103# 3 Moving Averages and Parabolic Binary Strategy

Submit by Lorenz 2025

3 Moving Averages and Parabolic Binary Strategy is designed for high-volatility markets during the New York trading session. It is optimized for 1-minute timeframes and 15 seconds and can be applied on various trading platforms such as MT4, MT5, TradingView, C-Trader, and others.

Indicators Used

-

Exponential Moving Averages (EMA)

-

EMA 5 (Fast)

-

EMA 15 (Medium)

-

EMA 200 (Trend Confirmation)

-

-

Parabolic SAR (PSAR)

-

Settings: Step 0.03, Maximum 0.3

-

Trading Session

-

Only trade during the New York session (typically from 8:00 AM to 4:00 PM EST).

-

The strategy is best suited for volatile assets such as major forex pairs, gold, indices, and cryptocurrencies.

Trade Entry Rules

Call Option (Buy Trade)

-

EMA 5 crosses above EMA 15.

-

Price is above EMA 200, indicating an uptrend.

-

Parabolic SAR dots are below the price, confirming bullish momentum. The candle must break the opposite dot (important).

-

Wait for a minor pullback before entry (preferably when price touches EMA 5 or EMA 15).

-

Enter a Call Option with an expiration time of 5 minutes.

Put Option (Sell Trade)

-

EMA 5 crosses below EMA 15.

-

Price is below EMA 200, indicating a downtrend.

-

Parabolic SAR dots are above the price, confirming bearish momentum. The candle must break the opposite dot (important).

-

Wait for a minor pullback before entry (preferably when price touches EMA 5 or EMA 15).

-

Enter a Put Option with an expiration time of 5 minutes.

Additional Entry Conditions

-

Avoid trading against the trend (use EMA 200 as a guide).

-

Confirm momentum using candlestick patterns (avoid weak signals like small candles or wicks).

-

Do not trade during major news events (check the economic calendar for high-impact events).

Risk Management

-

Trade only during peak market hours (avoid low liquidity times).

-

Limit trades to 3-5 per session to reduce exposure.

-

Never risk more than 2-5% of your account per trade.

-

If you hit 3 consecutive losses, stop trading and reassess the strategy.

Conclusion

This strategy is designed to capitalize on short-term market movements with high probability setups. Proper risk management and disciplined execution are key to success. Always backtest the strategy before applying it in live trading.

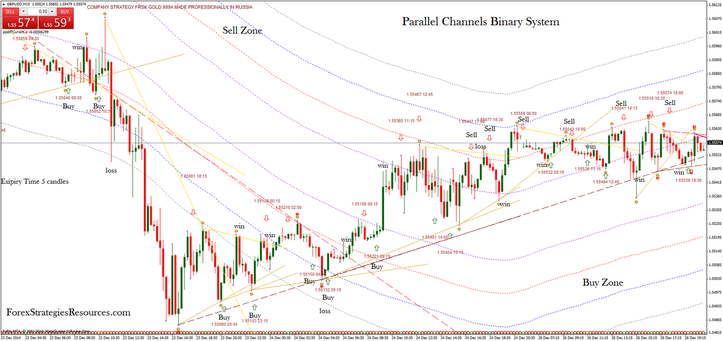

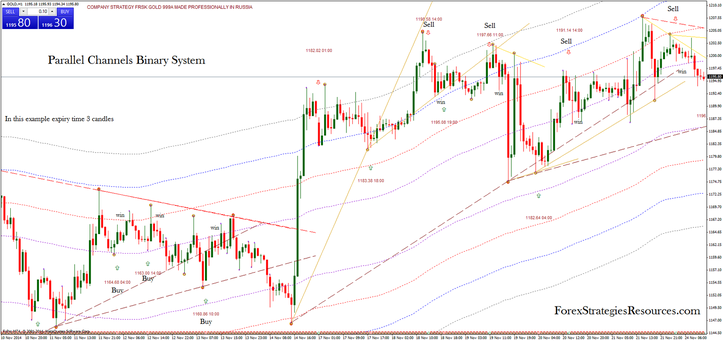

Parallel Channels Binary System

Istochastic, Trend line and Channels

Submit by Maximo Trader 28/12/2014

Parallel Channels Binary System is a Price Action Momentum strategy. This trading system is complex but profitable is also applicable at the trading without binary options.

Time Frame 15 min, 30 min, 60 min, 240 min.

Expiry time 4-5 camdles /time frame 15 min or 30 min) expity time (3-5 candles time frame h1 or h4).

Markets: Forex (EUR/USD, GBP/USD, AUD/USD, USD/CHF, USD/CAD, NZD/USD, GBP/JPY, USD/JPY); Indicies (S&P 500, DAX, Dow Jones, FTSE,) Commodities: (Gold and Oil).

Metatrader 4 Indicators and setting:

Parallel Channels (120 period, atr:1) programmed by Rustem Bigeev.

Istoch (5, 3, 20),

True Trend line.

Rules Parallel Channels Binary System

Parallel Channels: Buy Zone lower bands, Sell Zone Higher bands.

Buy Call

Price move into lower bands or below of the Parallel Channels.

Buy Arrow of the isthocastic indicator,

Buy call at opening of the next candle if a trend line is below the buy arrow of the istochastic indicator.

Buy Put

Price move into higher bands or above of the Parallel Channels.

Sell Arrow of the isthocastic indicator,

Buy Put at opening of the next candle if a trend line is above the sell arrow of the istochastic indicator.

In the pictures Parallel Channels Binary System.

-

#1

I didn't see an alarm function when an arrow is triggered. Is it possible to add one? With multiple charts open, you have to look at each one all the time to see if there is a signal.