .v.7 (for filter).

Buy

When that the price breaks a support Pivot Point level, wait that jmo indicator come back up from overbought area and crosses upward.

This condition is reliable if P-Magic Rainbow does not break the upper band.

P-Rainbow Magic should fluctuate within the bands.

Sell

When that the price breaks a resistant Pivot point level, wait that jmo indicator come back down from oversold area and crosses downward.

This condition is reliable if P-Magic Rainbow does not break the Lower band.

P-Rainbow Magic should fluctuate within the bands.

Pivot Point Levels Reversal: Binary options One/Touch

Time Frame 240 minutes: Exiperes time 960 min

The Trading Rules are the same.

In the examples Pivot Point Levels Reversal in action

Binary Options Strategy: Pivot Point Levels Reversal Template and indicators

-

#4

quiero aprender tecnicas de tradig

-

#3

lemme see sumn

-

#2

top

-

#1

Please somebody test it (what is the winning rate ?)

i can not test cause my back tester broke and nobody is able to fix it

Pivot Point Levels Reversal: Binary options One/Touch.

Write a comment

Oliver (Monday, 23 September 2024 21:55)

Tested them. They heavily repaint. basically useless

FSR (Tuesday, 24 September 2024 16:47)

The graphs I show are from backtest, so very real. The expected profitability in real varies from 45% to 60. It is not the one that the indicator shows when you insert the template. There is a need to find a filter, the basis is good.