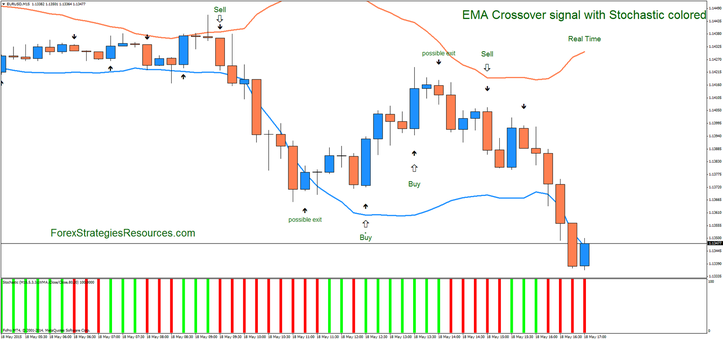

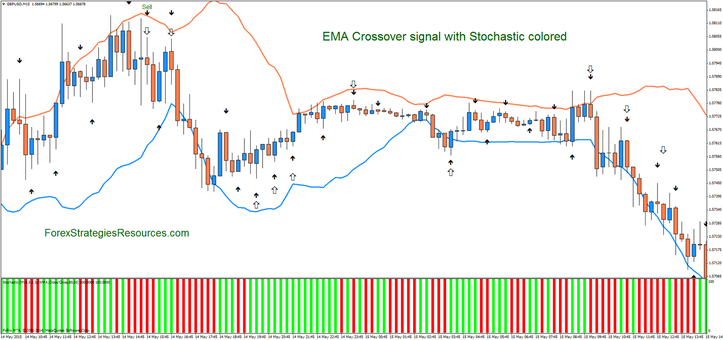

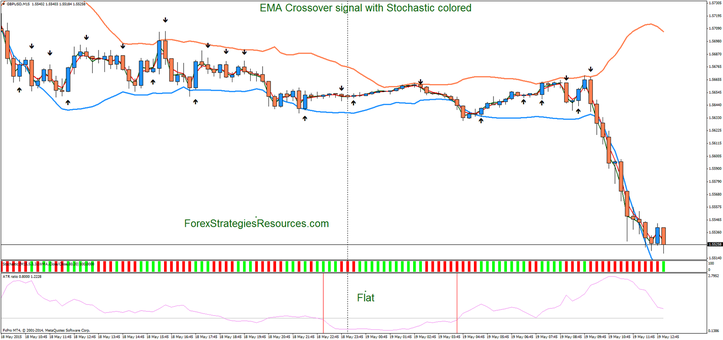

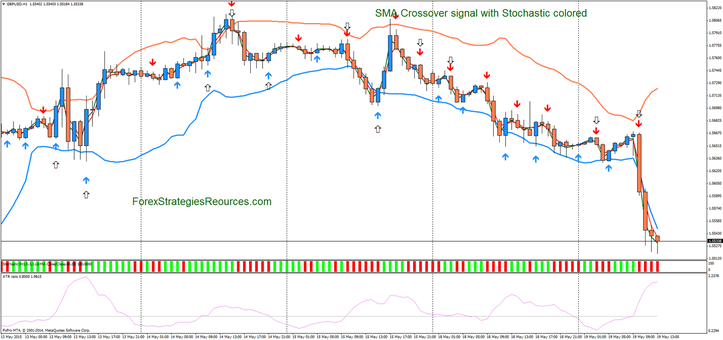

133# EMA Crossover signal with Stochastic colored

Crossover trading

Submit by Joy22 18/05/2015

EMA Crossover signal with Stochastic colored is a trading system very simple.

This system is trend momentum, you can apply this strategy for trading also with binary options high-low.

Time Frame 15 min or higher.

Expiry time 1 candle.

Indicators:

EMA alert signal ( fast EMA 1 period, slow EMA 2 period. This setting of EMA is very fast they are problem of stability.)

Note: A configuration so fast can create stability problems of the algorithm that diminish with time frames higher. A filter makes it more readable and reliable configuration so boost. The proposed filter is the stochastic oscillator.

Stochastic colored (5,3,3).

In my experiments with SMA with 0 mode is better (more stable).

Trading rules EMA Crossover signal with Stochastic colored

Trend following

Buy

Buy Arrow of the EMA crossover

Stochastic Green bar.

Sell

Sell Arrow of the EMA crossover

Stochastic Red bar.

Reversal

Buy

When the price touches or broken the lower band wait the buy arrow confirmed by green bar of the stochastic colored.

Sell

When the price touches or broken the upper band wait the sell arrow confirmed by red bar of the stochastic colored.

Exit position at the opposit arrow

First update with atr ratio setting ( 5, 34, 0,8).

This system is trend momentum, you can apply this strategy for trading also with binary options high-low.

Second update with SMA setting (Fast ma 1, slow MA 3) more stable.

Alex (Friday, 23 September 2016 12:04)

One more thing I do, when I trade using this strategy. As soon as "reverse" candle is closed and stochastic change its color and new candle begins - I wait for for a little retracement (for about 10-15 pips). And do my trade to the end of this candle (to the end of 15 minutes). Sometimes it helps, when the candle closes against your trade (on or near the open level). In case, when there is no such a retracement - I shift the trade. I noticed, that in majority of cases - candle does this retracement. Of couse, sometimes it closes against your trade, nobody can escape OTM, but abot 75% are ITMs.

Alex (Tuesday, 20 September 2016 12:28)

Isidore, I mean, that after so called "reverse" candle is appered - we presume, that previous trend is over and we have another trend (even if it is short). So I mean - we follow this new trend. If "reverse" candle (born outside BB) is bullish (appeared after DOWN trend) and stochastic changed its color to green- I do CALL option on the next candle. And vice versa.

I really like this strategy.

Isidore (Thursday, 15 September 2016 02:06)

Alex, thanks for your input, but what do you mean by 'on the trend'?

Alex (Tuesday, 13 September 2016 20:53)

Wendell, you are not to pay attention to SMA. Forget it! I`d better delete all arrows. Strategy is good enough to trade without them. What I do. When the price brakes the BB band, I wait for the reverse candle. This reverse candle has to be born outside the BB band (or at least brakes BB band once or more). As soon as it appears and is in progress, stochastic needs to change its color. I make CALL (PUT) option on the next candle on the trend. 75% ITM are yours.

Wendell (Wednesday, 20 May 2015 01:55)

Sma repaint ...

svpm_trade (Tuesday, 19 May 2015 19:01)

Nice strategy indeed....will be more profitable if martingaled (max level 3) I suppose. What's the use of ATR?