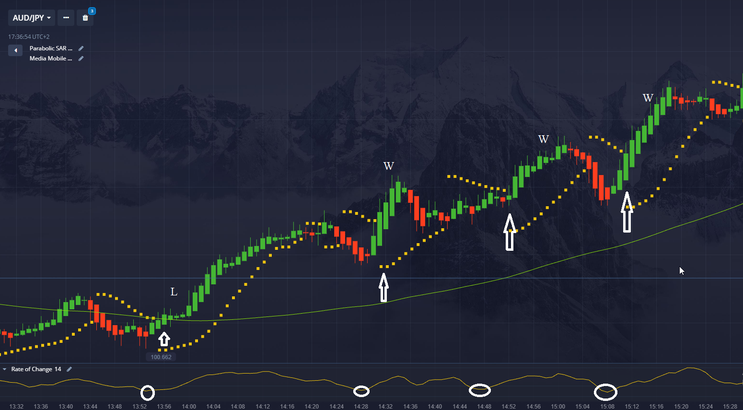

148# Rate of Change and Parabolic Sar Binary Strategy

Submit by Joy22

Rate of Change, Parabolic Sar is a pure trend momentum strategy for binary options high/low.

Time Frame: 1 or higher. Expiry time 1-3 candles. In the examples expiry time is 3 candles.

Indicators Used:

-

SMA 100 periods, close (Simple Moving Average) -

-

Heikin Ashi Candles or noemal candle -

-

Rate of Change (ROC) -

-

Parabolic SAR -0.2- 0.02 step with a maximum

Call (Buy) Option Setup:

-

SMA Confirmation:

-

Price must be above the 100-period SMA. This indicates an uptrend.

-

-

Heikin Ashi Candle Confirmation:

-

A green Heikin Ashi candle (bullish) appears.

-

-

Rate of Change Confirmation:

-

The Rate of Change (ROC) is upward from the last swing low, positive, indicating upward momentum.

-

Parabolic SAR Confirmation:

-

The Parabolic SAR dots appear below the candles. This signals that the price is in a potential upward movement.

-

-

Entry:

-

Enter a Call (Buy) option at the close of the candle that confirms all the above conditions.

-

-

Expiry Time:

-

For a 1-minute time frame, set the expiry for 2-3 minutes. Adjust the expiry time proportionally for higher time frames (e.g., 10-15 minutes for 5-minute candles).

-

Put (Sell) Option Setup:

-

SMA Confirmation:

-

Price must be below the 100-period SMA. This indicates a downtrend.

-

-

Heikin Ashi Candle Confirmation:

-

A red Heikin Ashi candle (bearish) appears.

-

-

Rate of Change Confirmation:

-

The Rate of Change (ROC) is downward from the last swing high! (very important). negative, signaling downward momentum.

-

-

Parabolic SAR Confirmation:

-

The Parabolic SAR dots appear above the candles. This suggests the price is in a potential downward movement.

-

-

Entry:

-

Enter a Put (Sell) option at the close of the candle that confirms all the above conditions.

-

-

Expiry Time:

-

For a 1-minute time frame, set the expiry for 2-3 minutes. Adjust the expiry time proportionally for higher time frames.

-

Additional Notes and Tips

-

Risk Management: Stick to a strict risk management plan. Limit your risk to no more than 1-2% of your trading capital per trade.

-

Best Market Conditions: This strategy works best in trending markets. Avoid ranging or choppy conditions as they may lead to false signals.

-

Backtesting and Optimization: Before using this strategy live, test it in a demo account to understand how each indicator behaves and how reliable the signals are. Adjust the settings if necessary based on backtesting results.

This approach aims to align the entry with both trend and momentum confirmations, improving the probability of profitable trades.

Alex (Wednesday, 12 March 2025 16:09)

Strategia ottima anche per OTC market, testata.